- Date 20th Jan 2017

- IPO Opens 23-25th Jan at offer price range: Rs. 805-806

- Its a Mid Cap with Rs 4,400 crore Mkt cap

- Industry – Stock Exchange

- P/E 35.9 and P/B 1.80 times (based on FY16)

- Advice: the IPO is rated AVERAGE

Overview: BSE is a stock exchange platform which is the first stock exchange in Asia and the world’s largest exchange by number of companies. Income for FY16 was Rs 658 cr. and profits Rs 123 cr. It offers a wide range of trading related services and monitors the listed companies, Sensex index and market activities. New product offerings, start of operations at GIFT city and stake divestment via CDSL IPO are likely to boost financials in the medium term. However it is an OFS, so BSE doesn’t benefit in IPO. Market shares are low at 39% in currency derivatives and 14% in equity cash. At FY16 P/E of 35.9, and a FY17E forward PE of 21.0, the valuations are high. NSE is a fierce competitor, and is ahead in terms of volumes, growth and profits, reducing BSE to a niche player.

Opinion: This offering is rated AVERAGE, and investors may look elsewhere for long term gains.

We present here a short video on the BSE IPO.

A VIDEO on BSE IPO

Here is a note on the Bombay Stock Exchange Ltd. (BSE) IPO.

IPO highlights

- This IPO opens: 23-25thJan 2017 with the Price band: Rs.805-806 per share.

- Shares offered to public number 1.54 cr. The FV of each is Rs. 2 and market Lot is 18. These shares are 28.26% of equity. The IPO will collect Rs 1,243 cr. (UMP) under the OFS route.

- The IPO shares are available to institutional, non-institutional and retail in ratio of 50:15:35.

- Trading Members hold 44% stake of BSE, and 56% is held by institutions & investors. Singapore Exchange, Atticus Mauritius Ltd and Quantum Ltd. are completely exiting through this IPO offering.

- BSE would not benefit from the IPO as it is an offer for sale (OFS).

Introduction

- BSE is a stock exchange platform, the first stock exchange in Asia, formed in 1875. It is the world’s largest exchange by number of listed companies, and India’s largest and the world’s 10th largest exchange by listings market cap, with US$ 1.7 tn. in total market cap of listed companies.

- Total income for FY16 was Rs 658 cr. and net profit Rs 123 cr. It has 513 employees.

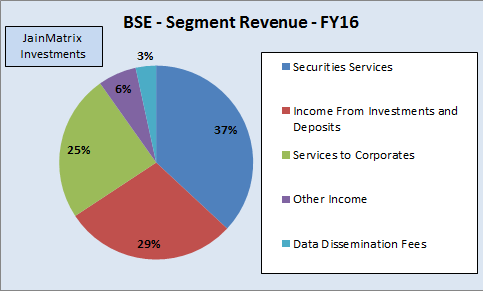

- As a platform, it regulates listed issuers and provides a market for listing and trading in various types of securities as allowed by SEBI. The primary operating businesses of BSE are as follows: (See Fig 1)

- Listing business: called the primary market, which relates to the issuance of new securities. It also has a platform for listing and trading in equities of small-and-medium enterprises (SME).

- Market business: which consists of trading of listed securities, MFs, OTC corporate bonds, membership of depository participants in CDSL depository and providing post-trade services.

- Data business: which consists of the sale and licensing of information and trading products.

- Their operations also include IT services and solutions, the setting up of indices and training. They offer equity and currency derivatives, securities lending and borrowing, and platforms to facilitate buyback and sale of securities by substantial shareholders of listed companies.

- BSE has listed 5,868 companies and 1,446 members across all segments, and in FY16 it took 28.49 crore orders and executed 15.5 lakh trades in equity shares average per trading day, making it the 12th most active trading exchange in the world.

- BSE extensively monitors the listed companies and market activities to minimize the risk of default, promote market transparency and integrity, contributing to growth of the Indian capital markets.

- Deutsche Borse, Singapore Exchange, SBI, LIC, and GKFF Ventures hold 4.75%, 4.75%, 4.75%, 4.68% and 4.58% respectively.

- BSE has a market share of 39% in the currency derivatives segment and 14% in equity cash segment whereas NSE remains the leader with shares of 56% and 86% respectively. In the profitable equity derivatives segment, BSE market share has dropped to almost zero.

- In April 2012, the SEBI board passed regulations limiting stock exchanges from owning more than 24% of the share capital of a depository and gave 3 years to comply. BSE was not compliant and SEBI extended its deadline to FY17. To meet this requirement, BSE divested 4.15% stake in CDSL to LIC in Oct 2016, but still holds 50.05%. BSE will dilute the excess stake in CDSL in the IPO of CDSL.

- Leadership Sudhakar Rao-Ch’man, Ashish Kr. Chauhan-MD/CEO, Nehal Vora-CRO, Nayan Mehta CFO

News and Updates for BSE

- BSE’s index – the S&P BSE Sensex is India’s most widely tracked stock market benchmark index.

- India International Exchange (IIE), a subsidiary of BSE, commenced trading at Gujarat International Finance Tech (GIFT) city on 16th Jan, 2017. Tech offerings by IIE will facilitate co-location of members in its center at GIFT IFSC as well as algo trading including high frequency traders. The high speed platform will provide cross-border opportunities of investment with a supportive regulatory framework, and many infra and tax benefits. NSE is also expected to launch here soon.

- SEBI announced a reduction of 25% in the fee payable by brokers and also decided to amend regulations to enable them to make payments through digital mode. This is a positive for the sector.

- BSE discontinued lump sum transactions through paperless SIP facility for MF investors in Jan 2017. It introduced iSIP to help set up a SIP without documents, and ‘BSE StAR MF’ mobile app for android.

- BSE was caught in two legal disputes just before the IPO. A contempt of court petition was filed in the high court because of irregularities in the Corporate office building, where a legal notice has challenged the launch of the IPO for BSE. The contempt petition has been filed by Yogesh Mehta against city officials, highlighting their inaction against illegalities in the building. The stock exchange lost the case right up to the Supreme Court, while another PIL in the case was dismissed by the HC.

- BSE introduced new interest rate futures (IRF) contracts from Dec 30, 2016 on 6-year govt. bonds. The contract is based on 6.84% central govt. security maturing in 2022. An IRF contract is an agreement to buy or sell a debt instrument at a specified future date at a pre-determined price.

- BSE announced in Jan 2017 that it will conduct periodic call auction for illiquid securities of 335 illiquid stocks. The auction would be based on trading activity during the period July–Dec 2016.

- BSE shares 85% of profits as dividend, and plans to continue with high dividend in future

- Subsidiary CDSL has filed papers for IPO with SEBI. BSE would dilute 26% stake in this IPO.

- The unofficial/ grey market premium for this IPO is in the range of Rs. 128-130. This is a positive.

STOCK Exchange Sector OVERVIEW

- Globally, there are over 70 major stock exchanges with a listings market cap of more than US$5 bn each. The total global market cap of WFE member exchanges (World Federation Exchanges) aggregated to US$68 tn. Of these stock exchanges, 16 had a market cap of above US$1 tn. each. Market cap of these stock exchanges taken together account for 86% of the total global market cap.

- The NYSE dominates with a market cap of about US$18.2 tn. In terms of turnover, Shanghai SE topped the list with a turnover of about US$21.3 tn. in 2015. BSE was the largest in the world in terms of number of listed companies at the end of Oct 2016, with 5,868 companies.

- Global exchanges derive revenue from transaction fees, listing, clearing and depository services. For both exchanges, BSE and NSE, revenue mainly comes from securities. Services to corporates, like listing income makes a significant contribution to revenues.

- Equity as a percentage of financial savings in India is just 5%, compared with 14% China, 15% (Brazil), 20% (Indonesia) and 42% in USA. Growth for equity should grow and BSE will surely gain from this.

- The key growth drivers for the exchange sector in India are as follows:

- Demographic: India’s working age population is more than 60% of the population. A rising working age population results in a boost to consumer spending in the economy.

- Awareness and participation by retail investors: In recent years, equity investments by Indian investors is slowly increasing due to specific tax breaks for equity investors and financial awareness programs conducted by MF houses and stock exchanges.

- Initiatives by the GoI: Last year, GoI allowed the Employee Provident Fund Organisation (EPFO) to invest in equity markets. The state-run pension fund had a retirement corpus of Rs 8.5 lakh crore in 2015. It made a small investment of Rs 6,577 cr. in FY16, which may increase.

- FIIs: The FIIs are significant players in Indian capital markets, and constitute 18% of turnover in cash market, and 10% of client turnover in derivatives. FII flows will be a key driver of growth.

- From FY12 to FY16, the no. of shares traded on BSE & NSE combined grew by 30%. However, in H1 FY17, the shares traded on BSE declined by 9% YoY, while those traded on NSE increased by 22%.

- Information and data services contribute just 4-5% compared to 10-25% in other economies. They grew at 14% CAGR over 5 years. However, the base is low, so they should grow annually by 15-20%.

- India had an IPO revival recently, driven by strong economic fundamentals, favorable policy climate and strong investor confidence. Listing fees should grow at 15-20% over the next 5 years.

- Revenues from index services can further grow for the Indian market by expanding product offerings beyond equities. Revenues from index services should grow at 15-20% over the next 5 years.

- Source: BSE –RHP, NSE – DRHP

Financials of BSE

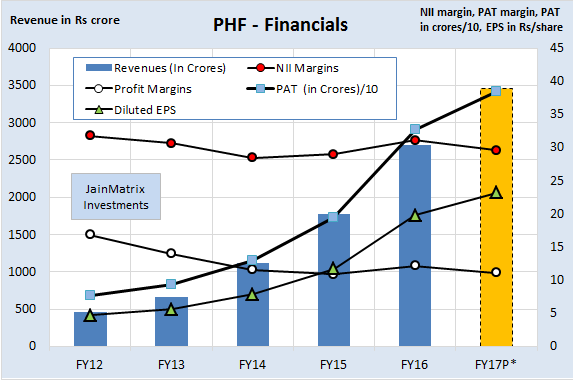

- BSE’s revenues, EBITDA and PAT have grown at 3.28%, -4.4% and -8.2% resp. CAGR from FY12 to FY16, see Fig 3. (Note: FY17 data is a simple doubling of H1 FY17 financials). Thus revenue growth is flat while profits have fallen, with NSE fast gaining market share in various segments. But we can see there is a recovery in earnings in H1 FY17.

- BSE has an ROE of 5% and ROCE of 8.2% for FY16 which is poor.

- BSE has robust margins that are improving. Even a small revenue growth will see improvements.

- The current dividend yield is 1.86% which is moderate. BSE distributes 85% of its profits as dividend and plans to continue with the high dividend in the future.

- The top 5 subsidiaries of BSE are CDSL, ICCL, Marketplace Technologies, CDSL Venture and BSE Institute. It has 50.1%, 100%, 100%, 100% and 100% stake in them resp. and all are profitable.

- BSE has a bank balance of Rs. 1,692 cr. which translates into Rs 310 as cash/share. With an IPO pricing of Rs 806, we can buy the operations of BSE for Rs 496. BSE has been generated free cash flows from FY12 through FY16. This is a positive. However it may be negative in FY17. See Fig 4.

Benchmarking

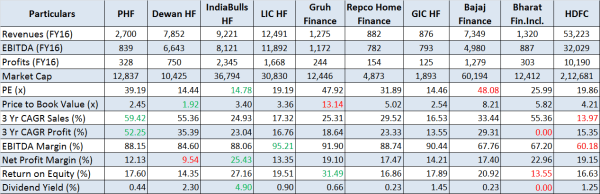

We benchmark BSE against NSE, MCX and other listed global stock exchanges. See Fig 5.

- The FY16 based PE for BSE appears to be high. P/B is lower and looks reasonable.

- BSE has the witnessed low sales and PAT growth compared to its peers. NSE has performed far better in the same macroeconomic conditions. BSE is debt free which is good. However low/no debt is common across all exchanges globally. BSE margins are high, which is a positive. However it appears low compared to its peer group. BSE has low return ratios, but moderate dividend yield.

Notes to financial benchmarking: Revenues, EBITDA and PAT values have been ascertained using the latest financial data/information available for global exchanges (CY15, Jun 16). Operating Margin (EBIT)/Operating Income has been used interchangeably with EBITDA Margin/EBITDA for global stock exchanges. Exchange rate of 1USD = Rs. 68, 1HKD = 8.77, 1SGD = 47.8, 1Euro = 72.5, 1AED = 18.51

Positives for BSE and the IPO

- BSE has strong brand recognition with a track record of innovation. According to CARE Research, BSE ranks third globally in terms of currency options and futures contracts traded in 2015.

- BSE has a diversified & integrated business model and good relationships with market participants. Revenues are more broad based with lower risk. With the largest number of listed firms, BSE provides critical listing infra for many firms.

- The valuations are moderate in terms of P/E and P/B. The company is debt free and has generated free cash flows from FY12 through FY16. This is good for investors looking for stable companies.

- Due to a good cash position, we can buy the operations of BSE for Rs 496, which is quite low.

- The IT platform of BSE is robust and high speed, which can be a valuable asset.

- BSE is nimble in its offerings and services, and has grabbed new opportunities, including the IIE.

- There has been a spate of IPOs in Indian markets in recent times, and they have almost all sailed through, some with massive over subscriptions. Listing revenues segment can be quite positive.

- In H1FY17, margin improved due to healthy growth in transaction charges and higher other income. In the near term, earnings may be boosted by changes in settlement guarantee fund (SGF) norms.

Risks and Negatives

- The IPO is an OFS, so BSE does not benefit. It is a liquidity event for past investors.

- The BSE is very weak in the profitable equity derivatives segment.

- Stock exchanges are the basic infrastructure for the trading industry. With higher volumes there can be a sharp rise in profits. However we see a flat revenue growth and falling profits at BSE. Even though H1FY17 results were good, we cannot say that this trend has been reversed yet. It’s likely that NSE will dominate the high volume and profitable segments, and BSE will remain a niche player.

- BSE operates in a highly regulated industry and may be subject to censures, fines and other legal proceedings if they fail to comply with their legal and regulatory obligations.

- BSE has received certain complaints from the public after filing of the DRHP with SEBI, with many allegations. Any litigation arising on account of such complaints, if adversely determined, could materially affect its businesses and financial condition.

- BSE isn’t loss making per se, however there hasn’t been real growth in the last 3 years. In spite of double digit margins, the bottom-line may not improve if there is no sales growth.

- Unconfirmed reports suggest that investors in BSE over the past few years are exiting with flat gains.

Overall Opinion and Recommendation

- Post demonetization, we feel Indian households will increasingly channel savings to equity markets, as will FIIs and DIIs. BSE should benefit from this.

- Not just historically but also in terms of market breadth, BSE is a leader and should be able to consolidate its position financially over the next few years.

- More product offerings, commencement of operations at GIFT city and stake divestment via CDSL IPO are likely to keep BSE financials healthy in the medium term.

- However NSE is a fierce competitor, and is way ahead in terms of volumes, growth and profits.

- At a FY16 P/E of 35.9, and a FY17E forward PE of 21.0, the valuations are average.

- This IPO offering is rated AVERAGE, and investors are advised to look elsewhere for long term gains.

JAINMATRIX KNOWLEDGE BASE

See other useful reports:

- CPSE ETF FFO – An Energizing Offer

- Balmer Lawrie – An Update

- Why Stocks, and Investment Outlook – Dec 2016

- Investment Outlook – Short Term Pain, Medium Term Gain

- The Natural Quotient: A Sustainability Metric for Business

- PNB Housing Finance IPO: A Transformed Lender

- Endurance Technologies IPO

- ICICI Prudential Insurance IPO – An Expensive BUY

- GNA Axels IPO

- RBL Bank IPO

- New Banks: Big Changes in Small Change

- Equitas IPO – Leader in SF Banks

- Do you want to be a value investor?

- Mahanagar Gas IPO

- A Repurpose for our PSUs

- How to Approach the Stock Market – A Lesson from Warren Buffet

- Announcement – SEBI approval as a Research Analyst

- Visit and Like JainMatrix FB or Follow on JainMatrix Twitter for reports

DO YOU FIND THIS SITE USEFUL?

- Visit the Investment Service offering page to find how you can get more.

- Register Now to get our Free reports and much more, on the top right of this page, or by filling this Signup Form CLICK.

Disclaimer

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. JM has no known financial interests in BSE Ltd. or any group company. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an Investment Advisor. Punit Jain is a registered Research Analyst under SEBI (Research Analysts) Regulations, 2014. JM has been publishing equity research reports since Nov 2012. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com.