Indian Stock Markets

It was about 20 years ago. I asked a relative about the stock markets. I got mixed stories.

On one hand 2-3 of their investments had done well and doubled in a few years.

On the other hand there were stories of (the Challenges)

- share values falling to almost zero, there were missing promoters or company locked in litigation

- difficult stock brokers. To know a good broker was rare. They were bullies, took your share and sold it and gave you money after a month; the transaction was opaque; you would be lucky if you only paid 4-5% commission on transactions.

- The stock market was famous for scams aplenty. The Harshad Mehta scam (1992), the Ketan Parekh Scam, the Satyam Scam, Saradha Scam and NSEL Scam, among other swirling stories of manipulation and operator driven shares naturally made outsiders wary. BSE had been in existence for a long time, and this was the nature of the market.

- A stock market transaction had a high degree of difficulty and uncertainty.

But it had piqued my interest. So a few years later when a new private bank offered me a website based stock broking account as an add on to the savings account, I went ahead and opened it.

Over the next few years, we saw a number of Equity Market Changes:

- The NSE came into existence with a digital trading offering

- Equity Shares began getting dematerialized. Once they were in Demat form, trading could be on the digital platform, quickly and cheaply

- SEBI as regulator began controlling and monitoring the sector’s progress

- A number of stock brokers came into existence, and with competition, broking commissions became reasonable.

- BSE and NSE had good digital backbones, so trading moved online

- The Mutual Fund industry took off, offering a simple entry level product for new investors

- Soon enough, the Equity Advisory, PMS and even AIF industries and products became available.

The digital transformation has dramatically changed Stock Market access, monitoring and information flow.

With these Equity Market industry changes, the nature of services available to the customer changed. The above Challenges were addressed:

- Share prices are still volatile. Some firms do fail/ go bankrupt. However, it does not happen in an information vacuum. We can track companies better today. Conversely, excellent companies do see good share price appreciation.

- Stock broking accounts can be opened easily. Transactions are easy, robust and transparent. Commissions are lower and competitive. Stock brokers are now much better, customer friendly and professional.

- Our Securities system has improved. The digital transformation has dramatically changed access, monitoring and information flow. Every scam perhaps made the system stronger eventually, as the loopholes found were blocked, (and hopefully that problem should not happen again). Of course there is no guarantee that there will not be another scam, but the stock market is a much safer place now.

- A stock market transaction is easily done now on websites, accessible from your PC, laptop, by phone call and even using mobile apps.

So a lot of people from my generation were afraid of the stock markets. The stories they heard from their friends and relatives were scary. Some people lost a lot of money and swore to never touch the sector again. However my message to them is:

Today the Indian Stock Markets are a very good Wealth option to all.

Its not too late. Take the plunge, and explore the stock markets for your wealth protection and appreciation.

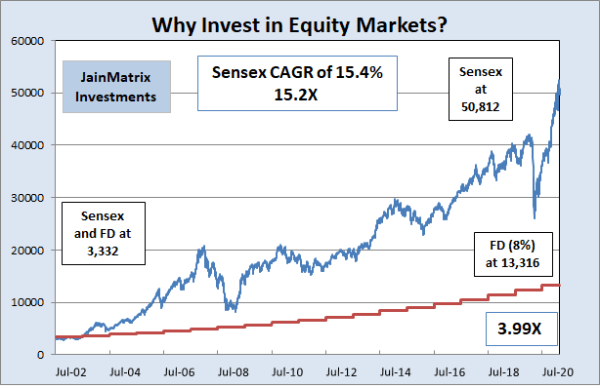

To substantiate this, I present a simple 20 year graph of the SENSEX index

In this graph, one can see the performance of a Fixed Deposit (at 8% interest) versus the Sensex, in both absolute value and in the form of multiples.

Real Estate

The traditional Indian Wealth option has been Real Estate. People bought Land, apartments and commercial property, and waited for it to appreciate. Or developed it, and very often reaped excellent returns. For many years it appreciated very well.

Then came a couple of changes in the real estate sector:

- GST was brought in to track and tax real estate transactions

- RERA Act was brought in to make builders professional, accountable and transparent. It has been changing the way they work. Customers may finally have some protection or recourse now from builder slippages. However several builders could not change and adapt to the new rules, and may have scaled down or even closed.

- Several initiatives against black money have made real estate transactions more ‘white’ than they have ever been in the past.

- Today even after some correction, we can see that a buy v/s rent decision, for a city apartment, is still unbalanced. The EMI for an apartment purchase (with loan) is much higher than the rental cost for a similar property. In most mature markets abroad, the EMI and Rent are close or in some balance with each other.

- All this has resulted in a Time and Price correction in the real estate sector across categories. We can see that today this is still playing out. As a result:

Real Estate is no longer the default Wealth option it once was. Do try other options.

In 2020, 55% of adults in the United States invested in the stock market. Today in India, this is just 2%.

This is not going to change overnight for India, but as awareness builds, individuals must try and nibble at stock markets and educate themselves on its potential.

I have managed to do OK with my website based stock broking account. I became a full time investment professional in 2012. My firm JainMatrix Investments offers an equity advisory service to help invest in the stock markets. See our SERVICE DETAILS section.

Do revert to me if you have any questions on above article.

Regards,

Punit Jain

Founder, JainMatrix Investments

Glossary: I often use standard terms or shortforms so here is some explanation:

- PMS – Portfolio management service

- AIF – Alternative Investment Fund

- EMI – Equated Monthly Installments, as in repayment for a loan

- GST – Goods and Services Tax

- RERA Act – link

DISCLAIMER

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an Investment Advisor. Punit Jain is a registered Research Analyst under SEBI (Research Analysts) Regulations, 2014. JM has been publishing equity research reports since Nov 2012. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com.