………………………………………………………………………………….

There is an update to this report. Read this latest Sept 2012 update called ‘Adani Port – The Great Australian Adventure’. Click this LINK

Introduction

- Mundra Port and SEZ (MPSEZ) is a Gujarat based infrastructure and exports play. Promoted by Adani Group, it includes the following businesses –

- India’s largest private port, with volumes having recently crossed 50 MT (FY11) and 15.08 MT in Q1 FY12

- An SEZ area adjacent to the port, which is being developed on an area exceeding 100 sq km

- The port has got ranked 5th in India among all ports, major, public and private. The port deals in a number of container and bulk products.

Fig 1 – Business Segments in Q1 2011. MPSEZ handles a broad range of products. A broad-based customer group means lower business risks.

- Connectivity and logistical facilities extend the Port, berthing and storage to Roads, Rail connection, Air strip and Pipelines based evacuation

- Port has also recently added specialized car exporting facility

- The SEZ facility enjoys a series of Indirect and Direct Tax benefits designed to encourage industrialization by the Gujarat Government

- Power supply will be by a plant being set up by Adani group, that will meet all the SEZ needs

- The SEZ area is organized into Industrial clusters that include – Engineering, Auto & Auto Ancillaries, Textile & Apparel, Chemicals & Pharma, Plastic Processing, Stone & Minerals, Food & Agro, Global Trading Hub, Timber & Furniture and Metals and minerals

Current Business Outlook

- The port has rapidly increased business throughput over the last 5 years, venturing into new categories of goods, and working closely with manufacturers and exporters to improve infrastructure

- Capacity building is ongoing including ICDs under development

Fig 2 – Mundra has shown steady revenue and profit growth.

- Sales have grown by 32% over the last 5 years

- Profits have grown an astonishing 128% CAGR over this period

- Major competition to MPSEZ is from Kandla, JNPT and Pipavav on the Western shores. Mundra is able to provide port access to North India based industry. Additionally

- Kandla and JNPT have not invested sufficiently in infrastructure due to government constraints.

- Pipavav is at an early stage of development. Also it is in South Gujarat and logistically more remote.

Additional Developments include:

- MPSEZ is also developing Dahej Port and Mormugao Port in terms of terminal creation or port operator.

- Acquisition of Australia Queensland based Abbot Point Coal Terminal (APCT). The coal terminal, has capacity of 50 MT a year, will facilitate the transport of coal from Australian mines to India.

Overview of Share IPO and Stock performance

- The IPO in Nov 2007 was amazingly successful. It was oversubscribed 115 times, and eventually provided huge listing gains. However it was aggressively priced.

- Business performance over the last 4 years has justified investor confidence in this stock

Fig 3 – IPO investors have received a 12% CAGR return over the four years since listing

- Debt-equity is 0.94 as of Mar’11 (down from 1.7 at IPO time). This is good, for an infra company.

- Healthy return Ratios. Return on Capital employed – ROCE is 15.4%; Return on Equity – ROE is 23.4%

- PEG is in the range of 0.84, indicating indicates safety and undervalued status

- For an infrastructure company, cash is critical. MPSEZ comes out excellent on this count as it has improved Cash flow from operations and EPS (Adjusted for stock split) rapidly in recent years

- Fig 5 – PE has fallen to attractive levels, and combined with robust business performance gives us a very good entry point for long term investments

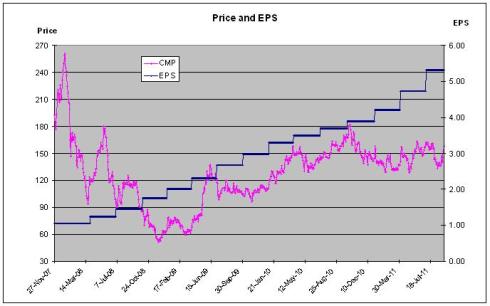

- The chart – Fig 6 plots the adjusted market price against the EPS over a 4-year period.

- EPS shows us a steady quarterly increase indicating stable business improvement

Projections and Investment Advice

- EPS may slow a little to 40-50% growth range over the next 3 years as competition intensifies and an interest rate driven domestic slowdown takes shape.

- Even this is very high. Also, MPSEZ is well placed to capture market share from the increase in Indian exports (oil, containers, manufactured goods and minerals) as well as imports (Coal, oil, commodities).

- SEZ revenues are lumpy, driven by sale of land to industries. However the infrastructure provided and industrialization will drive this business.

- The recent fall in prices has not affected MPSEZ, and it is expected to ride out this slowdown

- As long as it stays over 150, MPSEZ share price is in positive territory. Invest

Risks

- Adani group is a complex group of interconnected firms with cross holdings in group companies like Adani Power, the holding company Adani Group, Adani Enterprises Ltd. and MPSEZ.

- Recent shareholding reports for MPSEZ indicate the Promoter group has 77%, Institutional is 15% and Public Retail has 7%. Thus unless the Promoters sell more holding soon, it is possible that the promoters may try to buy-back from others and de-list this firm.

- Intensifying competition. It is possible that Indian government may finally able to grow capacities at Kandla and JNPT (they have both been running close to 100%), overcoming the current lethargy.

- Pipavav Port is owned by A.P. Moller-Maersk Group, is one of the largest container terminal operators in the world. Over the next few years, APM Terminals will transfer a lot of India business from other ports to Pipavav, and also build good infrastructure here.

- Recent rumours against Adani Group were that it has powerful political linkages, and interests in illegal mining in Karnataka/ Andhra Pradesh. These rumors affected investor sentiment in Adani Industries. This could also affect MPSEZ in the future. However MPSEZ is a different business, and the possibilities of this are remote.

- Like my post on Facebook

- Subscribe for Reports by filling the ‘Sign me up’ box on top right panel of this page.

Disclaimer:

These reports and documents have been prepared by JainMatrix Investments Ltd. They are not to be copied, reused or made available to others without prior permission of JainMatrix Investments. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com

A useful article on Mundra – copy following link

http://www.bhandarkarpub.com/NewsDetails.asp?id=11666

Hi Punit, How will u compare Essar Port(2.5K cr) with Mundra port(25K cr)

Sir

Your analysis is an eye opener for me. Wonderfully done. I appreciate your service.God bless you

antony.a