_____________________________________________________________

This report has been refreshed, read the latest April 2014 report Yes Bank – A Rediscovery

- Date: September 12, 2012

- CMP: Rs 333 Its a Large Cap with Mkt Cap Rs 11,833 cr

- Valuation: Today’s is Rs 414, available at 24% discount

- Mar’14 target is 790

- Advice: Buy now and systematically.

Summary:

Key Reasons to Invest:

- Aggressive growth (will continue in 35-45%), stable NIMs and profitablility

- Investments in Retail and SME will provide next phase of expansion

- Vision for 2015 is achievable and inspiring

- The 14% fall since Mar ’12 gives an opportunity to invest at lower levels

Risks:

- Global and India slowdown continues

- Exposure to troubled sectors – Airlines, Power

This is an update of the Mar’12 Report by JainMatrix Investments – LINK

Yes Bank – Description and Profile

- Yes Bank (YB) started in 2003, received the only New Bank license issued by RBI in 15 years.

- Leaders are Rana Kapoor, Founder, MD & CEO and Aalok Gupta, EVP & Country Head- Retail

- Promoter stake is 26%; other shareholders are FIIs 43%, MFs/ DII 14%, Individual – Retail /HNI 9.5%, Bodies Corporate/etc. 7.5%.

- The firm has 4,875 employees; branches doubled in 1.5 years to 380 in 275 cities, with 650 ATMs.

- Market cap is at 9,300 crores, putting it at #12 among Indian banks, and #7 in private sector.

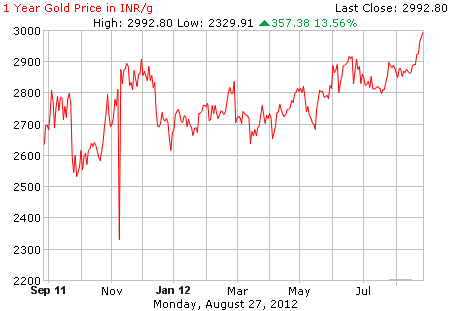

Fig 1 – Yes Bank – Growth Parameters, JainMatrix Investments (click any graphic to enlarge)

Superior Strategies and Execution

- YB has a Vision 2015 (Version 2.0) which is an inspiring combination of soft and hard targets – “The Best Quality Bank of the World in India”; and 900 Branches, 12,750 employees, 2000 ATMs, Advances –`100,000 cr., Deposit base –`125,000 cr. and Balance Sheet –`150,000 cr. (as of now).

- Seasoned, capable bankers in the Management team provide stability.

- The focus is on Retail and SME banking involves growth in branches and investments in Sales and retail products. Recent deregulation of Savings Account interest rates allowed YB to introduce highest rates of 7%. The CASA is up from 10% in March ‘10 to15% by March ’12. Fig 1,

- The firm rapidly enters high potential sectors for advisory, loan and banking services, with a Knowledge based approach to lending. Advances grew 45% CAGR in 4 years (industry growth 22%). With this approach, YB is pretty much The Brave Warrior of Indian Banks.

- The Loan Book is well diversified, and the banks credit exposure to sensitive sector (due to asset price fluctuation) like capital markets, real estate, power, iron & steel and textiles are below the industry average. Here is a view of the top ten sectors as part of the Loan Book Distribution, Fig 2.

Fig 2 – Yes Bank, Loan Book Distribution, JainMatrix Investments, (click any graphic to enlarge)

- In business development, mistakes are made, but YB learns from these, and exits fast (example – in 2007, the category of foreign exchange derivative products sold to SMEs turned loss making. There were litigations against YB (and several other banks too). These are now resolved.

- Growth will be organic as executives feel that organic growth costs less compared to available assets

Industry Note

- Scheduled Banks in India are Public Sector (27), Private Old (22), Private New (8) and Foreign (38).

- Total number of (scheduled bank) savings accounts was 12.1 crore in 2011. But 80% are inactive, giving 2.4 cr. active accounts. The gross penetration is 10%, and active accounts penetration is 2%. Thus India is underbanked. (RBI data).

- The FY12 credit growth of Indian banks was in line with the RBI projection of 16%.

- Market share in savings accounts of banks dropped – SBI/associates (30.3 to 29.2%), other nation-alized banks (49 to 47.8%), foreign (5.8 to 5.2%), but Private banks grew (14.9 to 17.8%) by FY12.

- The global Basel III requirements require banks to hold top quality capital equal to 7% of their assets adjusted for risk, will be phased in between 2013 and 2019. Aimed at improving financial stability and avoiding a repeat of the crisis of 2008, they will increase the cost of capital for banks.

- Channels: By 2011, there were 93,800 ATMs in India, about 70% of them in Metro/ urban locations. Mobile banking is also an important banking channel, due to penetration of smartphones and 3G.

Stock Evaluation, Performance and Returns

- YB had its IPO in July’05 priced at Rs 45. It was 31 times oversubscribed. At CMP of Rs 333 today, the stock has given a 28.5% CAGR return since IPO.

Fig 3 – Yes Bank, Price Trend, JainMatrix Investments

- The share has risen well, but is volatile. After IPO, price rose to 277 in early 2008, fell to 41 in Mar ’09 and peaked at 389 in Mar ’12. Today, it is 14% below this peak price. See Fig 3.

- EPS has grown at 59.5% CAGR over 5 years, Fig 4.

Fig 4 – Yes Bank – Quarterly Income and EPS, JainMatrix Investments

- Quarterly Income and Profit too have grown rapidly (Fig 5), with NII + Other Income, NII and Net Profit growing at 46.5%, 57.4% and 59.6% CAGR over the last 5 years.

Fig 5 – Yes Bank, Quarterly Income Profit, JainMatrix Investments

- The maiden dividend of Rs 1.5 was paid in 2010. Thereafter dividend has shown a steady increase.

- The P/B ratio has fallen over 6 years, in spite of price rise, due to rapid growth in Book Value, Fig 6.

Fig 6 – Yes Bank – Price, Dividends, BookValue, JainMatrix Investments

- Price and PE chart Fig 7, shows that average PE has been 15, while the PE range has been between 5 and 25. PE today is 11.2 and clearly in the ‘below average’ quartile. This PE fall has happened in spite of earnings growth, Fig 8.

Fig 7 – Yes Bank, Price and PE Chart, JainMatrix Investments

- Price and EPS quarterly graph, Fig 8, shows that EPS growth has been improving. The Share Price has been roughly following EPS. We expect the EPS of YB to stay within the channel in Fig 8.

Fig 8 – Yes Bank, Price and EPS Chart, JainMatrix Investments

- NIM has been between 2.7-3.2% over the past 5 years. This is low by industry standards as CASA is low. Capital Adequacy is at 16.5%, which is good.

- Gross & Net NPA are at 0.28% & 0.06%, among the lowest NPA levels in the industry.

- ROE and RONW are between 20-24% in FY12, which is excellent.

- Beta of the stock is 1.61 (Reuters) indicating high volatility.

- PEG is at 0.33 – indicates safety and great value.

Benchmarking and Financial Projections

In a benchmarking exercise, we compare YB with 3 firms in the same or related industry, Table 9.

Table 9 – Yes Bank, Benchmarking Analysis, JainMatrix Investments

- Conclusions: Compared to peer Banks, YB holds its own on most parameters. YB looks particularly strong on EBITDA and Profit per employee ratios indicating high productivity.

- Bajaj Finance has the flexibility of an NBFC, and has performed better on many parameters. See Research Report on Bajaj Finance.

In a Financial projections exercise, we project YB financials till FY 2014, See table 10.

Table 10 – Yes Bank – Financial Projections, JainMatrix Investments

Risks:

- Current Economic and Government data indicate a slowdown across industry, a rising govt fiscal deficit, current account deficit, and weak rupee. Further, oil prices are high and other commodity prices are falling. Decision-making is slowing in the government, as past decisions are being revisited in Telecom and Coal. These point to a slowdown that can affect YB.

- YB will continue to lead on performance parameters. But if there is a sector slowdown, the performance will be affected. The poor Indian economic data if seen in the context of an international slowdown, suddenly looks better than many other countries. Currently the Indian market indices are holding up well due to FII confidence and fund inflows. So there may be a cushion to the fall in Indian Indices.

- YB is an aggressive player that enters new potential sectors and can make mistakes that can affect the overall brand. These can impact sentiment and valuations.

- Infrastructure woes: Ratio of Non-fund based exposure to Power Sector to net worth is high at 49% (Macquarie Research). This sector while critical for the India growth, is in a stressed condition, and awaiting government driven systemic improvements. Also exposure to troubled Airline sector. Airline companies owe RS 770 Cr to YB.

- The Loan Book details in Fig 2 and the calibrated approach to loans exposure build confidence that YB has a safer approach than industry.

Opinion, Outlook and Recommendation

- India is underbanked. There is potential for Banks to invest in new sectors and stimulate industry growth. In Retail, the consumption play is bank accounts, personal/housing loans, credit cards, etc.

- The banking industry is also a proxy to the overall economy, and one can expect, as a thumb rule, the industry to grow at 2-3 times the GDP growth. The Indian economy is well placed to grow at 6-9% per annum over the next decade. Basis this, the Banking sector will grow at 15-24% p.a.

- YB is well placed to exploit the trend of Private sector growing faster than PSBs, and its own growth rate will be superior to the peers. The strategies followed and good execution means that the growth will continue to be in the 35-45% range for the next 3 years.

- The recent price fall of 14% since the peak in Mar ’12 provides an opportunity to invest in YB.

- The share price is currently poised at its 200 DMA of 333. The expectation is that it will take support at these levels before rising higher.

- The valuation and projection/ targets for YB are:

- Current valuation is of 414, indicating it is available at a 24% discount at CMP

- The target for March ‘14 is 790 (a 137% appreciation)

- YB will continue on the path of solid stock performance and dividends over the next decade. Invest now and systematically to gain for the long-term.

JainMatrix Knowledge Base

See other useful reports

Disclosure: It is safe to assume that if the JainMatrix website recommends a stock, the researcher has already invested in it.

Do you find this site useful? You can:

- Subscribe to be the first to receive new posts. Click on SUBSCRIBE

- Request for Email Updates. Enter your email on the ‘Email Updates’ box at the top right of this page.

- Or Click on this Signup Form CLICK

- Socialize with us – Like on Facebook or Visit on LinkedIn

Disclaimer:

These reports and documents have been prepared by JainMatrix Investments Ltd. They are not to be copied, reused or made available to others without prior permission of JainMatrix Investments. Any questions should be directed to the director of JainMatrix Investments at punit.j@jainmatrix.com . Also see: https://jainmatrix.wordpress.com/disclaimer/

Consult your financial planner for deciding about your investment funds.

Click and Share this post :