————————————————————————————————————————————

Snowman Logistics IPO – Original report

- Date August 27, 2014

- Industry – Logistics, and Small Cap share – 783 cr. mkt cap

- Price range: Rs. 44 – 47 and IPO Period: 26-28 August 2014

Here is a note on Snowman Logistics Ltd. IPO (SLL).

Summary:

- SLL is a leader in cold chain infra and logistics, has synergies with promoter Gateway Distriparks

- It’s a high demand sector, with good growth prospects, visible food wastage and govt. support.

- Seen rapid growth from small base – Income, EBITDA, Profits have grown 43, 51 and 55% CAGR

- The market is looking positive and open to such offerings.

- Risks include aggressive opportunistic IPO pricing and negative cash flows.

- Advice: Buy with a medium term, 1 year perspective

Introduction

- Snowman Logistics is a Bangalore based firm with a cold chain and distribution network.

- It operates 23 temperature controlled warehouses (at 14 locations) and 370 reefer transport vehicles.

- Revenues in FY14 were Rs 155 cr and Profits 23 cr. It has 1490 employees (but only 383 permanent).

- Started 21 years ago as Snowman Frozen Foods, and attracted investors like HUL and Gateway Distriparks.

- The leadership team is Gopinath Pillai – Chairman and Kannan Ravindran Naidu – Director & CEO.

- Key customers are Baskin Robbins, McCain Foods, HUL, Fererro India and Novozymes South Asia.

- SLL is now a subsidiary of Gateway Distriparks Ltd (GDL), an integrated logistics firm of market cap of 2,800 cr. The firm has been a good performer for investors over the last 6 years.

- Business segments are split across warehousing and distribution, see revenue segments in Fig 1a.

Fig 1a – Revenue Breakdown and Fig 1b – Shareholding post IPO (click on image to enlarge)

IPO Highlights

- In this IPO there are 4.2 cr. shares of Face Value 10 each, which make up 25.2% of equity post IPO issue.

- Retail investor quota is only 10% of the issue, 15% is reserved for non-institutional investors while the balance 75% is available for qualified institutional buyers. See Fig 1b for post IPO pattern.

- The Price range: Rs. 44 – 47, and the amount range to be raised: Rs. 185 – 197 cr. will be used for:

- Capital expenditure for new temperature controlled / ambient warehouses of 128.3 cr.

- Long term working capital of 8.4 cr. Rest of funds will be utilized for general corporate purposes.

- The P/E of SLL is 31.5 – 33.7 times at Lower – Upper price limits, based on the FY14 nos.

- Post IPO, the market cap of the firm will be 783 cr. (upper end).

- News – SLL has decided to allot 44.4 cr worth of shares (94.5 lakh shares at higher end of Rs 47) to three anchor investors, Faering Capital India Evolving Fund, ICICI Prudential and IDFC Funds.

- The Issue has been graded by CRISIL Ltd as 4/5, indicating that the fundamentals of the Issue are above average in relation to other listed equity securities in India.

Snapshot of promoter firm Gateway Distriparks

Since GDL is the holding company and Promoter of SLL, we will do a quick analysis of this firm.

- GDL is a logistics player with 3 verticals – Container Freight Stations (CFS), Inland Container Depots (ICD) with rail movement of containers to maritime ports, and Cold Chain Storage and Logistics – SLL.

- It had a 2005 IPO at Rs 72. The share had a fair performance, appreciating at average 13.6% annually over 9 years, from the IPO level. Much of these gains came in the last 1 year when it shot up from 100.5 to CMP. However including a (2007) bonus and regular dividends, gains are 21% annually.

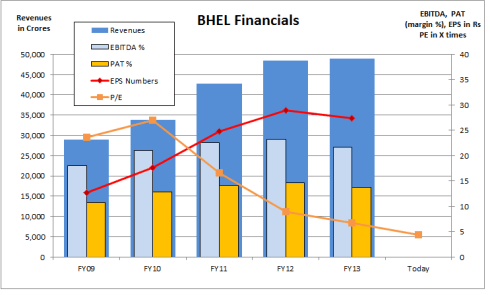

- The Income, EBITDA and Profits have grown at 24.7%, 15.1% and 12.5% CAGR over the last 7 years.

- The Blackstone Group made a private equity investment in 2009 in the GDL subsidiary, Gateway Rail.

- The promoter group hold 38% of GDL, of which 49% (18.7% overall) is pledged. This is a negative.

- GDL standalone has good cash flow, as the firm has been FCF positive over 5 years.

- Investors have been fairly rewarded for their shareholding in this firm.

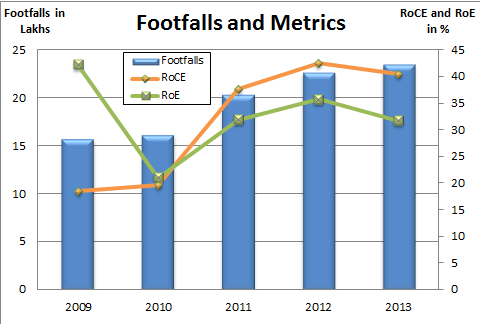

- Today GDL is available at a P/E valuation of 19.6 times. See Fig 2.

- This is a background/indicator for performance of the IPO of subsidiary SLL from same promoters.

Fig 2 – GDL Financials Snapshot (click on image to enlarge)

Financials of Snowman Logistics

- The Income, EBITDA, Profits & EPS have grown 43.2, 50.5, 54.8 and 54.7% CAGR over last 5 years.

- The margins are fair with Operating and Profit margins at 26% and 15% for FY14. Fig 3.

- Top 20 customers contributed 44.1% of revenues (2014) indicating good customer diversification.

- The D/E of the firm post IPO will be 0.54. This is a good ratio, particularly for this industry.

- Price to Book Value is at 3.5 for FY14, a little expensive.

- RoCE and RoE metrics are at 6.5 and 10.1 in FY14, which are fair.

Fig 3 – Financials, Source: Company data (click on image to enlarge)

- The business has been Cash Flow negative for the last 5 years. See Fig 4.

Fig 4 – Cash Flow of SLL

Business and Industry Notes and Trends

- SLL’s expansion plan involves the set-up of warehouses, six temperature controlled and two ambient, in six cities. The pallet capacity should increase from 61,543 pallets (FY14) to 85,000 pallets (FY15) and to 100,000 pallets (FY16). This is likely to boost the operations of SLL over 3 years. (Pallet is a unit of load which allows for efficient handling and storage of products in warehouses).

- The customer segments include Dairy Products – Milk, Butter, Cheese, Fruits & veg, pulp, canned food, Meat & Poultry, Beef, Seafood, pharmaceuticals and Packaged consumer Products.

- Industry Notes: The logistics business requires a large initial capital investment in land, warehouse, and equipment and then client acquisition and operations, which finally results in capacity utilization and revenue. Thus revenues increase only 2-3 years after investment starts. The business is very investment and cash flow intensive, with a mid to high gestation period. The challenge in logistics is also to achieve critical mass, operations scale, capacity utilization and minimum business volumes.

- Demand drivers: India’s per capita income has grown at a five-year CAGR of 16%. Food has grown in terms of absolute consumption. In addition to fruits and vegetables (F&V), the value added foods, Quick Service Restaurants, ice cream chains and packaged foods segments have grown rapidly.

- The temperature controlled logistics industry in India is estimated at nearly 15,000 crore and expected to grow at 15-20% in the next 3-4 years. Further, the industry remains fragmented and unorganised and only 6-7% comes in the organised sector.

- Massive wastages in transportation of F&V, can be addressed by an upgradation of the cold chain.

- Trends: A long term trend is of logistics services moving from unorganized to organized sector. This may accelerate given the brand, support and guarantees that can be offered by larger players.

- Another trend is towards specialization and outsourcing of logistic processes to vendors like SLL. Modern firms stay lean by focusing on core competences and partnering to stay efficient.

Positives for Snowman Logistics in the IPO

- Rating agency CRISIL has rated its IPO at 4/5. This is an excellent rating.

- The demand from food, pharma and consumer product industries likely to grow steadily. Proliferation of multinational QSR chains should also help pan-India cold chain logistics players.

- Value added services can be a high potential segment that can boost profits for SLL.

- The equity investment climate has improved in the last 6 months. Logistics firms have seen their valuation improve, and the sector outlook has improved based on anticipated economic revival.

- SLL is a leader in the cold chain logistics sector, far ahead of other organized sector players. With pan-India operations and growth plan, SLL may be able to achieve the critical mass and business volumes required to sustain investments and operations and generate high profits.

- SLL has a 21 year history of cold chain services and has built expertise in this area. It has experienced promoters and leadership that manage the operations of the company.

- From a small base, SLL financials have grown at very good rates of 43-54% CAGR over 5 years.

- Good parentage, with GDL having sustained and survived the tough economic climate of 2007-14. GDL may do much better in the next few years. This expertise should certainly rub off on SLL. Synergies with GDL include common customers, good GDL network and similar systems / processes.

- Serving diverse end-products helps SLL to counter demand volatility as the end-products that require cold storage have seasonal demand. This helps run facilities at high utilization all year long.

- Tax benefits available to SLL under Section 35 AD will help the company. The sector has infra status.

Risks and Challenges

- Stretched valuations: At a P/E range of 31.5 – 33.7 times trailing twelve months earnings, the price ask is surely high. Even parent GDL is available at 19.6 times, much more reasonable.

- A smaller portion (than most IPOs) is available for Retail, indicating that issuers are targeting investments from deep pocketed institutions. This may crowd out retail from IPO allotments.

- The trio of labor, fuel and power form a large chunk of expenses of SLL, and these have been rising rapidly in the last few quarters due to external events.

- A slowdown in economic growth in India could cause the business at SLL to suffer.

- Competition from existing and new players. Cold Chain operations are embedded in the business of firms like Concor and Gati. The unorganized sector is large and competes on price.

- While pledging of shares by GDL (to raise funds) is seen in many infra players, it is a systemically risky practice and a sign of poor free cash flows, long gestation projects, or both. A sudden share price fall due to any factor can result in an unwinding by the brokers, triggering a further price fall.

- The cash flow history of SLL is poor and it is still bleeding cash. In addition there is a stated IPO objective to invest in further expansions. Cash flow positive status is at least 2-3 years away.

- If expansion plans are not implemented in a timely and efficient manner due to any reasons, it could adversely affect the business performance. Typically land permits and local permissions are important here and are notoriously unpredictable to obtain.

- So far, funding for growth of SLL has come partially from Private equity and VC players. Post listing, SLL will have to use the IPO proceeds for investments and thereafter be able to fund its growth out of internal cash generation. This is an inevitable challenge at this stage of business growth.

- The GDL group is financially controlled by the Delhi-based businessman, Prem Kishan Gupta, whose connection with a 1998-CBI case casts a shadow on the Gateway group image.

Benchmarking

We will benchmark SLL against peer logistics listed firms.

Fig 5 – Benchmarking

Based on the benchmarking chart Fig 5, we have the following thoughts

- The high growth of SLL matches with high valuation parameters like P/E and P/B.

- Margins are on the higher side, which is good

- RoE is high, but RoCE is low among peers indicating an investment phase in logistics operations.

Overall Opinion

- There’s no doubt that Snowman is a leader in its niche of cold chain logistics. It is also a high demand sector where (assuming fair services pricing) capacities created will be quickly utilized.

- The pricing of this IPO is high and opportunistic, and assumes high growth rates will continue. It is high even compared to the parent GDL, and peers in the sector. Hence we have – A Snowman in the Summer Sun.

- This sector has cash flow challenges, and needs long investment cycles. Investors will realize that very few corporates from infra sector are good long term investments compared with other sectors.

- Having said all this, this is a good investment climate for the logistics sector. The market is overall positive these days post budget, and this small cap IPO is likely to sail through easily.

- There may also be a good pop on listing as the 3 day IPO is already subscribed 83% on Day 1. Retail has dominated so far, and this category has already been subscribed 270% of the quota. Track further on LINK.

- Based on all this, the SLL IPO is a buy with a medium term, 1 year perspective.

JainMatrix Knowledge Base:

See other useful reports

Do you find this site useful?

- Visit the SUBSCRIBE page to find how you can get more. Click LINK

- Register Now to get our Free reports and much more, on the top right of this page, or by filling this Signup Form CLICK.

Disclaimer

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an independent expert/advisor. Either JM or its affiliates or its directors or its employees or its representatives or its clients or their relatives may have position(s), make market, act as principal or engage in transactions of securities of companies referred to in this report and they may have used the research material prior to publication. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com

Click and Share this post :