- Date: 13 Jan 2015

- CMP: Rs 11,766

- Mid Cap – with Mkt Cap 13,020 crores

- Advice: HOLD now, and buy on dips

Overview:

Page Industries with the Jockey franchise in India is a pioneer of the premium innerwear market. It is extending the success in menswear to womens wear and active wear, and with the Speedo brand to swimwear. Their revenues, EBITDA and PAT have grown by 36%, 35% and 37% CAGR over 6 years. With investments in manufacturing and retail, we expect this success trajectory to continue.

Why is it a HOLD?

- Page has a PE of 71.3 times, a PEG is 2.4 and a P/B of 45.4 times

- It has seen a 109% price appreciation in the last one year.

- It is a Quality business, but available today at excessive valuations.

- It’s a Hold but investors may Buy on Dips.

Description and Profile

- Page Industries, located in Bangalore makes innerwear (Jockey) and swim/active wear (Speedo).

- FY14 revenues were 1187 crores, and profits 154 cr. Set up in 1994, Page listed in Mar 2007.

- They have over 16,000 employees and manufacturing in 17 locations in Karnataka.

- Page has an exclusive license for mfg. & sale of the Jockey brand innerwear, sports and leisure- wear for men and women in India, Sri Lanka, Bangladesh, Nepal and UAE. The Speedo brand was launched last year for swimwear, water shorts, apparel, equipment & footwear in India.

- Page has a strong pan-India distribution across 1,200 cities, with 400 distributors, 147 exclusive Jockey outlets and more than 25,000 retail outlets.

- Speedo is available in 826+ stores across 70 cities including 5 exclusive brand outlets.

- The India Jockey business recently became the largest franchise globally from 142 countries.

- Management has Sunder Genomal as MD, Vedji Ticku as COO and Pius Thomas is ED-Fin.

- Shareholders are: Promoters 51.8%, MFs/ DII 6.4%; FIIs 32.3%, Individuals 6.8% and others 2.7%.

Business Model, News and Industry Note

- Page has pioneered the premium segment of the inner-wear garments in India with the Jockey brand. They started distributing through multi-brand outlets, improved the display standards and raised the profile of this segment of garments. Marketing expenses are high at 6% of sales.

- Page has an installed capacity of 16.2 cr. pieces per annum, in 17 units spread over 1.7 Million sq. ft. in Karnataka (FY14). The company plans to increase its capacity by 42% by Dec 2015.

- Even though the consumers may be affluent people across age groups, the core target consumer for Jockey in India is “children born during the economic liberalisation era of the 1990s”.

- Page through its Jockey relationship has access to good technology and marketing collateral which it utilizes as per its needs.

- Though men’s innerwear is the major contributor to sales, the share of women’s innerwear and other categories has been rising steadily.

Fig 1 – Products by Revenue

Fig 1 – Products by Revenue

- Personal experience: This analyst visited a Jockey exclusive outlet in Bangalore to gain first-hand experience. The store was impressive in terms of location, access and visibility. The bright and clear displays inside make personal browsing easy. Men handled the mens products and girls handled womens products in their section at the rear of the store. Smart layout indeed. The sales assistants were helpful, and responsive. I did end up buying more than I had planned for :-)

- Online presence: Page products are widely available through the popular ecommerce sites, but not sold on their own website. Here they have the catalogue on display but no purchase facility.

Industry

- Garments: The Indian Textiles Industry accounts for 4% of GDP, 14% of industrial production; it directly employs 3.5 cr. people (highest after agriculture) and accounts for 17% of all exports.

- The size of the domestic readymade apparel industry is expected to double within 5 years due to prosperity, better government policy, fashion and brand trends and consumer expectations.

- Government Policy Support: The Indian government supports the textile industry by investment promoting schemes like TUFS (Technological Up gradation Fund Scheme) and SITP (Scheme for Integrated Textile Parks). Page too is investing in new capacities using TUFs loans.

- Innerwear: The innerwear market in India is estimated at Rs 17,750 cr. (Technopak Consultancy). This is split among menswear 39% and women 61%. The unorganised segment is estimated to be 69% of the innerwear market. This indicates the potential for growth for companies like Page.

- The innerwear market is expected it to grow 3 times in 10 years. Growth will be driven by rising discretionary spends, growing number of mid-high income households and rising urbanization.

- Jockey is at the premium end of the innerwear market in India. Peers include international brands such as Levi’s, Fruit of the Loom, United Colors of Benetton, Lovable Lingerie, Triumph, Enamor and Tommy Hilfiger, as well as the more mass brands like Rupa, Lux and VIP.

- In the organised space, Page has 20% market share in men’s innerwear (about 50% of Page’s revenues) and just 3% in the highly fragmented women’s innerwear segment.

Stock Evaluation, Performance and Returns

- Page had its IPO in Mar 2007 at Rs 360. The issue was subscribed 1.44 times.

- The price never fell below 241 in March’07, and instead has appreciated by 73% per year since IPO. This why this share is rated one of the best Indian wealth generators in recent times.

- The share has gained 109% in 1 year. We need to assess if the share is currently overvalued.

- The company’s Revenues, EBITDA and PAT have grown by 36%, 35% and 37% CAGR over 6 years.

The Price History is available on the LINK.

Fig 2 – Page Financials and Fig 3 Cash Flow, Dividend

Fig 2 – Page Financials and Fig 3 Cash Flow, Dividend

- In Fig 2 – Page Financials, we can see that Revenues and EPS have risen steadily. The surprise is that the Operating and Profit margins have not fallen even with a substantial rise in scale and business volumes. They have continued in the 18-25% and 10-15% range over a 6 year period.

- The maiden dividend was paid in 2007. Thereafter dividend has shown a good increase, Fig 4. Dividend yield is currently at 0.51%,

- Cash flow data Fig 3 shows that Page has been investing in its facilities & businesses. Even so, the operating cash flow has been good in the last 3 years, and net free cash flow is positive.

Fig 4 – Price and PE Chart, and Fig 5 – Price and EPS Chart

Fig 4 – Price and PE Chart, and Fig 5 – Price and EPS Chart

- The Price and PE chart Fig 4 indicates that the historical average PE has been 35 times over 6 years. However the PE is clearly trending up indicating an exceptional situation – a significant business improvement, or a re-rating of the firm (or both).

- At 71.3 times today, the PE is clearly among the highest in the Indian consumer industry. The only other names that come to mind are Jubilant Foodworks (91 times)

- The Fig 5 – Price and EPS graph shows that EPS has been on a steep ascent. The share price has been roughly following the EPS.

Fig 6 – Finance Metrics

Fig 6 – Finance Metrics

The Fig 6 displays some of the key financial ratios.

- The company has a healthy interest coverage ratio. The Profit and Operating Margins are consistent over the years.

- The firm has used its good cash flows to reduce debt, and the debt-equity ratio has been falling.

- Page has an impressive and rising RoCE (59%) and RoNW (61.2%).

- Page has not changed its equity capital in 7 years since listing, which is very good stability.

- The beta of Page is 0.12 (Reuters). Thus it is far more stable than the market, which is very good.

- PEG is 2.4 – indicates overvalued/expensive valuation, basis current PE and EPS projections.

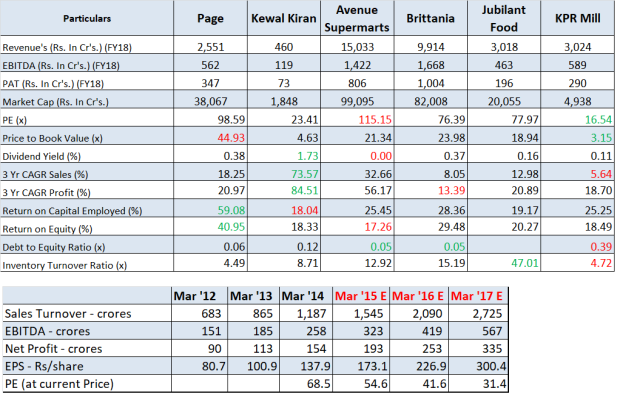

Benchmarking and Financial Projections

A benchmarking exercise compares Page with peers in the apparel industry. See Table 7.

- Page looks the most expensive but it also has the highest Sales and Profit growth, RoCE and RoE.

- The dividend yield (%) is in the lines of the industry and is one of the better paced company.

- Page is the leader in terms of returns. The company’s return on equity is overwhelming and hence, the stock is popular among the investors.

- It is doing well on most of the parameters and is expected to continue on these lines in future.

Table 7 – Benchmarking and Table 8 Projections

Table 7 – Benchmarking and Table 8 Projections

Risks

- Entry of international brands + ecommerce. The ecommerce sector is booming in India and a number of high priced international brands are making their entry into the Indian market. By avoiding the retail route, they save costs and directly address the premium buyers.

- Page has a good presence in multi-brand ecommerce websites and should compete strongly.

- Increase in labour costs.

- The company has taken steps to monitor and improve labour productivity and labour relations, which will mitigate the impact of increase in labour cost to large extent.

- Increase in input and raw material costs.

- The company is confident that the increase in input cost can be passed on to the consumers and moreover, there has been softening trend in the price of input material especially cotton.

Opinion, Outlook and Recommendation

- The innerwear market in India is underpenetrated as compared to other Asian peers. Also favourable demographics and low penetration are strong growth factors.

- Page has done pioneering work and is an innovator that has built the premium innerwear market in India, particularly in menswear. They have a robust brand, good marketing and retail practises and reputation for quality.

- We expect Page to continue its rapid growth and repeat the success of means-wear in other segments such as womens-wear, swimwear, active/ sports-wear, etc.

- Financially Page is well managed with good revenue and profits growth, strong balance sheet, good free cash flow, investments in capacity expansions and low debt.

- However, a PE of 72 times, P/B of 45.4 times, an 109% price appreciation in the last one year and a PEG of 2.4 are indictors of over valuation. It is a Quality business, but at excessive valuations.

- Page is a HOLD.

Disclaimer

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. Punit Jain has been a long term investor in Page Industries since June 2014. Other than this, JM and its promoters/ employees have no financial interest in Page and no known material conflict of interest as on date of publication of this report. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an Investment Advisor. Punit Jain is a registered Research Analyst under SEBI (Research Analysts) Regulations, 2014. JM has been publishing equity research reports since Nov 2012. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com.

To see latest price of Page Industries, click on // Page Industries

JainMatrix Knowledge Base:

See other useful reports

- Godrej Properties – A Towering Success

- Happy New Year 2015 – the year of Focus and Concentration

- Top performing sectors in 2015 – An Interview

- MidCap Portfolio – Celebratory Outperformance

- V-Guard Industries – Electrifying Growth

Disclosures and Disclaimer

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. Punit Jain has been a long term investor in Page Industries since June 2014. Other than this, JM and its promoters/ employees have no financial interest in Page and no known material conflict of interest as on date of publication of this report. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an Investment Advisor. Punit Jain is a registered Research Analyst under SEBI (Research Analysts) Regulations, 2014. JM has been publishing equity research reports since Nov 2012. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com.