- 25th June 2018

- Mid Cap of Rs. 13,000 cr.

- Industry – Auto Ancillary; IPO Opens 26-28th June at Rs. 965-967

- Valuations: P/E 28.9 times TTM

- Advice: SUBSCRIBE

Summary of Report

Summary of Report

- Overview: Varroc Engineering is a global tier-1 auto component firm. They design, make and supply exterior lighting systems, plastic and polymer, electricals-electronics and precision metallic components to passenger car, CV, 2W, 3W and off highway vehicle OEMs directly worldwide.

- India and global revenues are split 35:65 so they have good international presence.

- Varroc’s FY18 revenue, EBITDA and PAT were Rs. 10,417 cr., Rs. 985 cr. and Rs. 451 cr. resp., and they grew at 13.1%, 12.9% and 18.2% CAGR in 4 years.

- At a FY18 PE of 28.9x, valuations appear fair. It has a healthy balance sheet with conservative financials. It has good Indian and global presence.

- Key Risks: 1) High Competition 2) Currency Risks 3) Downturn in macro-economic environment.

- Opinion: Investors can SUBSCRIBE to this IPO with a 2 year perspective.

Other Auto Sector reports from JainMatrix Investments

- Endurance Technologies (IPO) – The Firm Has Stamina

- Eicher Motors – It’s Firing On Both Engines

- Motherson Sumi Systems – Global Auto Ancillary Growth

- GNA Axles Ltd IPO – The Globe Beckons

Here is a note on Varroc Engineering (Varroc) IPO. You may also Download the PDF file – JainMatrix Investments_Varroc Engineering IPO_June2018

IPO highlights

- The IPO opens: 26-28th June 2018 with the Price band: Rs. 965-967 per share.

- Shares offered to public number 2.01 cr. The FV of each is Re. 1 and market lot is 15 numbers.

- The IPO will raise Rs. 1,955 cr. while selling 15% of equity. The offer will be completed via an Offer for Sale (OFS) by existing shareholders of Rs. 1,955 cr. and there is no fresh issue of shares.

- The promoter (Tarang Jain) owns 86.3% of Varroc which will fall to 85% post-IPO. The other investors 1) Omega TC Holdings (a PE firm) and 2) Tata Capital Fin. Serv. are fully exiting their 13.7%.

- The selling shareholders are both Tata group firms that invested in Varroc in Mar 2014. The cost of acquisition was Rs. 162.4/share, so they are getting ~5x returns in 3+ years.

- The IPO share quotas for QIB, Non Institutional Buyer (NIB) and Retail are in ratio of 50:15:35.

- The unofficial/ grey market premium for this IPO is Rs. 55-60/share. This is a positive.

Introduction

- Varroc is a global T1 (tier-1 companies directly supply to OEMs) automotive component group. It’s FY18 revenue, EBITDA and PAT were Rs. 10,417 cr., Rs. 985 cr. and Rs. 451 cr. resp.

- They design, mfg. and supply exterior lighting systems, plastic-polymer, electricals-electronics, and precision metal components for PVs, CVs, 2W, 3W and off highway vehicle OEMs worldwide.

- They are the 2nd largest Indian autocomp. group and a leading T1 mfg. and supplier to Indian 2-3W. It is also the 6th largest global auto lighting firm with 4% market share and $1 billion in sales and one of the top 3 independent exterior lighting players (by market share in 2016). Source: News reports.

- Varroc started with the polymer business in 1990, and grew organically by adding business lines, like electrical and metallic and diversified products. Inorganic expansions – in 2012 Varroc acquired Visteon’s global lighting business, now known as Varroc Lighting Systems (VLS). In 2013, they acquired Visteon’s holding in a 50/50 JV with Beste Motor Co. Ltd. for auto lighting in China, Varroc TYC (China JV). They acquired 70% in auto accessories firm Team Concepts in 2018.

- Varroc has 2 primary business lines, namely (i) VLS with the design, mfg. and supply of exterior lighting systems to passenger car OEMs worldwide. VLS has a portfolio of lighting products including Halogen, Xenon/high-intensity discharge, LED, OLED, Flex LED and LED pixel headlamp, catering to 5 segments in external automotive lighting. (ii) India Business with the design, mfg. and supply of auto components in India, to 2W and 3W OEMs, including exports. This offers products across 2 product lines, polymers/plastics, electrical/ electronics and metallic components. See Fig 1.

Fig 1- Varroc’s FY18 Segment Revenue/ Fig 2 – Varroc Geographic Revenue

- Varroc has a global footprint of 36 mfg. facilities spread in 7 countries, with 6 facilities for the VLS, 25 for their India Business and 5 for others. In FY18, their largest customer contributed 18.6% of their revenue and their top 5 customers contributed 59.9% of revenue.

- VLS has relationships with auto OEMs across the premium, mid-range and mass market pricing spectrum, like Ford, Jaguar Land Rover, Volkswagen, Renault-Nissan-Mitsubishi, Groupe PSA, FCA, a European car and an American electric car maker. The global lighting business has 185 patents.

- Within India the 25 mfg. and 5 R&D centers form a footprint in the auto hubs, close to customers. Varroc has supplied to Bajaj Auto for 28 years across product lines, it is the largest customer contributing 18.6% and the top 6 are 50%. Other 2W customers are Honda, Royal Enfield, Yamaha, Suzuki and Hero. Export are to global 2W makers namely KTM and Volvo.

- Leadership is Tarang Jain (MD age 56), Naresh Chandra (Chairman, 83), Ashwani Maheshwari (CEO India), T.R. Srinivasan (CFO) and Arjun Jain (head, electricals, 28). Tarang, Naresh and Arjun are related as Promoter, father and son. Stephane Vedie is the CEO of Varroc lighting, based out of USA.

Endurance Technologies – Snapshot and Varroc connection

- Endurance Technologies is an India-based company, which makes aluminum casting (including alloy wheels), suspension, transmission and braking products. Endurance is connected with Varroc as Anurang Jain (MD Endurance) is the twin brother of Tarang Jain (Founder promoter of Varroc).

- Income and PAT has grown at 11.6% and 17.5% CAGR resp. over 5 years. Endurance Tech had its IPO in Oct 2016 at Rs. 472, the share has gained 176% since to Rs. 1,304.

- Endurance Tech is perceived as a stable, fast growing and a high quality firm.

- The Varroc promoters are related to the promoters of Bajaj Auto & Endurance. However even though Endurance Tech is owned by a brother, the two firms have separate businesses and different product offerings for the same customers, so they don’t compete directly. The two brothers had an amicable business split in 2002.

News, Business Notes and Strategies of Varroc

Varroc’s business strategies are:

- To focus on growth markets for VLS with new plants in Brazil and Morocco, to supply the South American, southern European and North African markets.

- To focus on increasing customer revenue for the India business.

- To invest in R&D, design, engineering and software capabilities and capitalize on future trends.

- Pursue strategic JV’s and inorganic growth opportunities.

- In Feb 2018, Varroc entered into a JV in India with Dell’Orto S.p.A., a customer, for the development of electronic fuel injection control systems for 2W’s and 3W’s.

- Varroc is setting up a mfg. facility in Brazil, one in Morocco and 2 in India.

- Varroc in June 2018 opened an office in Tokyo to expand its global footprints. With this, they can now target Japanese OEMs for project management and engineering, lighting and electronics.

- As per Tarang Jain, in the lighting business they want to be in the top 3 globally, while for the 2W business, they want to grow in India and also tap South-East Asia as they are the biggest markets. The revenue target is Rs. 20,000 cr. by FY21, double from FY18, through organic & inorganic growth.

- Organic investments are going be about Rs 850 crore annually. Varroc has four successful acquisitions in the past, of the lighting business of US-based Visteon Corp, Tri OM for 2W lighting, IMES Poland & Italy for forging business and a small Indian firm which indicates their M&A success.

- Varroc’s chief of Sales & Marketing Vikas Marwah quit in Apr 2018 after just 5 months. It appointed T R Srinivasan in Oct2017 as CFO taking over from B Padmanabhan, who retired after a 10-year stint.

- Varroc is eyeing surface LEDs to drive future growth. Surface-LED technology uses thin layers of micro-optic filters and conventional LED light sources to achieve the homogeneous appearance generally associated with OLEDs. The metallic division is also targeting to grow 30% CAGR.

Automotive Exterior Lighting Industry Outlook

- The global auto exterior lighting market had revenues of USD 17.8 bn. in 2016. Revenue grew 4.5% (FY11-16) CAGR and is expected to grow at 4.3% (FY16-21).

- Globally, the market growth drivers are (a) increased LED penetration (b) technology innovation (c) design differentiation and (d) higher lighting content per vehicle.

- The global auto exterior lighting industry comprises more than 20 players around the world. The main 8 players are Koito Mfg. Co., Magneti Marelli, Valeo, Stanley Electric Co., Hella KGAA Hueck & Co, Varroc Lighting Systems, SL Corporation and ZKW, which generated US$16.3 bn. in revenue, representing 91% of the total global auto exterior lighting revenue.

- Varroc’s market share in the exterior lighting segment in India at present is reported to be 8%.

Financials of Varroc

- Varroc’s revenues, EBITDA and PAT grew at 13.1%, 12.9% and 18.2% CAGR in 4 years, see Fig 4.

- The 3 year PAT growth is modest. Varroc as a part of its strategy focuses on cost optimization.

- Margins are in a range of 7.5-9.5% for EBITDA and 3-4.5% for PAT over the last 4 years. The margins are low, but at par with other OEM suppliers in the industry.

Fig 4 – Financials

- Note: The FY15 figures are Indian GAAP, and FY16-18 are IND-AS numbers.

- Varroc has a RoE of 15.9% for FY18 while the 3 year average RoE stood at 16.1% (FY16-18). The RoCE stands at 16.2% for FY18. These return ratios are moderate.

- Varroc has been Operational Cash flow (CFO) positive in last few financial years. This is a positive. They have typically been investing available CFO for CAPEX i.e. funding expansion plans from internal accruals. It has generated FCFE in the last 3 years. See Fig 5.

- The current D/E ratio is 0.42 which is moderate. There is ample room for the management to grow faster by raising debt. However Varroc has guided that they would not want a D/E of over 1.

- The dividend payout ratio is low because of CAPEX needs, the FY18 ratio was 1.37%.

Fig 5 – Varroc’s Cash Flow

Benchmarking

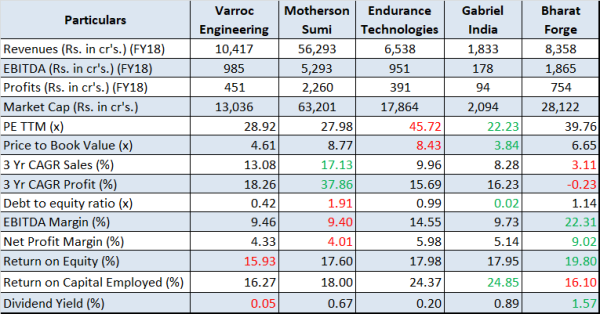

We benchmark Varroc against other comparable Indian auto ancillary companies. See Exhibit 6.

- The PE post IPO is fair. PE ratio of Varroc is in the mid-range amongst its peers.

- The 3 year sales and PAT growth are next to only Motherson indicating stability.

- Margins in FY18 have improved and are also in the mid-range. The RoE for FY18 stood at 15.9% and RoCE at 16.3%. The return ratios are fair, not very low. The dividend yield at 0.05% is low.

- In many ways, Varroc appears to be executing a strategy similar to Motherson, but are at about 1/5 the size in terms of revenue, PAT and target market cap.

Exhibit 6 – Benchmarking

Positives for Varroc and the IPO

- IPO pricing and valuations are fair and at lower end of the peers.

- Varroc has shown good financial performance and operating efficiency recently.

- The MD appears to be hiring professionals at the next level / reporting to him, which should strengthen the firm and enable it to grow to the next level.

- Varroc has a consistent track record of organic and inorganic growth. It has strong customer relationships with high quality OEMs in India, NorthAm and Europe.

- Varroc has a proven business model and strategy, as seen with the success of Motherson Sumi. There is ample room to grow for Varroc in the sector globally.

- Strong competitive position in attractive growing markets for VLS.

- Low cost, strategically located mfg. and design footprint. Varroc has located its facilities primarily in low-cost countries but near major auto markets. They are making investments to expand into Brazil and Morocco, which would keep costs low yet deliver easily to their customers.

- Robust in-house technology, innovation and R&D capabilities. The VLS business has 964 engineers located in 9 R&D centers, which are located in the Czech Republic, India, China, Mexico, Germany, the USA and Poland. Their R&D teams are focused on quick adoption of technology, enabling them to grow their product portfolio in line with customer expectations and industry developments.

- Focus on expansion in auto electronics, an important trend in the industry.

- The Varroc teams including the MD have good experience in the auto component sector.

Risks and Negatives for Varroc and the IPO

- General economic conditions like the global trade war and protectionism.

- Auto ancillary sector is considered a working capital and an asset heavy business. New orders involve big additions to working capital, so Varroc will need to manage growth and financial health.

- Competition is high and Varroc may face pressure on price or margins in future.

- Varroc is subject to environmental and safety regulations that it has to adhere to.

- Their success depends on the success and survival of the auto models launched by OEMs. Thus several key success factors for Tier-1 suppliers are out of their control.

- Varroc’s business is dependent on certain principal customers, especially Bajaj Auto in India. Sales to their top 3 customers for VLS were 50.7% of revenue for FY18, indicating client concentration. However this is a typical auto B2B situation.

- Labour unrest is always a challenge in a firm with many employees. We came across news of strikes or unrest in Varroc factories in Aurangabad in 2009 and 2017. However these were quickly resolved.

Overall Opinion and Recommendation

- The Indian auto ancillary mfg. is a high potential space with fair domestic size and growth; there are also significant global opportunities. India has many competitive & comparative advantages, so many global auto firms have set up here; there is also a vibrant two wheeler OEM sector here.

- In this sector, Varroc has grown to a good size, has improving margins and marquee customers. It has a healthy balance sheet with conservative financials. It has both Indian and global presence.

- Management quality is excellent with a global vision, eye for controlled growth and financial prudence and in sync with key global auto trends. Governance appears good and transparent.

- At a FY18 PE of 28.9x, valuations appear fair, but are not cheap. We do not see a near term gain.

- Key risks are 1) High Competition 2) Currency Risks 3) Downturn in macro-economic environment.

- Opinion: Investors can SUBSCRIBE to this IPO with a 2 year perspective.

DISCLAIMER AND DISCLOSURE

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. JM has no stake, ownership or any other known financial interests in Varroc or any group company. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an Investment Advisor. Punit Jain is a registered Research Analyst under SEBI (Research Analysts) Regulations, 2014. JM has been publishing equity research reports since Nov 2012. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com.