The Indian economy has been hit by the Covid-19 epidemic. Even in this tough market, we find that the Indian Specialty Chemicals sector has the potential to not just survive, but actually grow rapidly.

Introduction

- The Chemical sector constitutes a significant part of Indian economy. It’s a very diversified industrial sector, as chemicals cover over 70,000 commercial products. India is the 6th largest producer of chemicals globally and 3rd largest in Asia. Export were US$ 19.1 billion during the year 2018-19.

- The Govt. of India allows 100% FDI in the chemical sector. The mfg. of most of the chemical products like organic/ inorganic, pesticides and dyestuffs is delicensed except hazardous products. It contributes 16% of the mfg. sector GDP.

- Industry has 5 segments: basic chemicals, agrochem, specialty chem, pharma and consumer products. The specialty chemicals constitute 22% of total chemicals market in India.

- Chemicals are the basic building blocks of a range of end-user products like drugs & pharmaceuticals, agrochemicals, paints, construction material, auto parts, textiles, and packaging, among others.

- Specialty chemicals are value added chemicals, they are used towards specific end use applications They are performance or quality products, niche and high value. These provide a wide variety of functionality on which many other industry sectors rely.

Chemical Sector Notes

- India is an attractive hub for chemical companies. The Indian chemical industry is a global outperformer in terms of Total Returns to Shareholders (TRS), source McKinsey & Co report. This has resulted in rapid growth for chemical industry of India. See Fig 1. It can be seen that The Indian Chemical industry enjoys superior returns.

Fig 1. CAGR of TRS, source McKinsey & Co

Fig 1. CAGR of TRS, source McKinsey & Co

- China has implemented strict environmental norms, because of which many Chinese capacities are shutting down, which is benefitting large organised Indian players.The Ministry of Environment of China stated that 70% of companies inspected failed to meet the air pollution standards. Large global chemical supply chains may look at India as an alternative mfg. location.

- The Coronavirus lockdown in China in Jan-Mar 2020 revealed and exposed global dependency on Chinese mfg. China is now seen to be an unreliable partner and many countries are actively looking at alternate manufacturing locations to de risk supply chain. Loss of China (37 % share) as a reliable partner and continued shifts from EU/Japan (16 %/4 % share) means share of India (3%) will rise. India will gain advantage because of availability of talent for mfg. and R&D.

- Fig 2 represents share of countries in sales of global chemical industry.

Fig 2. Region wise sales of Chemicals

Fig 2. Region wise sales of Chemicals

- Today, India has a chemical trade deficit of $15 billion. There is a massive opportunity for import substitution – for Indian demand, as well as exports, of such products.

- INR to Dollar is now Rs 75.5, it is weakening so imports are becoming expensive. So, import substitution for chemical products is attractive.

- In India, during lockdown due to COVID, there was a disruption in supply chains and speciality chemicals also faced logistics (supply chain) and labour problems. But chemical industry is expected to be less impacted by COVID because most companies have fully or partially restarted their operations as it supplies chemicals to essential sectors like pharma, hygiene, personal health and agrochemicals.

Key Players

- Fig 3 shows contribution of domestic and exports revenues to the total revenues of firms.

Fig 3. Revenue from exports

Fig 3. Revenue from exports

- We have done a benchmarking exercise to compare the Chemical industry’s sector players. Fig. 4 depicts the comparison between different Indian companies on basis of vital parameters.

- We can see that Vinati Organics has the highest contribution of export to revenues and Aarti the lowest.

- In terms of size and scale SRF and Aarti lead.

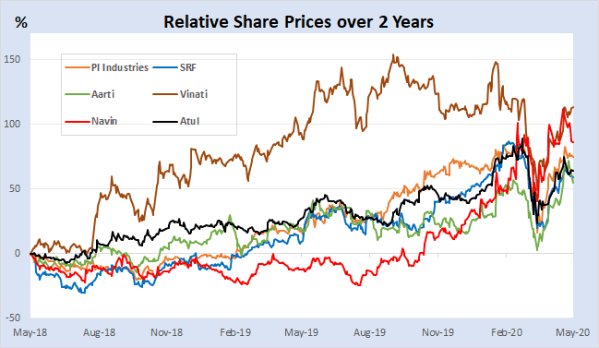

- Over a 2 year period we can see the relative share prices.

- Vinati and Navin have gained the most while Aarti and SRF the least among these firms.

Conclusion

- Indian chemicals players will benefit from the expanding specialty chemicals market globally led by growing new applications alongside manufacturing shifts from China ― which has been battered by reliability and transparency woes; and EU, due to its ageing workforce; focus on innovation, and M&As.

- There exists a good opportunity for Indian chemicals players to scale up and tap the opportunities for import substitution and exports.

Disclaimer

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. Punit Jain has no known financial interests in any firm mentioned here. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an Investment Advisor. Punit Jain is a registered Research Analyst under SEBI (Research Analysts) Regulations, 2014. JM has been publishing equity research reports since Nov 2012. Any questions should be directed to the director of JM at punit.jain@jainmatrix.com.