- Date 05th Sept 2020; IPO Opens 7-9th Sept at ₹165-166/share

- Valuations: P/E 34 times FY20, P/B 7.6 times (Post IPO)

- Small Cap: ₹ 2,438 Mkt cap

- Sector – IT Services

- Advice: SUBSCRIBE

Here is a note on Indian Happiest Minds Technologies Ltd (HMT) IPO.

Summary

- Key Strengths: HMT is a small but fast growing IT services firm with a focus on digital services.

- HMT concentrates on new and emerging technologies, platforms and ecosystems, which have a greater impact on customers and help HMT stand out in a crowded industry.

- The promoter Ashok Soota, is a successful executive and serial entrepreneur.

- The Covid pandemic has accelerated outsourcing, offshoring and demand for digital services.

- In FY20 the Revenues, EBITDA and Profits of HMT were ₹ 698 crore, ₹ 101.9 cr. and ₹ 71.7 cr. resp. In just 9 years the firm has gone from startup to $100 million of revenues, and Rs 100 crores of EBITDA, it is a good achievement.

- Risks: 1) Valuations at PE of 34 times and PB of 7.6 times (TTM) are expensive. 2) Intense competition 3) Covid induced challenges – demand from customers as well as employee health 4) Rupee strengthening against USD

- Opinion: Investors can SUBSCRIBE to this IPO with a 2-3 year perspective.

IPO highlights

- The IPO opens from 7 – 9th Sept 2020 in a Price Band of ₹ 165 – 166 per share

- The IPO includes a Fresh issue of ₹ 110 cr. and an Offer for Sale of 3.56 cr. shares. So the Total IPO size is max 702 cr. of about 4.2 cr. shares.

- This will be about 28% of the equity share capital of HM.

- The lot size is 90 shares and Face Value ₹ 2 per share

- The IPO share quotas for QIBs: Non-Institutional Investors: Retail is 75:15:10%.

- The promoter & promoter group owns 61.8% in HMT which will fall to 53.3% post-IPO. Th other seller is CMDB-ll (JP Morgan Asset Management).

- The unofficial/ grey market premium is ₹ 115-125 /share over IPO price. This is a positive.

Introduction

- Happiest Minds Technologies provides end-to-end solutions in digital business, product engineering, infrastructure management and security services. It was incorporated in 2011.

- The FY20 Revenues, EBITDA and Profits of HMT were ₹ 698 crore, ₹ 101.9 cr. and ₹ 71.7 cr. resp.

- It offers solutions across the spectrum of digital technologies such as Robotic Process Automation (RPA), Software-Defined Networking/Network Function Virtualization (SDN/NFV), Big Data and advanced analytics, Internet of Things (IoT), cloud, BPM and security.

- There are 3 key divisions: the Product Engineering Services (PES) unit helps by transforming the potential of digital by making the product secure and smart. The Infra Management (IMSS) provides an end to end monitoring and management capability for applications and infrastructure. The Digital Business (DBS) is focused on digital content management, connected retail and other customised offerings for clients.

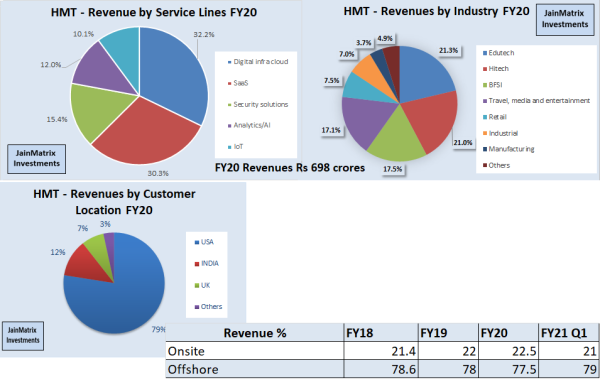

- In FY20, 96.9% of revenues were from digital services, one of the highest among Indian IT companies. See Fig 1 a, b and c for details of revenue by Service Lines, Industry and Geography. d) gives us the trends in onsite: offshore employee deployments.

Fig 1 – HMT FY20 Revenues by (a) Service Lines (b) Industry Vertical and (c) Geography (d) Onsite share (clickable)

- HMT has 79% USA based business, higher than most Indian IT firms where it is 65-70%.

- The HMT philosophy is quite simple – that the happiest people make happiest customers. Thus there is a focus in the company to keep employees motivated, engaged and happy.

- The business units of the company are assisted by the 3 Centers of Excellence which are Internet of Things, Analytics / Artificial Intelligence, and Digital Process Automation.

- As of FY20, the company had 157 active customers with average revenue per customer at USD 614,675. Its repeat business (revenue from existing customers) has steadily grown and contributes a significant portion of revenues. There is a high degree of customer stickiness.

- It has 2,439 employees.

- Happiest Minds delivers services across industry sectors such as Retail, Edutech, Industrial, BFSI, Hi-Tech, Engineering R&D, Manufacturing, Travel, Media and Entertainment.

- Key leaders: Ashok Soota (77, Promoter, Exec. Chairman-Dir.), V. Narayanan (ED-CFO) J. Anantharaju (V. Chairman, President-CEO PES), Rajiv Shah (Pres-CEO DBS) and C. Ramamohan (Pres-CEO IMSS).

News, Updates and Strategies

- Deep Tech can Enable Business Growth: Per a news report, HMT has Deep Tech capabilities like AI, 5G, Blockchain, drone-tech, 3D printing, advanced material, quantum computing, biotechnology, etc. These emerging technologies are powerful and can solve specific business problems, and enable growth for clients. The adoption has accelerated post Covid.

- Happiest Minds is India’s Top 25 Best Workplaces in IT & IT-BPM – Nov 2019.

- However attrition was high at 19 %, higher than industry levels of 17-18%.

- Happiest Minds has positioned itself as “Born Digital, Born Agile”.

- The IPO share quotas indicate a tilt towards QIB, with smaller quotas to NII and Retail.

- The Digital Content Monetization is a software as a service platform from HMT that helps firms digitize and monetize their content, delivering it to their customers, partners, and users. DCM comes with consumption-based pricing, and is powered by IBM Cloud.

- Post Covid, the Indian IT services firms are seeing a surge in offshoring biz. This may be due to cost pressures from clients, or even a change in attitude caused by Work from Home (WFH) as firms allow employees to WFH to stay safe and productive during the pandemic.

- The Covid pandemic has accelerated investments in technology infra as corporates have upgraded to allow WFH and also redesigned the customer and employee interactions.

- HMT works with partners like Microsoft, Amazon Web Services, McAfee, IBM, PTC, etc.

- On Sept 4 HMT raised ₹ 315.9 cr. from 25 anchor investors, ahead of its IPO. Anchor investors included Govt. of Singapore, Pacific Horizon Investment Trust, Integrated Core Strategies Asia Pte, Aditya Birla Sun Life MF, Axis MF, Goldman Sachs India Fund, HDFC Life Insurance, Franklin Templeton MF, ICICI Prudential MF, Kuwait Investment Fund, Fidelity Asian Values Plc and SBI MF.

IT Services Industry Outlook in India

- The global sourcing market in India continues to grow at a higher pace compared to the IT & BPM industry. India is the leading sourcing destination globally, accounting for 55% market share of the US$ 200-250 billion services sourcing business in 2019-20. Indian IT & BPM firms have set up over 1,000 global delivery centers in 80 countries across the world. (IBEF)

- IT & BPM industry global revenue was US$ 191 billion in FY20, growing at 7.7% y-o-y. It is estimated to reach US$ 350 billion by 2025. Moreover, revenue from the digital segment is expected to form 38% of the total industry revenue by 2025. (IBEF).

- The Covid pandemic has sharply accelerated the adoption of digital solutions and automation across corporates and personal consumers. The safety and isolation requirements for employees in factories and offices and individual consumers has resulted in high demand for eCommerce based purchasing, employee WFH solutions, video call services and demand for contact free work and customer interaction solutions.

- While the pandemic has accelerated the demand for digital, it is unlikely that the trend will reverse, as it has benefited productivity and efficiency. For example WFH may partially reverse in time but it may emerge as a permanent option as it has been widely accepted.

Financials of HMT

- HMT’s revenues, EBITDA and PAT over the years are in Fig 2. The firm moved from losses in FY18 to good profits by Q1FY21. EBITDA and PAT margins have improved from FY18-20.

- EPS too is sharply up, from losses in FY18 to an excellent result in Q1FY21.

- In Fiscal 2018, HMT had restated loss for the year of ₹22.5 cr. This was due to relatively lower revenue from contracts with customers and higher employee benefit expense and finance costs. Further, to write off accumulated losses, the Company reduced the Securities Premium Account of HMT by ₹159.5 cr., after approval from the NCLT, Bengaluru bench through its order to the scheme of reduction of capital filed by HMT.

- RoCE was 28.9% and RoE was 27.1% in FY20, a positive.

Fig 2 – HMT Financials (clickable)

Benchmarking

We benchmark HMT against listed small IT service firms and the leader TCS. See Fig 3.

Fig 3 – Benchmarking (clickable)

While the other firms are larger than HMT, we can draw some parallels:

- The valuations of HMT are higher than all the others.

- Sales growth has been good a leader in HMT. Profits cant be measure as HMT was loss making to years ago.

- D/E ratio is highest here. One of the objects of the fresh issue in IPO is to reduce debt.

- Margins are still on the lower side as HMT is building scale for its operations.

- Return ratios are high while not being highest.

- The Revenue per employee is low, indicating that HMT is investing in employees for growth.

Positives for HMT and the IPO

- Ashok Soota is the promoter, he has a great track record as a software executive at Wipro, and serial successful entrepreneur who started (and created great value with) Mindtree and now Happiest Minds. He has built great teams in these firms. He is well known also due to several books he has written on entrepreneurship. Many investors will be drawn in by him, to buy into this, his next firm. However at 77, he may be unlikely to be able to take an active / executive role in the firm.

- However there is a solid next line of management team in place at HMT.

- HMT says it is “Born Digital, Born Agile” and has over 90% of revenues from digital services, quite higher than most other Indian services firms. There is no doubt that digital services are a high demand, cutting edge space with better growth prospects.

- The Indian IT services firms are generally debt free, high cash and RoE generating firms once they stabilize operations. HMT should be able to do this in 1-2 years post IPO.

- The philosophy at Happiest Minds is simple yet powerful – that happy employees ensure happy customers. While this is well known, there appears a special focus on this at HMT.

- In just 9 years the firm has gone from startup to $100 million of revenues, and Rs 100 crores of EBITDA, is a good achievement.

- The covid pandemic offers an opportunity to grow faster as customers are forced to work remotely and need more solutions and support.

Risks and Negatives for HMT and the IPO

- Valuations at PE of ~34 times and PB of ~7.6 times (FY20 trailing basis) are expensive. However a premium is usually demanded by good quality firms in their IPOs.

- While HMT may present a digital focus, and a large percentage of business from digital, most Indian software services firms have a digital business segment, and their significant legacy businesses may actually offer an opportunity to add a digital layer. So competition is intense for HMT and the key in IT services has always been to adopt and absorb new technologies fast and roll these out to clients.

- HMT appears to be just another vanilla 1st generation IT services firm, when we are already seeing the 2nd generation services firms focused on Engineering R&D, Pharma R&D, legal, etc.

- The 79% tilt to USA of business can be a constraint if visa availability declines there.

- The financial performance of HMT has been uneven, and there’s no certainty that the solid FY19 and FY20 will be followed by a good FY21 post IPO.

- While Covid offers some opportunities, there is no doubt that many economies are entering a recession and corporate spending for the most part may reduce over the next 1-2 years.

- IT services are facing competition from 1) the enterprise Product firms 2) the large application and product firms dedicated to Google Android, Apple and Microsoft platforms and 3) the Social Media firms.

- The INR:USD is at 73.3 today. After many years of 5% a year average weakening of INR against USD, in the last few months the trend appears to have reversed. Indian economic factors such as lower crude prices, lower gold imports, international trade surplus, large forex reserves, falling fiscal deficits and USA Fed policies all point to a stable or strengthening of INR against USD. We expect INR to be in a 70-75 range against USD over the next year.

Overall Opinion and Recommendation

- IT services are always going to be needed to stitch together solutions for their clients, and to help them navigate, evaluate and deploy the complex IT landscapes and technology options. Indian IT services companies have time and again proven their mettle and have the skilled resources and project management skills to deliver successfully.

- Happiest Minds as a small-cap firm has many of the quality ingredients required to succeed including great management, new digital tech focus and good employee policies.

- If HMT continues its growth story over 5 years, this IPO entry price will look quite reasonable.

- Risks: 1) Valuations at PE of 34 times and PB of 7.6 times (TTM) are expensive. 2) Intense competition 3) Covid induced challenges – demand from customers as well as employee health 4) Rupee strengthening against USD

- Opinion: Investors can SUBSCRIBE to this IPO with a 2-3 year perspective.

Disclaimer

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. JM has no stake ownership or financial interests in HMT or any group company. Punit Jain intends to apply for this IPO in the Retail category. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an Investment Advisor. Punit Jain is a registered Research Analyst under SEBI (Research Analysts) Regulations, 2014. JM has been publishing equity research reports since Nov 2012. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com.