Date: June 26, 2012 CMP: Rs 90.3 Mid-Cap – Market Cap 520 crores

Advice: Sell on any rally, as stock is Risky Targets: Unpredictable

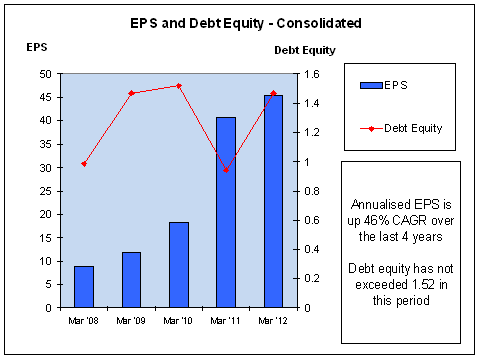

Ramky is a diversified infrastructure mid-cap firm. The focus areas are water solutions, sewage, roads, bridges, industrial parks, etc. FY12 revenues are 3884 cr. & PAT 260 cr. The growth figures are Sales (40.3%), EBITDA (47.6%), Net Profit (46.4%) and EPS 46% over 5 years CAGR. Net Debt at 1840 cr (D/E 1.47) is within limits.

On the other hand, the share has performed very badly with an 80% fall since the IPO. The fall in the infrastructure sector over the last two years has had a disproportionate effect on this stock. A CBI investigation of Ramky Group about projects awarded during 2004-2009 by the AP Govt. and rumors of linkage to an AP politician have pulled down this stock to tragic levels.

Ramky is classified as a Risky stock, and Investors are advised to exit.

Ramky Infrastructure Ltd – Description and Profile

- Ramky is an infra and construction firm with an environment focus.

- FY12 consolidated revenues are 3884 cr. & PAT 260 cr. The 2,916 full-time employees are engaged in projects for Water (supply, storage, treatment), irrigation, Roads & Bridges, Buildings, Industrial parks and power distribution.

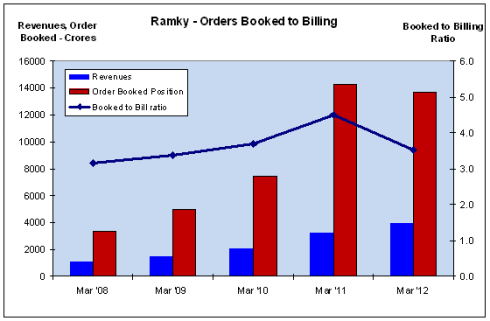

- The order book of 13,703 cr (3.5 times revenue), is split by vertical as per Fig 1.

- Customers are State Govt 59%, Private sector 29%, Central Govt 10% and PSU 2%

Prestigious projects include:

- Hyderabad Ring Road, a 150m road cum area development corridor with 8-lane controlled access expressway.

- 80 MLD Sewage Treatment Plant at Airoli, Navi Mumbai, bagged an Urban Infrastructure Excellence Award given by CNBC TV18 & Essar Steel.

- Construction of one of the Asia’s largest sewage treatment plants (172 MLD) with uplift an aerobic sludge blanket process, at Nagole Hyderabad.

- Construction of Gandhi Medical College and Hospital Complex in Hyderabad.

- Core strengths: 1) in-house design and engineering team that specializes in designing Water and Waste Water projects 2) Qualified / experienced employees and proven management

- Shareholding pattern is: Promoters – Individual/Corporate 66.8%, MFs/ DII 7.2%; FIIs 2.1%, Individuals retail & HNI 6.7% and Bodies Corporate plus others 17.2%. Thus Promoters hold a clear majority stake – a good sign.

- Many of the project payments are made at project execution milestones, so revenues are lumpy. Newer projects in Roads and Power transmission involve upfront payment of premium to government, so revenues start only once Toll collection starts, while construction is internally funded.

- The Chairman / founder is AA Rami Reddy, and the MD is Y R Nagaraja.

Events, News and Strategies

- Recent wins: Ramky was awarded two major projects under the NHDP. 1) Six laning of Agra – Etawah Bypass section of NH-2, to be executed as BOT (Toll) basis on DBFOT pattern. Concession period is 30 years, including construction of 910 days and cost is Rs.1207 Cr. 2) Four Laning of Hospet – Chitradurga section of NH-13 in Karnataka under NHDP on DBFOT/BOT basis. Concession period is 25 Years, including construction of 910 days, and cost is Rs 1033.65 Cr.

- Promoters have been increasing shareholding in the past year as per BSE reports.

- CBI is investigating Ramky Group and Ramky Estates and Farms about projects awarded during 2004-2009 by the AP Govt. The allegations include political clout used in awarding projects by former CM YSR and son JaganMohan Reddy. The share recently tanked following the arrest of Jagan Reddy in a disproportionate assets matter. Ramky is cooperating with the team in their investigation.

- Rating: In April ’12, CRISIL revised its credit rating outlook on the long-term bank facilities to ”Negative” from ”Stable”, while reaffirming the rating at ”CRISIL A+”; the rating on the short-term bank facility has been reaffirmed at ”CRISIL A1”.

- MF holdings have fallen from 3.1m shares (Dec’11) to 1.9m (Mar’12), a bad sign

Strategies executed:

Competition is intense across all business segments. To handle this, Ramky has executed the following strategies:

- Bidding for high value projects in construction to benefit from economies of scale. Diversifying the construction business into more complex projects, with higher contract value and better margins.

- Enhancing its project planning and design capabilities. Hiring – all employee adds are supervisory level and above.

- Smart sourcing – subcontracting of low-end project work, strategic imports and also in house manufacture where appropriate.

- Investments in equipment and fixed assets help achieve higher operating margins.

- Structurally, Ramky executes projects either directly, or through SPVs created for specific Road or Infra project; so there are 19 subsidiaries.

- Thrust on pan-India presence, with 5 Zonal and 3 Regional offices and UAE & West Africa, though international revenue is only 1%.

Industry Note:

- There is a massive infra push by the Indian govt, envisaged in the 11th and 12th Plan, 30% of which is expected to be funded by private sector capital.

- This is a crowded space. There are over 60 listed peers in the Construction & Contracting – Civil sector, not including conglomerates.

- In roads, competition includes Reliance Infra, Jaypee Infra, IL&FS Transp., GMR Infra, Lanco Infra, L&T, IRB, IVRCL, Ashoka Buildcon, etc. Industry estimates are that 90 firms are pre-qualified for prestigious NHAI projects. Many more are present in buildings, Power – Transmission/Equipment, etc sectors.

- Roads sector is now poised for a 2-3 year period of consolidation. High competition drove infra firms to bid aggressively for new projects. Many firms in this sector have overstretched their balance sheets and may default on payments/ restructure debt/ sell assets.

- Ramky has entered into power transmission sector where there are many entrenched players in a market that is currently flat. Also Power sector suffers from systemic issues like weak finances of state electricity boards, and fuel linkage issues. As a result many plants are underutilized today. Margins will be stretched here.

Stock Valuation, Performance and Returns

Ramky had its IPO in Sept’10, with pricing at Rs 450; subscription was fair at 2.9 times and collected 530 cr.

- From its IPO price of 450, the stock rose to 460, its all time high. Then the fall was continuous and the CMP of 90.3 is near the all time low of 88.5. The share has fallen 80% in these 21 months, causing tremendous value destruction, Fig 2.

- Dividend was 45% in 2011, at a dividend yield of 4.8%. However, this was a maiden dividend, so we do not have history of steady dividend distribution.

- As compared to share price, for a 5-year period the growth figures are Sales (40.3%), EBITDA (47.6%), and Net Profit (46.4%) CAGR, see Fig 3. The Q4 of every year is higher due to government client customers.

- We can see from the Consolidated EPS and Debt Equity – Fig 4, that EPS has grown steadily, at 46% CAGR. The Debt Equity has not risen beyond 1.52.

- Consolidate Cash Flow is available for the Financial periods after listing and is negative, while showing some improvement y-o-y. See table 5.

| 31-Mar-10 | 31-Mar-11 | |

| Net cash generated by/(used in) operating activities | -169.93 | -111.77 |

- An important ratio for Ramky is the Orders Booked to Billing ratio (BTB). This has fallen, but is still quite comfortable (Fig 6). Order Booked position at Ramky is 13,703 cr, providing 3.5 years visibility.

- The Price and PE Chart of Ramky, Fig 7, indicates that IPO in 2010 was at high valuations. Further, in the next 2 years, the share price has shown a disappointing downward trend. Today the PE of Ramky is 2.0 times, (based on Consolidated EPS), below the industry average of 12.5.

- In Fig 7 we can see that the average PE in the last 2 years has been 7 times. PE has today fallen to very low levels in the valuation range.

- The EPS chart, Fig 8, shows that EPS has been flat to gently rising for 2 years.

- The EPS of Ramky is expected to stay in the trend line range in Fig 8.

- The Infra sector has not done well recently, but a comparison with CNX Infra index, Fig 9, shows the index has fallen by just 15.7% while Ramky has fallen 80%.

- ROCE and RONW is 18-19%, these are good ratios.

- PEG is at 0.17 – indicates undervalued status.

Risks:

- Persistent rumours of political connections and investigation by CBI. The price has got hammered due to this news in the last 3 months. Detailed in section ‘Events, News, Strategies’.

- Ramky states a business objective as ‘to build more complex and multi-disciplinary projects’. Complexity by itself is not a virtue, and makes understanding the Ramky business model more difficult for investors.

- Diworsification: The firm is spreading itself thin across too many sectors – Water (supply, storage, treatment), irrigation, Roads & Bridges, Buildings, Industrial parks and power distribution, and recently Railway projects.

- The sector is government dependent, for orders and payments.

- High interest rates in India are certainly impacting the firm.

Opinion, Outlook and Recommendation

- The Indian infra sector is critical to the GDP growth, and a lot of resources will be poured into development over the next few years. Ramky straddles this across a number of sectors. Ramky also appears to have good financials over the last 3-5 years.

- However the consistent fall in share price is not explained by fundamentals, the overall market sentiment, or even the infrastructure sector performance. Current valuations are highly stressed, and the market is awaiting political and investigation outcomes rather than any business achievements.

- Ramky is a Sell for the long-term investor due to the consistent fall in market prices and political cloud over the firm, all of which can extend or reverse unpredictably.

- At some point in time, the share should start rising again, to achieve some reasonable valuations after the excessive fall, but this is neither predictable nor advisable for investors to aim for.

JainMatrix Knowledge Base:

See other useful reports

- KEC International – LINK

- BGR Energy Systems – LINK

- IRB Infrastructure Developers – LINK

- Adani Port: Infra play at good valuations – LINK

Disclosure: It is safe to assume that if the JainMatrix website recommends a stock, the researcher has already invested in it.

Do you find this site useful?

Visit the SUBSCRIBE page to find how you can get more. Click LINK

Add your comments/ queries below

Disclaimer:

These reports and documents have been prepared by JainMatrix Investments Ltd. They are not to be copied, reused or made available to others without prior permission of JainMatrix Investments. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com