Post IPO report dated 17th Aug 2015

Dear Investor,

Here is a short post listing report on the Syngene International IPO.

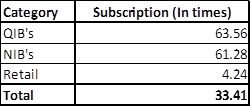

- The IPO that was open from 27-29th July received excellent response with a 32.05 times over-subscription.

- While Retail was only 4.8 times oversubscribed, the QIB portion was over 51.5 times and non institutional investors (NII) category was over a massive 90.2 times.

- The IPO price was declared at the upper end of Rs 250. We saw the positive mood continuing on the listing date also.

- Listing happened on 11th Aug and was enthusiastic as the share closed with a 24% gain at Rs 310.

- Today, one week from listing date, the share is at Rs 347, a solid 39% gain for investors.

For us at JainMatrix Investments, this is another win with a correct analysis so far.

Happy investing,

Punit Jain

IPO report dated 27th July 2015

- Issue Price range: Rs. 240-250 and Issue Period: 27-29th July 2015

- Target Market Cap Rs 5,000 crore and Industry – Pharma R&D

- First day – 32% subscribed

- Advice: Buy for 2-3 years

The Syngene IPO is a first time offer from the high potential sector of pharma R&D Outsourcing. The Income, EBITDA and Profits have grown well at 18.2%, 30% and 31.3% CAGR resp. over 5 yrs. There is ample global growth possible if Syngene is able to manage scale and efficient operations. The valuations are high by Indian IT services levels, but is justified by sector leadership & innovation. Investors may BUY with a 2-3 year perspective.

Here is a note on Syngene International Limited IPO. (Syngene)

IPO highlights

- The Syngene IPO is open from 27-29th July 2015 with Issue Price band: Rs. 240-250 per share.

- Shares offered in IPO are 2.2 crores, of Face Value Rs 10 per share, which is 11% of their post-Offer equity share capital. This will raise Rs.550 cr. and target market cap is Rs 5,000 cr.

- Minimum bids: 60 shares & multiples thereof. Minimum investment: Rs. 14,400.

- The IPO involves no equity dilution, and IPO proceeds will flow to the promoter, Biocon Ltd.

- The P/E of Syngene are 30.3 – 31.5 times estimated FY15 earnings, at lower/upper price limits.

- The company has already raised Rs 150 cr. from anchor investors.

- To understand Syngene better, we first see a snapshot of the listed parent company Biocon.

Biocon Ltd. Snapshot

- Biocon Ltd is engaged in developing medicines (generic insulins and biosimilar monoclonal antibodies) for addressing chronic diseases for cancer, diabetes and autoimmune patients.

- FY15 revenues were 3,300 cr and PAT 528 cr. The Income, EBITDA and Profits have grown at 15%, 9% and 10% CAGR respectively over 5 years. See Fig 1.

Fig 1 – Biocon Financials, JainMatrix Investments

- It had its IPO in 2004, at a price of Rs 315. There was a 1:1 bonus issue in 2008, so with the CMP of Rs 465, the share has given shareholders a 10.3% CAGR return over 11 years. The Sensex gave 15.3% CAGR in this period, so Biocon underperformed the Sensex by 5% CAGR.

- Overall we rate Biocon as an average performer.

Introduction to Syngene

- Syngene started in 1993 at Bengaluru, and is a subsidiary of Biocon. It is engaged in providing contract research and manufacturing services for pharma sector. It is one of India’s leading Contract Research Organisations (CRO) in the $14.7 bn global pharma CRO market.

- Revenues in FY14 were Rs 708 cr and profits Rs 135 cr. It has 2,667 employees, incl. 2,096 scientists.

- It offers a suite of integrated, discovery, development and delivery services for novel molecular entities (NMEs) across sectors like pharmaceutical, biopharma, and biotechnology.

- It is primarily an export oriented business, see Fig 2.

Fig 2 – Syngene Business Segments, JainMatrix Investments

- With a laboratory area of 9 lakh sq. ft., Syngene currently services over 200 clients, ranging from MNCs to start-ups, including 8 of the top 10 global firms. It has dedicated research centers with Bristol-Myers Squibb, Abbott Labs and Baxter International.

- Syngene helps its clients in conducting discovery (from hit to candidate selection), development (including pre-clinical and clinical trials, analytical and bio-analytical evaluation, formulation development and stability studies) and pilot manufacturing (scale-up, pre-clinical and clinical supplies) each with distinctive economic advantage.

- In addition to research staff dedicated to a particular client, Syngene also offers resources through flexible business models like a full-time equivalent (“FTE”) and fee-for-service (“FFS”).

- Syngene is planning investments in the next three-four years of a new mfg. facility, a center for work on biologics and formulations (Bengaluru) and also to expand existing facilities. This will be with funds raised from internal accruals and debt.

- The leadership team is Kiran Mazumdar Shaw (MD) and Peter Bains (ED/ CEO).

- Silver Leaf Oak, a private equity fund acquired 10% stake in Syngene in 2014.

Financials of Syngene

- The Income, EBITDA and Profits have grown at 18.2%, 30% and 31.3% CAGR resp. over 5 years. See Fig 3.

- The EPS, adjusted for the IPO has grown by 31.4% CAGR over 5 years.

Fig 3 – Syngene Financials, JainMatrix Investments

- The business has been Cash Flow positive for 4 of the last 6 years. Of late, the firm has been investing heavily in its business. In FY15, the Free Cash Flow has been positive. See Fig.4.

- RoCE and RoE metrics are quite impressive, which are at 30.5% & 20.5%.

- Finance costs decreased by 94% in FY14 (from 6.5 cr. in FY13) on account of repayment of debt. In addition there were forex losses in FY15. As a result, in FY15 we see that there is negative cash from operations and positive flow from Investments.

Fig 4 – Cash Flows (Chart by JainMatrix Investments)

- Shareholding Pattern (%): Post-issue the shareholding pattern will be Promoter Group 74.5%, Institutions and Public 22.1% and Non Promoter & Non Public is 3.3%. See Fig 5.

Fig 5 – Shareholding Patterns, JainMatrix Investments

Business and Industry Notes

- CRO firms offer outsourced services to support R&D driven organizations across industrial sectors like pharmaceuticals, biotechnology, biopharmaceuticals, nutraceuticals, animal health, agro-chemicals, cosmetics and electronics.

- CRO services for pharma sector span the range of R&D activities from New Molecular Entity (“NME”) discovery, development and manufacturing.

- CROs offer clients an opportunity to manage costs, have flexible operations and realize efficiencies in R&D and related functions. However most CRO service providers specialize to some degree based on the needs of their clients and the market in which they operate.

- As per Frost & Sullivan estimates, global R&D expenditure for the pharma industry in 2014 was approximately US$139 billion, of which US$105 billion could have potentially been outsourced. According to the report, outsourcing penetration for the CRO market for development services as of 2014 is estimated to be 27.3% of the potential outsourcing market for development services, but poised to grow to 38.7% in 2019, reflecting a CAGR of 12.5%.

- Growth in the CRO market has historically been driven by growth in R&D spending and increased outsourcing of R&D. The CRO industry has grown substantially in recent years and there is also an opportunity to grow through an increase in market share.

Positives for the IPO

- Syngene has plans for capex of Rs 1200 cr. over the next 3‐4 years. Out of this, one half would be for expanding existing facilities and the rest for setting up a new facility at Mangalore.

- Syngene has 2,096 scientists, including 259 PhDs, and 1,661 scientists with master’s degree. Resource knowledge and experience is the major asset for Syngene.

- Syngene has a good track record in compliance, getting a clean chit in three audits conducted by the US Food and Drug Administration (USFDA) over the past 18 months.

- Syngene has already signed commercial supply contract for 3 molecules with its clients. Besides, the company has a list of potential molecules lined up from its clients to sustain its base business over the medium term.

- Syngene is the first listing of an Indian pharma CRO firm. It is thus a leader and an innovative company and may receive a premium valuation.

- There is a good synergy between the Biocon (pharma manufacturing) and Syngene (CRO). This will help Syngene in its planned growth.

Negatives and Risks

- Syngene’s top 10 clients gave 72% of its revenues in FY15. There is a dependency on a few large clients, and the financials of Syngene can be affected in case loss of any of these clients.

- There are a number of pending litigations against Syngene, under heads Tax Matters, Threatened Litigation and Pending CIL Litigation (former subsidiary); and Litigation by and against the Promoter, all numbering close to 100. An adverse outcome in these proceedings may affect the reputation and financials, and harm future business.

- The FY14 balance sheet showed Contingent Liabilities totaling to Rs. 181.3 cr. which if materialized may adversely affect the profitability of the company.

- Intensifying competition for pharma CRO services.

- The Syngene financial performance can be affected by INR/ USD price fluctuations. In addition, international economic, taxation and outsourcing policy changes can materially affected operations.

- Ability to attract, retain and develop key personnel and R&D talent.

- The pharma sector faces many IP related compliances and legal challenges. Syngene needs to ensure it stays protected and safe from such issues.

- Clients need high secrecy and confidentiality as R&D work is for multi-billion dollar new drugs. Syngene needs to ensure that at the group and employee level, information stays safe.

- Regulatory tightening of clinical trials in India has slowed the work on Indian clinical trials.

Benchmarking

As there are no listed companies in India that are directly comparable to Syngene, we benchmark the firm against IT services, KPO and PHARMA firms like Biocon, eClerx, Glenmark and Mphasis Ltd.

Fig 6 – Benchmarking of Syngene, JainMatrix Investments

- Based on Fig 6, we come to the following conclusions.

- Syngene revenue growth is impressive. On margin parameters, it ranks second after eClerx.

- Syngene rates high on RoCE and RoE.

- For an early stage company, Syngene appears good in terms of low debt and financials.

- Syngene’s closest listed peer outside India is a Chinese firm, Wuxi Pharmatech, which is four times bigger in revenues, and is trading at a PE of 30.

Overall Opinion

- The Syngene IPO is a first time listing from a new and high potential sector of pharma CRO.

- This business builds on Indian advantages in IT services and KPO, with a pharma sector focus. The benefits have shifted from cost arbitrage to enhancing R&D productivity and reducing time to market.

- The promoters have an average record of providing returns to shareholders in Biocon. However, Syngene represents a high potential business segment, which is being spun off.

- The success of competition, eg Wuxi Pharmatech, indicates that there are ample opportunities for Syngene to grow and compete in the global market.

- We are positive on the prospects of Syngene in this IPO offering. Buy at cut off with a 2-3 year investment perspective.

Disclaimer

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. JM has no known financial interests in Syngene International Limited or any related firm. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an independent expert/advisor. JM has been publishing equity research reports since Nov 2012. JM has applied for certification under SEBI (Research Analysts) Regulations, 2014. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com.

Click and Share this post :