JainMatrix Investments presents an Investment Report on RACL Geartech Ltd.

- 03rd May 2022

- Sector – Life Insurance

- IPO Opens 4-9th May

- Price range ₹902-949 /share; discount for policyholders is ₹60, and for employees is ₹45

- Large Cap: ₹ 6,00,000 crore Mkt cap

Summary

- Positives: 1) High life insurance market share 2) massive Assets Under Management and equity market ownership 3) LIC is a solid brand 4) low operating cost 5) good all India sales presence 6) the IPO can be transformative to make LIC more flexible, competitive and profitable.

- Risks: 1) govt. initiatives and directives that are unprofitable 2) capital and profit ratio restructuring makes financials unpredictable 3) competition from private players and falling market share 4) High NPA ratio 5) attrition in sales agents team 6) Periodic FPOs can subdue the share price.

- Opinion: Conservative Investors can SUBSCRIBE to this IPO with a 2 year perspective.

Other related IPO reports

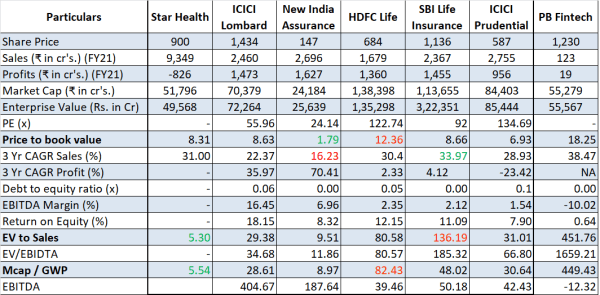

- Star Health IPO – A Toast, to your Health !!

- IRCTC – A Matter of Convenience

- UTI AMC (IPO) is Losing Share

Here is a note on LIC IPO.

IPO highlights

- LIC IPO will have a price band of ₹ 902-949 and will open from May 2 for anchor investors and May 4-9 ‘22 for others.

- The firm will raise ₹ 21,000 cr. by selling 3.5% stake sale through Offer for Sale (OFS) by promoter. LIC market cap at this pricing is ₹ 6 lakh cr.

- Promoters of LIC are the President of India, acting through the Ministry of Finance, Government of India. Currently GoI holds 100% stake and post-IPO this will come down to 96.5%.

- The IPO quotas are: Policy Holders 10%, employees 0.7%, QIB 44.6%, Non Institutional 13.4% and retail 31.25%. The total number of shares in IPO are 22.14 crore shares. This discount for policyholders is ₹60, and for employees is ₹45.

- Objects of the issue: GoI unloads stake to list LIC. Since it is an OFS, it will not receive any funds in IPO

- The grey market premium (GMP) of LIC is ₹85 as of today.

- One lot is 15 shares and Face Value is ₹10. Retail investors can bid for 1 to 14 lots i.e. 210 shares.

- The anchor investor portion of Life Insurance Corporation of India’s (LIC) initial public offering (IPO) was oversubscribed on Monday, raising around ₹5,620 crore from anchor investors.

Introduction to LIC

- LIC is the largest public life insurance companies in India, and took its current form in 1956.

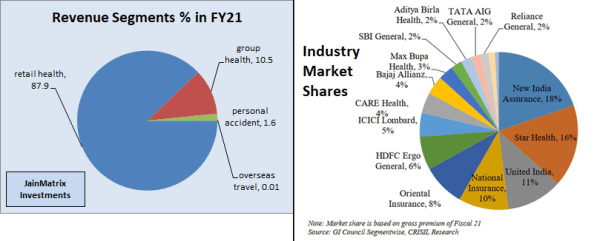

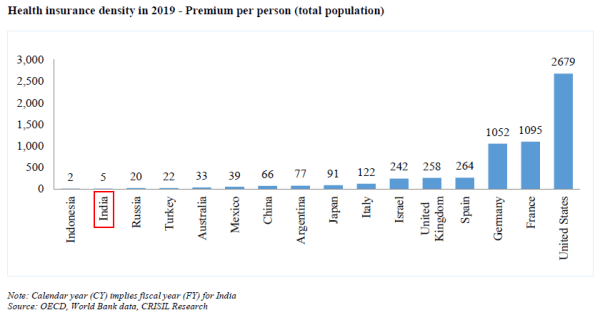

- It has a 64.1% market share in Gross Written Premium (GWP) in FY21 (CRISIL). It is the #5 largest life insurer globally by GWP, see Fig 1b. LIC has a distribution network of 5,004 offices spread across 36 states and UTs, with 28 cr. policies served as on FY22. It has a workforce of 1,05,207 employees.

- The proposed IPO will make it the biggest Indian IPO ever.

- In India, LIC has the largest agent network of 13.5 lakh individuals in 2021, which is 55% of the total agent network in the country and was 7.2 times the number of agents of the second largest life insurer.

- LIC is the largest asset manager in India (Dec’21) with AUM (includes policyholders’ investment, shareholders’ investment and assets held to cover linked liabilities) of ₹ 41 lakh crores, which was (i) 3.2 times the AUM of all private life insurers in India, (ii) 15.6 times the AUM of the #2 player in Indian life insurance industry in terms of AUM, (iii) 1.1 times the entire Indian MF industry AUM and (iv) 17% of India’s GDP for FY22. (CRISIL). LIC’s investments in listed equity represented 4% of the total market capitalisation of NSE as at that date. (CRISIL). See Fig 1a. Close to 25% of this is equity oriented, and they own more government bonds than the RBI. Thus it is a mega player that can dominate and profit from the growing Indian capital markets. Thus it is India’s Family Silver, which is made available in the IPO.

- LIC is thus both a Life Insurance and an Asset Management firm.

The rest of the report is available as a download, see PDF –

Do read our insightful research, we attach the complete Investment report in PDF format here.

Disclaimer

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. JM has no stake ownership or financial interests in LIC or any group company. Punit Jain has been a retail – insurance and annuity customer of LIC for 20+ years. Punit Jain intends to apply for this IPO. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from a RIA – Registered Investment Advisor. Punit Jain is a registered Research Analyst under SEBI (Research Analysts) Regulations, 2014. JM has been publishing equity research reports since Nov 2012. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com.