_________________________________________________________________

- 06-Jan-2014

- CMP: Rs 340

- Mid Cap – Mkt Cap 2120 crores

- Advice: Buy

- Target: 660 by March 2016

Here is a note on Repco Home Finance (RHF). Download the report using the Link – REPCO home finance_JainMatrix Investments_Jan2014

Summary

Repco Home Finance is a Chennai based NBFC. The average loan ticket size is small, and aimed at self-employed and weaker sections of society. Even so, it’s a well-managed firm with Total income, NII and Net Profit growing at 42.6%, 39.7% and 39.6% CAGR over the last 6 years. After the May 2013 IPO the share price has appreciated 98% already. RHF is addressing “the Bottom of the Pyramid” and still doing so with low NPAs and a good NIM. Invest in this firm not just for the growth or profits or share price appreciation, but for the immeasurable social benefits it provides.

Business Profile

- Repatriates Cooperative Finance and Development Bank, (REPCO BANK) a Govt. of India firm was set up for supporting the rehabilitation of repatriates from neighboring countries mainly Sri Lanka and Burma. Chennai based Repco Home Finance, (RHF) was promoted by REPCO bank in 2000.

- Total Income in FY13 was 406 cr and Profits 80 cr. Its asset under management are at Rs 4035 crore.

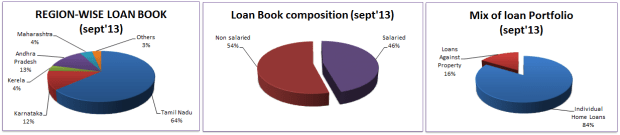

- RHF focuses on relatively under-penetrated markets, see their business profile in Fig 1.

- RHF has 82 branches and 20 satellite centers, majorly in South India, with 64% of loan book from TN. The plan is to grow to 100 branches with new branches in Mah, Gujarat, Orissa and West Bengal.

- The M.D of Repco Group including RHF is Mr R. Varadarajan, a career Banker.

- Consumer – The average home loan size is Rs 9.8 lakhs given to lower-income self-employed people. The total construction value may be Rs 15 lakhs, for a 1000 sq. ft house. (JainMatrix estimates).

- RHF follows a lean and efficient business model, with small branches having 2-4 employees with local knowledge, a centralized loan process, no DSA sourcing and totally only 398 employees.

- Good ratings post IPO with ICRA (upgraded) AA- and CARE (assigned) AA- rating for RHF long term loans.

- Current shareholdings are Promoters 37.4%, FII 6.3%, DII 15.9%, NRIs/Foreign Individuals/Non Resident companies 35.8%, others 4.8%.

Industry Note

- There are a large number of NBFCs in India (>10,000). This fragmented market offers big growth opportunities for Home Loans. RBI has projected a 14% growth in loans for Banks; NBFCs should have higher industry growth rates of around 24% for the next five years. (ICRA/ industry experts).

- Housing finance companies account for 40% of the retail home loan market. The home loan portfolios of mortgage NBFCs have also grown faster than commercial banks in the last few years.

- The top 4-5 companies will have close to 85-90% share of the retail home loans. These firms are HDFC Ltd, LIC Housing Finance, Dewan Housing Finance Corporation and Indiabulls Housing Finance.

- RHF addresses a market segment that is underserved, and only addressed by a few micro-finance NBFCs. This is a large and unaddressed, high potential sector.

- Inflation and Interest rates are at highs as of now, which is difficult for the sector. However the 2 year outlook is a slow fall in both, even as the investment cycle recovers in India.

Fig 1 – Business Overview

Unique Strengths

- Since RHF is promoted by REPCO Bank (a PSU Bank), it should get state govt. support. Repco Bank is part owned by Govt. of India, and TN, AP, Kerala and Karnataka governments.

- RHF reaches to the underserved, weaker sections of the society, offering small ticket home loans to self-employed persons. It addresses a segment which is underserved and has high growth potential.

- RHF has a strong local presence in Tamil Nadu, and is extending operations to neighboring states.

- With a healthy 4% NIM, RHF is profitable while growing fast.

- With its lean branches and its presence in Tier 2 and 3 cities, and periphery of Tier 1 cities, RHF has an organisation structure well geared to addressing its current customer segment. RHF shares branches with Repco Bank, thus reducing the cost of operations and having synergies.

- Cost of capital was stable for the last 2 years, and loan rates for customers have not been increased.

- RHF has conservative lending metrics: LTV (Loan to Value) 65% and IRR 50%. This is a strength.

- A personal visit by the researcher to a Repco Bank/ RHF branch indicated courteous service and discussions, a competitive home loan rate and simple but efficient branch environment.

Stock Evaluation, Performance and Returns

- RHF was listed recently in April 2013, with an IPO pricing of Rs 172. The Rs 270 crore IPO was a success with 1.62 times over-subscription. It has already appreciated 98% since to date.

- RHF has shown very good performance over the last few years, with Total income, NII (Net Interest Income) and Net Profit growing at 42.6%, 39.7% and 39.6% CAGR over the last 6 years. See Fig 2.

- A fall in NII% indicates an increase in cost of loans. PAT margins too have fallen from 27% to 20%. However in the backdrop of surging Total Income, this is not worrying.

- The loan book grew at 38% CAGR from FY-09 to FY-13.

- The cost of borrowing of the company is 9.3% which is quite low. The dividend yield is 0.31%.

- From the chart we can see that the NIM ranges between 4-5%. See Fig 3. NIM may have fallen recently, but it is high at 4% levels. It may rise again post IPO.

- Gross and Net NPA are within comfort levels at 1.48% and 0.99%.

- Post IPO the capital adequacy ratio (CAR) is at very good level of 25.6% which is well above 12% level specified for the sector. RHF has room for loans growth for several years with current capital.

- Price and PE chart shows that Share Price and PE are fairly in sync. We can see that PE has risen rapidly post IPO from 12 to 22 times and the mean level stands at 17 times. See Fig 4.

- ROCE is 11.6% and Return on net worth is 12.6%, these are good ratios.

- Its asset under management stood at Rs 4035 crore by H1 FY14, a growth of 30% in 1 year.

- PEG is at 0.7 – indicates undervalued status, below the norm of 1.

Peer Benchmarking and Financial Projections

In a benchmarking exercise, we compare RHF with its peers.

- It appears that RHF is overpriced and closer to HDFC Ltd on valuations. However we can see that RHF has good NIMs and lower D/E ratios.

- Also on productivity metrics, RHF scores high. This indicates that in the short term, growth can be accelerated by means of hiring.

- RHF by virtue of its small size, growth and lack of competition looks well placed.

- Bajaj Finance also shows good metrics. See a research report on the same. LINK

Find projections of RHF financials in Exhibit 6.

Opinion, Outlook and Recommendation

- Indian market is underserved for loans and financial services. This is more so in the poorer sections and self-employed of society. RHF has little competition in this segment.

- Indications are that RHF will continue to grow its business well. The exit of some Private equity investors post IPO should actually accelerate the profits due to lower costs.

- RHF is not just doing a Social Service, but doing so at a healthy profit. In his famous book, “The Fortune at the bottom of the Pyramid” the respected author C K Prahalad turned attention to firms that can do this. We feel RHF is one such company.

- RHF has had its IPO only 9 months ago. As the company becomes better known and understood, we feel investors will understand the Social achievements of RHF.

- Invest in RHF not just for the growth or profits or share price appreciation, but for the immeasurable social benefits it provides. Invest systematically for long-term out-performance.

- Advice: Buy with a Target of Rs 660 by March 2016

JainMatrix Knowledge Base:

See other useful reports

- Future Gazing – Business and the Internet of Things

- Balkrishna Industries – The Tyres Roll Faster

- BHEL – a Power Value Play

- Cairn India – A Formula for Success

- Mindtree Ltd. – A Possible Star

Disclosure: It is safe to assume that if the JainMatrix website recommends a stock, the researcher has already invested in it.

Do you find this site useful?

- Visit the SUBSCRIBE page to find how you can get more. Click LINK

- Register Now to get our Free reports and much more, on the top right of this page, or by filling this Signup Form CLICK.

Disclaimer:

These reports and documents have been prepared by JainMatrix Investments Ltd. They are not to be copied, reused or made available to others without prior permission of JainMatrix Investments. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com