Dear Readers,

I’d like to thank one of my subscribers for his appreciation note.

Punit Jain

On Fri, May 22, 2015 at 6:37 PM, Mohit <mohit…..@gmail.com> wrote:

Feels nice to see that 2 of your recommended midcaps are featuring here – Great Going

Dear Readers,

I’d like to thank one of my subscribers for his appreciation note.

Punit Jain

On Fri, May 22, 2015 at 6:37 PM, Mohit <mohit…..@gmail.com> wrote:

Feels nice to see that 2 of your recommended midcaps are featuring here – Great Going

Report dated: 20th May 2015

JainMatrix Investments presents its Investment Outlook, and the May 2015 update of its Retirement LC Model Portfolio.

In terms of outlook we expect the next few triggers to be:

In terms of Risks we would identify

Upgrade to Premium User to receive this Model Portfolio.

Not a subscriber? Sign up for a JainMatrix Investments subscription to help navigate your investment journey. Visit Subscribe.

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an independent expert/advisor. JM has been publishing equity research reports since Nov 2012. JM is voluntarily compliant with SEBI (Research Analysts) Regulations, 2014. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com

Britannia rides not just the consumption theme, but within that the large food segment and also commands a premium image. Britannia is a powerful brand in this space. As an organization, BIL has recovered completely from the poor performance in 2010. Under a new leadership it is reinventing itself across marketing as well as operations. After many good initiatives in biscuits, the focus is on the high potential dairy products. The market conditions have been challenging in 2014-15, but even so, BIL has performed excellently so far. We expect the demand to look up in the next few years, and BIL to be a multi-year outperformer for investors. Investors may buy the stock for a Mar’17 target of Rs 3168, a 47.3% appreciation.

This is an update of our Feb 2014 report on Britannia Industries – A Ready to Eat Investment. The share has appreciated 144% in the 14 months since this BUY recommendation.

The report can be downloaded – JainMatrix Investments_Britannia_Apr 2015.

See other useful reports

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an independent expert/advisor. JM has been publishing equity research reports since Nov 2012. Punit Jain has been a long term investor in BIL since March 2014. Other than this JM and its promoters/ employees have no financial interest in BIL or their group companies, and no known material conflict of interest as on date of publication of this report. JM is voluntarily compliant with SEBI (Research Analysts) Regulations, 2014. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com

VRL Logistics Financials, by JainMatrix Investments

JainMatrix Investments has created a 4 page Research report of VRL Logistics IPO. This captures our perspective of VRL Logistics IPO in the current economic context, including financial review and Cash Flow analysis, SWOT review with Risks and Overall Expert Opinion.

This report is available for your usage. Click link above to download the PDF format report.

See other useful reports

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an independent expert/advisor. JM has been publishing equity research reports since Nov 2012. JM and its promoters/ employees have no financial interest in VRL Logistics Ltd or their group companies, and no known material conflict of interest as on date of publication of this report. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com

Dear Investor,

Here is a short post facto report on the Inox Wind IPO.

Happily for us at JainMatrix, another win and a correct analysis, (so far).

Happy investing,

Punit Jain

———————————————————————————————–

Inox Wind – 5 year financials

JainMatrix Investments has created a 5 page Research report of INOX Wind IPO. This captures our unique perspective on INOX including Promoter Group review, Industry and Competition Notes, Strengths /Positives, Risks and Challenges and Overall Opinion.

This report is now available for your usage. Click link above to download the PDF format report.

See other useful reports

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an independent expert/advisor. JM has been publishing equity research reports since Nov 2012. JM and its promoters/ employees have no financial interest in Inox Wind Ltd or their group companies, and no known material conflict of interest as on date of publication of this report. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com

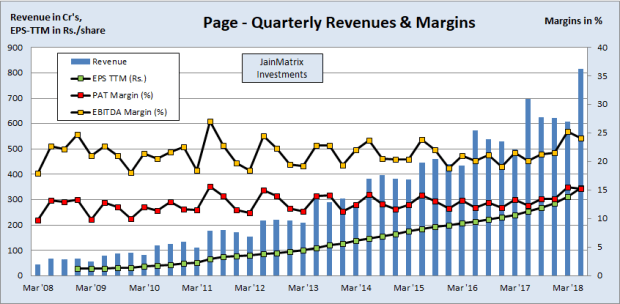

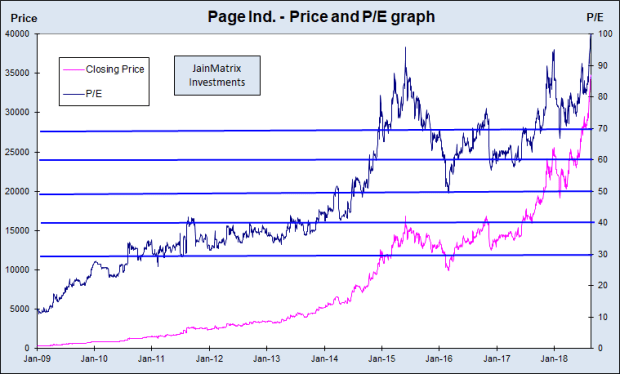

Page Industries with the Jockey franchise in India is a pioneer of the premium innerwear market. It is extending the success in menswear to womens wear and active wear, and with the Speedo brand to swimwear. Their revenues, EBITDA and PAT have grown by 36%, 35% and 37% CAGR over 6 years. With investments in manufacturing and retail, we expect this success trajectory to continue.

Fig 1 – Products by Revenue

Fig 1 – Products by Revenue

The Price History is available on the LINK.

Fig 2 – Page Financials and Fig 3 Cash Flow, Dividend

Fig 2 – Page Financials and Fig 3 Cash Flow, Dividend

Fig 4 – Price and PE Chart, and Fig 5 – Price and EPS Chart

Fig 4 – Price and PE Chart, and Fig 5 – Price and EPS Chart

Fig 6 – Finance Metrics

Fig 6 – Finance Metrics

The Fig 6 displays some of the key financial ratios.

A benchmarking exercise compares Page with peers in the apparel industry. See Table 7.

Table 7 – Benchmarking and Table 8 Projections

Table 7 – Benchmarking and Table 8 Projections

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. Punit Jain has been a long term investor in Page Industries since June 2014. Other than this, JM and its promoters/ employees have no financial interest in Page and no known material conflict of interest as on date of publication of this report. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an Investment Advisor. Punit Jain is a registered Research Analyst under SEBI (Research Analysts) Regulations, 2014. JM has been publishing equity research reports since Nov 2012. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com.

To see latest price of Page Industries, click on // Page Industries

See other useful reports

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. Punit Jain has been a long term investor in Page Industries since June 2014. Other than this, JM and its promoters/ employees have no financial interest in Page and no known material conflict of interest as on date of publication of this report. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an Investment Advisor. Punit Jain is a registered Research Analyst under SEBI (Research Analysts) Regulations, 2014. JM has been publishing equity research reports since Nov 2012. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com.

————————————————————————————————

Dear Investor, Almost 2 years ago, I wrote an investment note on Apple Inc. Here it is.

The key message was that Apple is innovative, cash rich, will reward shareholders, and even after Steve Jobs, it will do well.

Today, we have just seen the Q4/2014 results from Apple, and its been a record quarter.

The launches of iPhone 6 and 6 plus were very successful. Apple Pay and Apple Watch are the new products that have good potential. And every analyst who tracks Apple is now positive about the stock and rates it a BUY.

So lets see. In about 2 years, the share has appreciated from $63.7 (my call was at $446, and then there was a 7 for 1 stock split) to $124.9, a gain of 96%. And now every analyst calls it a Buy?

It is at such moments that an equity analyst feels the happiest. The day when after a very good appreciation in a recommended stock, it gets rediscovered and rated highly by the community.

Cheers to such moments.

The most profitable moment is still to come.

Regards,

Punit Jain. Founder, JainMatrix Investments

See other useful reports

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an Investment Advisor. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com Punit Jain does not have any shareholding in Apple Inc., and JM and its promoters/ employees have no financial interest in Apple Inc., and no known material conflict of interest as on date of publication of this report. He does own an old iPad2.