———————————————————————————————-

- Date 7-Aug-13

- CMP: Rs 116

- Large Cap – Mkt Cap 28,300 crores

- Advice: Buy with a 2-3 year perspective

Here is a short note on BHEL (Bharat Heavy Electricals Ltd)

Introduction

- BHEL is an integrated power plant equipment manufacturing and implementation firm.

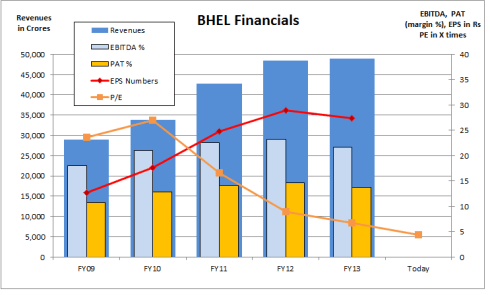

- Its turnover in FY2013 was 48,000 crores, with profits at 6,600 cr. It has achieved Maharatna PSU status in 2013, which allows it greater operational freedom. Market Capitalization today is 28,300 cr, at CMP 116.

- The manufacturing capacity is now 20,000 MW per annum, highest among all power-equipment vendors in India. It has a 59% share in Indian installed generating capacity contributing 69% to the total power generated.

- Orders booked backlog is 1,10,000 cr, which is 2.3 times current revenue. This should tide it through the current slowdown. Core business is slow today but the manufacturing and execution strengths are immense.

- Business is from sectors like Power Generation and Transmission, Railways, Renewable Energy, Oil & Gas and Defense. International projects are also increasing, diversifying business.

- The divestment of BHEL has been postponed due to low valuations. It is still 67% owned by government, so this process is not urgent from a SEBI regulations point of view.

Power Sector

- In India, the overall power demand is growing at 8-10%. However, the domestic power sector looks weak right now due to poor fuel linkages, slow execution of projects, high debt and drying up of investment funding.

- The govt is reviving the sector by:

- Breaking State Electricity boards into independent distribution, generation and transmission firms.

- Allowing raising of power tariffs, which the States have started to do. This is an economic necessity but a politically challenging task.

- Pushing Coal India to meet production targets and sign fuel supply agreements with power producers.

Technical Factors

- The Share price of BHEL has fallen 57% in last 1 year, and by 23% since the 3rd Aug Q1FY14 results.

- A look at the price/volume shows that that this sharp sell-off seems to be done with, and the share should reverse rapidly from here.

Valuations

- Current P/E is 4.6 times, very cheap. Price/ Book is 1.12

- Debt is almost zero, and cash on hand is 6600 cr (2012, the annual report of 2013 is not yet available).

- Cash flow was only a small negative in 2012.

- Dividend Yield is 5.5% today, comparable to post tax returns from FDs.

- This fall is an over-reaction, and BHEL is available at 2005 price levels.

Overall Opinion

- Based on all this, BHEL is a good contrarian call, value buy.

- Buy with a 2-3 year perspective.

Do you agree? Whats your opinion? Share it. Visit, like and follow us with JainMatrix on Facebook and JainMatrix on LinkedIn

JainMatrix Knowledge Base

See other useful reports

- NHPC – Steady, Cheap, Defensive Power Generator – LINK

- Cairn India – A Formula for Success – LINK

- Mindtree – A Possible Star – LINK

- JainMatrix Mid Cap Model Portfolio 2013 – LINK

- Apple Inc. – LINK

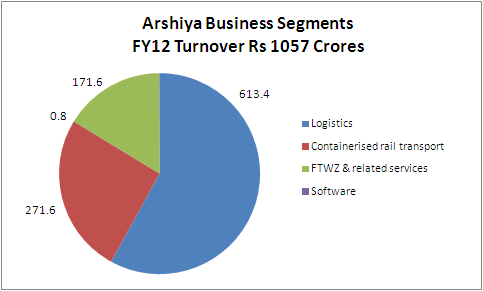

- Arshiya International: A Collapsing Star – LINK

- Bharti Airtel – This is a year of consolidation – LINK

Disclaimer:

These reports and documents have been prepared by JainMatrix Investments Ltd. They are not to be copied, reused or made available to others without prior permission of JainMatrix Investments. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com