Viewers may prefer to see the latest May 2012 version of this report at LINK

Date: 19th April 2012

One of the Subscribers on JainMatrix Investments raised a query – here it is:

Hi Punit, I have a question about the IT sector stocks. I own Infy, TCS and Wipro. How can I evaluate which one is better? From the share price trend over few years, TCS has performed the best. What are the other parameters to check and which is best according to you? I would ideally want to sell two of them and have only one, so not sure which is the best. Regards, S.

I would like to dedicate this post to answering this question.

Introduction

Of these three, Infosys is of course the bellwether – the traditional indicator of the health of the sector. TCS in the 8 years since the Aug 2004 IPO has shown healthy growth, and finally Wipro, the soaps to software conglomerate is also a top player. Today’s Market Prices of these are: Infosys 2380, TCS 1091 and Wipro 421

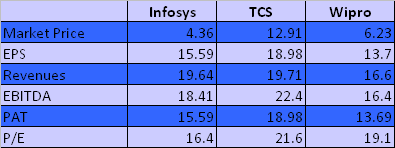

1. 5-year snapshot of key financials

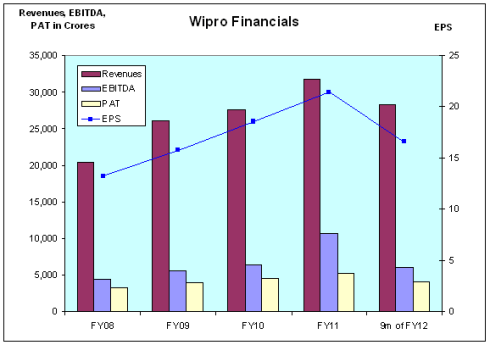

Let us first look at a 5-year snapshot of financials of the three. This can give us good visual feel of the relative and absolute financials of the three. (Note that as of today we do not have Q4 FY12 data for TCS and Wipro, so I have only included the data till Q3 FY12 for all shares, for the comparison)

Infosys:

Fig1 – Infosys Financials, Click on image to enlarge

TCS:

Fig 2 – TCS Financials, Click on image to enlarge

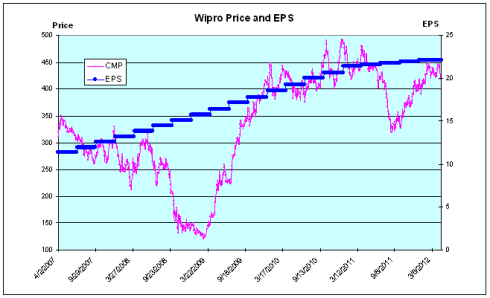

Wipro:

Fig 3 – Wipro Financials, Click on image to enlarge

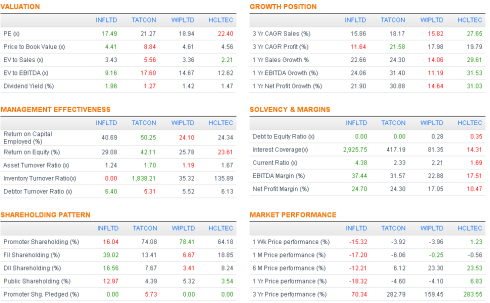

2. Detailed Comparison

Next we will look at a detailed comparison of the firms in terms of valuation, growth characteristics, debt, shareholding pattern, etc.

See LINK (thanks to Edelweiss Financials for the excellent data). We can see from this analysis that on 5 important parameters:

- Valuation – Infosys clearly leads

- Growth – TCS is better of our three

- Management effectiveness – TCS clearly leads

- Solvency and Margins – Infosys clearly leads

- Market performance – TCS clearly leads of our three

A copy of this data is available below – dated 20 April ’12.

Fig 4 – Performance snapshot, (Edelweiss), Click on image to enlarge

3. Key Trends in Price, P/E and EPS

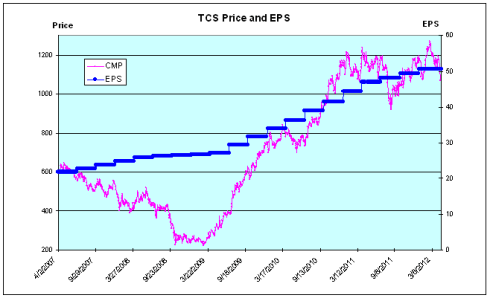

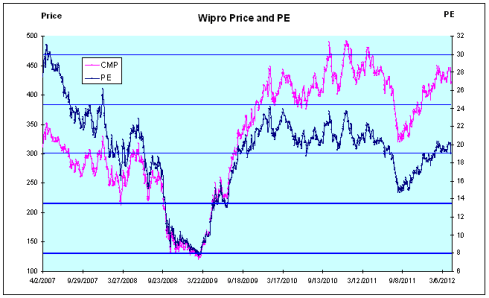

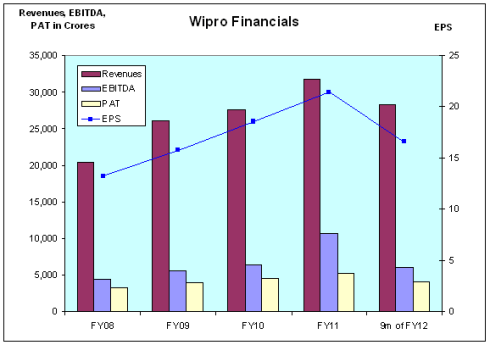

Finally, let us look at a 5-year snapshot of Price, P/E and EPS of the 3 stocks, in my charts. (As of today, we do not have the Q4 FY12 data for TCS and Wipro, so I have projected approximately the EPS for Q4 ’12. This data may change in a few weeks).

Infosys:

Fig 5 – Infosys Price and PE, JainMatrix Investments

Fig 6 – Infosys Price and EPS, Click on image to enlarge

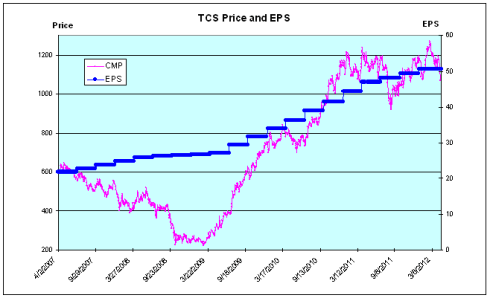

TCS:

Fig 7 – TCS Price and PE

Fig 8 – TCS Price and EPS

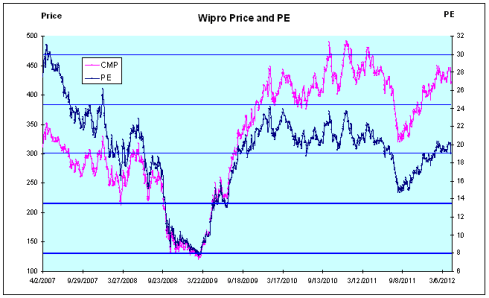

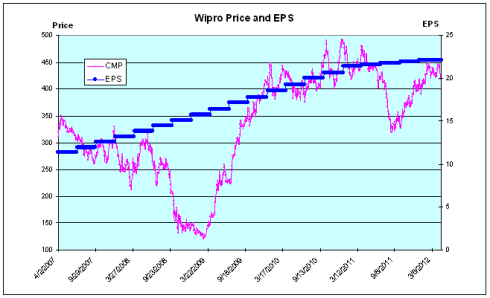

Wipro:

Fig 9 – Wipro Price and PE

Fig 10 – Wipro Price and EPS

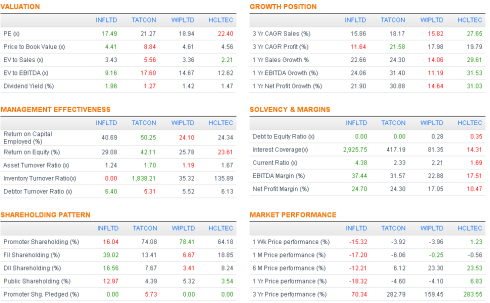

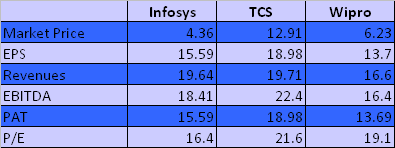

The Decision Table:

Finally, the decision is made by comparing the 5-year CAGR growth on key parameters:

Fig 11 – IT Sector Decision Table, JainMatrix Investments

Notes: PE is as on 17th April

Conclusions:

1. The Elephant can Dance – Hail the new leader – TCS

- The largest player, TCS, leads on Growth, Management Effectiveness and Market Performance. In the Decision Table, it leads on EPS, Revenues, EBITDA and PAT. Market Price and Valuations reflect this leadership.

- Valuations wise TCS is more expensive than Infosys, but note that the consistent leader will always command premium valuations, as Infosys had till 3 years ago.

- The past 3 years have not been the best of times for the IT industry, but the performance from TCS should get better as the developed economies recover

- Clarity in leadership and strong leaders helps in many softer aspects such as Acquisitions, new business lines and corporate aggression. TCS also scores here.

2. Infosys remains a defensive play

- Infosys leads on parameters like Valuations and Solvency & Margins. In the Decision Table on Valuations, it is cheaper than TCS.

- Perhaps the superior margins that Infosys commands has clashed with poor market conditions in the developed economies.

- It does not help that there seems to be a lack of top-notch leaders in the firm. This is a legacy issue, with the old promoters team calling the shots, rather than proven professionals.

- Infosys does not have a good record in acquisitions.

3. Wipro is recovering from a couple of top management changes

Wipro has not yet shown clear directions and results. It is neither a growth not a margins leader. This may change soon, but until then, it will be rated third of these three.

Dear S,

Based on the analysis done, I would put my money on TCS.

My recommendation is to transition smoothly, so try to switch from others to TCS over a period of 3-6 months, selling others monthly and simultaneously buying TCS.

Warm regards and profitable investing,

Punit Jain

………………………………………………………………………………………………………..

Disclosure and Notes: 1) It is safe to assume that if the JainMatrix website recommends a stock, the researcher has already invested in it. 2) The above financial investigation is not comprehensive, but a short and sufficient study.

Do you find this site useful? You can:

- Check back on this website www.jainmatrix.com for updates.

- Subscribe to be the first to receive new posts. Enter your email on the ‘Subscribe’ box at the top right of this page

- Or Click on this Signup Form CLICK

- Socialize with us – Like on Facebook or Follow on Twitter

- Be sure to add punit.jain@jainmatrix.com to your address book or safe sender list so our emails get to your inbox.

- Add your comments/ queries below

Disclaimer:

These reports and documents have been prepared by JainMatrix Investments Ltd. They are not to be copied, reused or made available to others without prior permission of JainMatrix Investments. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com

Also see: https://jainmatrix.wordpress.com/disclaimer/

Click and Share this post :