I came across an excellent article on Business Standard.

This is very useful for investors new to Equity. Several important concepts are covered here.

Do Read –

Warm regards

I came across an excellent article on Business Standard.

This is very useful for investors new to Equity. Several important concepts are covered here.

Do Read –

Warm regards

Happy investing,

Punit Jain,

JainMatrix Investments

See other useful reports:

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an Investment Adviser. Punit Jain is a registered Research Analyst under SEBI (Research Analysts) Regulations, 2014. JM has been publishing equity research reports since Nov 2012. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com.

Fig 1 – Business Segments in 2011 (click chart to expand)

Bharat Forge has successfully diversified from Auto into other verticals, de-risking their overall business profile

Fig 2 – Quarterly revenues have surged (click chart to expand)

Business is surging, in both Auto and non-Auto segments. Profit growth follows in a phased manner, as investments in new businesses break even

Fig 4 – PE has fallen to attractive levels, and combined with robust business performance gives us a very good entry point for long term investments – (click chart to expand)

Fig 5 – Adjusted EPS has retraced rapidly and is into all time high territory

These reports and documents have been prepared by JainMatrix Investments Ltd. They are not to be copied, reused or made available to others without prior permission of JainMatrix Investments. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com Also see: https://jainmatrix.wordpress.com/disclaimer/

A 5-year view of the share price of Pantaloon Retail. (click on graphic to enlarge)

A view of financials of Pantaloon Retail. (click on graphic to enlarge)

A view of financials of Future Capital. (click on graphic to enlarge)

The short profiles of group companies show that while the ‘BigBazaar’ brand is very good, and revenue growth high, the group has not been able to translate it’s ambitious plans into profitable businesses, and benefit shareholders.

| Category | Company | Products/ Market | Remarks |

| Retail distribution | 1. Aadhaar Retailing Limited | Rural and semi-urban retail distribution of agricultural and consumer products | Majority stake |

| FMCG | 2. Future Consumer Enterprise Ltd. | Brands such as Tasty Treat, Clean Mate, Care Mate, Premium Harvest and Fresh and Pure, being marketed through Big Bazaar and Food Bazaar. | Majority stake |

| FMCG | 3. Future Consumer Products Ltd | Brand ―Sach. | Majority stake |

| Fashion | 4. Indus League Clothing Limited | Ready-made garments under brands like Indigo Nation, John Miller, Scullers and Urban Yoga | Majority stake |

| Home Products | 5. Indus Tree Crafts Private Limited | Domestic retailing and distribution of a wide range of environmentally and socially sustainable products. | Majority stake |

| Fashion | 6. Lee Cooper India Limited | A manufacturer and retailer of denims, trousers, jackets, shirts and shoes under the Lee Cooper brand. | Majority stake |

| Fashion | 7. Biba Apparel, | Holds 17.3% stake in Biba, which will be upped to 28% soon | |

| Food Processing | 8. Capital Foods | A food processing company with brands like Chings Secret, Smith & Jones, Raji, Mama Marie and Kaeng Thai. | |

| Consumer | 9. Amar Chitra Katha | Stake to increase to 26% from 13.7% presently | |

| Fashion | 10. AND Designs India Ltd; Global Desi | Luxury clothing brands | |

| Fashion | 11. Holii Accessories Private Ltd | A joint venture with Hidesign India Private Limited for leather handbags and wallets | |

| Fashion | 12. Celio Future Fashions Ltd | A JV with a French brand of men‘s apparel and accessories | |

| Fashion | 13. Turtle Limited | Manufacturer, distributor, exporter and retailer of men‘s wear products. | |

| Retail | 14. SSIPL Retail Ltd | A retailer of Nike branded products, wholesaler of footwear, sportswear and apparel, and a manufacturer and distributor of footwear. |

Strategy

These reports and documents have been prepared by JainMatrix Investments Ltd. They are not to be copied, reused or made available to others without prior permission of JainMatrix Investments. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com

Also see: https://jainmatrix.wordpress.com/disclaimer/

![]()

Yes Bank is an aggressive high potential new generation bank. The recent fall in prices by 28% makes this an attractive entry point for long term investment.

There is an updated report of Yes Bank available at link The Brave Warrior of Indian Banks by JainMatrix Investments includes Q1FY13 results, news updates and FY15 projections.

In spite of over a hundred banks as competition, Yes Bank stands out for the following reasons:

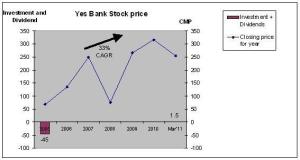

Fig 1 – Yes Bank stock performance (click to enlarge) Source: JainMatrix graphics

Fig 1 – Yes Bank stock performance (click to enlarge) Source: JainMatrix graphics

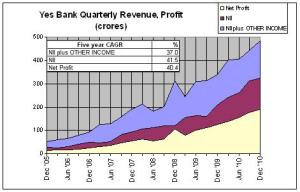

Fig 2 – Quarterly income and Profit have grown steadily over the last 5 years Source: JainMatrix graphics

Fig 2 – Quarterly income and Profit have grown steadily over the last 5 years Source: JainMatrix graphics

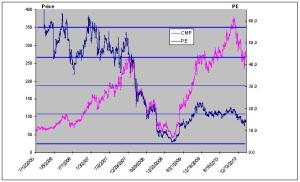

Fig 3 – Price and PE Graph (click to enlarge) Source: JainMatrix graphics

Fig 3 – Price and PE Graph (click to enlarge) Source: JainMatrix graphics

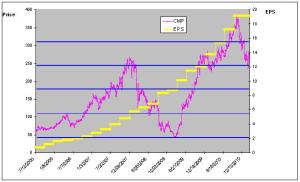

Fig 4 – Price and EPS Graph Source: JainMatrix graphics

Fig 4 – Price and EPS Graph Source: JainMatrix graphics

Fig 5 – Price and DMA chart (click to enlarge) Source: JainMatrix graphics

Fig 5 – Price and DMA chart (click to enlarge) Source: JainMatrix graphics

These reports and documents have been prepared by JainMatrix Investments Ltd. They are not to be copied, reused or made available to others without prior permission of JainMatrix Investments. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com

Here is a quick round up – of the bad news:

So what does an investor do? Calm down. And look at the good news.

Relook at the big picture

Disclaimer:

These reports and documents have been prepared by JainMatrix Investments Ltd. They are not to be copied, reused or made available to others without prior permission of JainMatrix Investments. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com Also see: https://jainmatrix.wordpress.com/disclaimer/

![]()

Petronet LNG stock performance (click to enlarge)

Petronet LNG stock performance (click to enlarge)

Quarterly revenues have grown steadily over the last 6 years

Quarterly revenues have grown steadily over the last 6 years

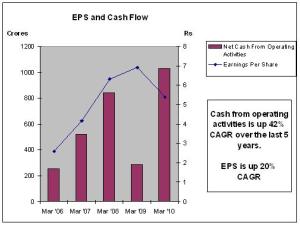

Cash Flow and EPS have grown substantially

Cash Flow and EPS have grown substantially

Disclaimer:

These reports and documents have been prepared by JainMatrix Investments Ltd. They are not to be copied, reused or made available to others without prior permission of JainMatrix Investments. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com Also see: https://jainmatrix.wordpress.com/disclaimer/

![]()