- Date 11th July; IPO Opens 13-15th July at ₹423-425/share

- Small Cap: ₹ 2,200 Mkt cap

- Sector – Specialty Chemicals

- Valuations: P/E 30.7 times TTM, P/B 6.9 times (Post IPO)

- Advice: SUBSCRIBE

Summary

- Overview: Rossari Biotech is a leading Indian textile and specialty chemical firm. Revenues, EBITDA and profit for FY20 were ₹ 603.8 cr., ₹ 105 cr. and ₹ 65 cr. resp., and grew at 32.3%, 67.6% and 66 % resp. over the last 3 years. Rossari has seen a rapid growth in recent times, and has a balanced product portfolio and a large number of domestic customers. Growth plans look promising with the planned Dahej plant. The debt is low, and balance sheet looks healthy with good return ratios. Expansion plans have been funded mostly from internal cash generation. The firm is small but looks nimble in terms of product formulations, R&D, new export markets, etc. At a P/E of 30.7 times FY20 earnings, the valuation is expensive. However the current growth rates justify this valuation.

- Risks: 1) Valuations look expensive 2) delay in new Dahej plant could affect growth 3) Covid19 infection can affect Revenues. It can also affect manufacturing operations.

- Opinion: Investors can SUBSCRIBE to this IPO with a 2 year perspective.

Here is a note on Indian Rossari Biotech (Rossari) IPO.

IPO highlights

- The IPO opens: 13-15th July 2020 with the Price band ₹423-425 per share.

- There is a Fresh issue of ₹ 50 crore, and an Offer for Sale of 10,500,000 shares by promoters. The FV is ₹ 2. The IPO in total will collect ₹ 500 cr.

- The IPO share quotas for QIB, NII and retail are in ratio of 50:15:35.

- The unofficial, grey market premium is ₹125-130 /share, indicating a 30% upside. This is a positive.

Introduction

- Rossari Biotech is a leading Indian textile and specialty chemical firm with over a decade history of innovative, agile, and rapid growth. They provide customized solutions to industrial and production requirements of customers through a diversified chemical products portfolio. Building upon expertise in textiles sector, they have successfully diversified into the home, personal care, animal health and nutrition and performance chemicals markets.

- Revenues, EBITDA and profit for FY20 were ₹ 603.8 cr., ₹ 105 cr. and ₹ 65 cr. resp.

- It has 3,783 employees. The Silvassa (in UT of Dadra & Nagar Haveli) mfg. facility has a capacity of 120,000 MTPA. They have a dedicated team of 22 employees in R&D facilities situated at Silvassa mfg. facility and another one in Mumbai.

- Rossari relevant market includes following Segments – Home Care, Personal Care, Textile Chemicals, Construction Chemicals, Paints & Coatings, and Water Treatment Chemicals.

- Promoters of the company are Edward Menezes, 59, and Sunil Chari, 54. They started together in 2003, and are career technocrats having 45 years of experience cumulatively in specialty chemicals industry.

- The two Promoters hold about 82% pre IPO and 62% shares post IPO and are the primary sellers.

- On 10th July, Rossari raised Rs 149 cr. from anchor investors, with top 3 MFs as key investors.

Financials of Rossari

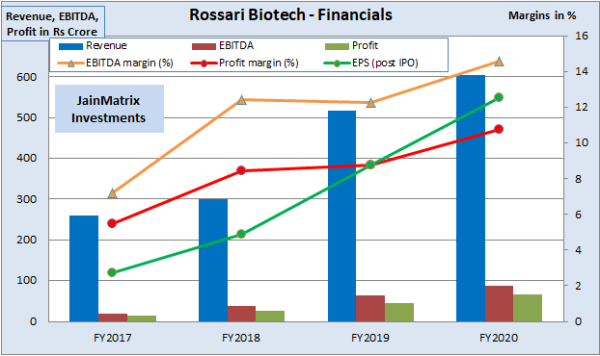

- The 4 years financials shows rapid revenue growth, and improving EBITDA and profit margins. The Revenues, EBITDA and Profits grew at 32.3%, 67.6% and 66 % resp. See Fig 1.

- The firm has grown Operating Profits sharply, but the working capital has grown in FY20, reducing the final Cash from Operations, see Fig 2. The firm is also making significant investments into a new manufacturing facility at Dahej, so the Free Cash Flow has turned negative in FY20.

Fig 2 – Free Cash Flows

Fig 2 – Free Cash Flows

- The firm has in recent years grown its offering in the Home, personal care and performance chemicals (HPPC) segment and this is 47% of its revenues, see Fig 3.

- Per news reports, Rossari seized the opportunity after Covid19 to make Hand Sanitizers and Disinfectants, which saw a massive demand spurt in recent months.

Fig 3 – Key Product Segments

Fig 3 – Key Product Segments

- The firm has also grown its exports pie and now exports to 18 countries including Vietnam, Bangladesh and Mauritius. It plans to grow the international business in future. See Fig 4.

Fig 4 – Exports

Fig 4 – Exports

- The firm has grown its manufacturing capacity steadily at the Silvassa plant, see Fig 5.

- The Capacity utilization has been over 80% for the last 2 years.

- Rossari is setting up a new plant at Dahej (Gujarat) of 1,32,000 MTPA. This is expected to go on stream in FY21. There is no expansion planned at Silvassa, as the plant area is saturated.

- Funding for this plant has been from internal cash generation as well as loans.

- The rapid revenue growth has come at the cost of slightly lower average realizations from products.

Fig 5 – Manufacturing

Fig 5 – Manufacturing

Chemicals Industry Outlook in India

- The outlook can be seen in Indian Specialty Chemicals Sector – A Spotlight. Do read this.

- In brief, we are positive on Chemicals and particularly Specialty Chemicals sector. There are good opportunities around replacement of Chinese supply for domestic and global demand.

Benchmarking

We compare Rossari to Chemical industry peers in India. See Fig 6.

- It’s the smallest firm by revenues in this group. In terms of valuations, ie P/E and P/B, it is on the higher side. The margins are also on the lower side, both Operating and Profit.

- Growth numbers are leading, both Sales and Profits, indicating a good burst of recent success.

- In terms of ROE it’s a leader, and on RoCE above average. Post IPO there is some 5% dilution to equity, so the number may be reduced to that extent.

- The D/E looks healthy, even though the company is in expansion mode. This is good.

- In a growth phase, one does not expect dividends from small cap firms, so its not an issue.

- Plans are afoot around growing exports, and this should help Rossari improve revenues and realization.

Risks and Negatives for Rossari and the IPO

- Valuations at PE 30.7 times of FY20 earnings looks expensive. However the PEG is 0.46, indicating undervalued levels.

- Any delay in the Dahej plant in terms of commissioning and a start of production in FY21 will slow the revenue momentum at Rossari as the current plant is running close to capacity.

- The IPO is primarily an offer to sell by promoters, so the firm gains only by Rs 50 crores of capital raised by fresh issue of shares. Conversely the equity capital will not be much diluted.

- In FY20 domestic sales were 86% of revenues, a low ratio, so exports is an opportunity.

- When we see a sharp burst of growth in financials in 2-3 years before an IPO, we worry that such growth may not be sustained in the next 5-10 years after a successful listing.

- The promoter owned firm has not benefited from the oversight, partnership and approval of Private Equity or other investors, so future success of Rossari is highly dependent on them.

- This is the first IPO after a pause of several months. It’s possible that demand from hurt investors for this IPO may be low. But this may be to the benefit of investors in this IPO.

- Covid19 epidemic is still gathering momentum in India, and till we see a fall in infection numbers, both investors and overall demand in the economy may be subdued. However the firm has grabbed the opportunity by making Covid safety products such as d Sanitizers and Disinfectant liquids.

- This is a B2B space, so verification and confirmation of customers, brands and quality is difficult.

Overall Opinion and Recommendation

- Specialty Chemicals sector is a high potential growth sector.

- Rossari Biotech has seen a rapid growth in recent times, and has a balanced product portfolio and a large number of domestic customers. Growth plans look promising with the planned Dahej plant.

- The debt is low, and balance sheet looks healthy with good return ratios. Expansion plans have been funded mostly from internal cash generation.

- The firm is small but looks nimble in terms of product formulations, R&D, new export markets, etc.

- At a P/E of 30.7 times FY20 earnings, the valuation is expensive. However the current growth rates justify this valuation.

- Risks: 1) Valuations look expensive 2) delay in new Dahej plant could affect growth 3) Covid19 infection can affect Revenues. It can also affect manufacturing operations.

- Opinion: Investors can SUBSCRIBE to this IPO with a 2 year perspective.

Disclaimer

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. Punit Jain discloses that he has no stake ownership or known financial interests in Rossari Biotech or any group company. Punit Jain intends to apply for this IPO. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an Investment Advisor. Punit Jain is a registered Research Analyst under SEBI (Research Analysts) Regulations, 2014. JM has been publishing equity research reports since Nov 2012. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com.