- The Banking sector in India is looking attractive for equity investments.

- In this investment report, we have analysed 32 listed banks to identify the best firms on two broad parameters 1) Blue Chip banks 2) High growth and turnaround banks.

- We identify a 5 bank basket for a 2-3 year period investment horizon.

- Do read the Risks and Disclaimers sections of this report also.

Introduction

- The Indian banking system consists of 12 public sector banks, 21 private sector banks, 44 foreign banks, and additionally, regional rural banks, urban cooperative banks and rural cooperative banks.

- However, only 32 of these banks are listed entities. We limit this sector report to this universe.

- The Reserve Bank of India (RBI) is the central bank regulating and supervising the banking industry. It formulates and implements monetary policy, issues currency, manages foreign exchange reserves and provides overall direction to the banking sector.

- This industry has witnessed the rollout of innovative banking models like payment banks and small finance banks. RBI’s new measures are helping the growth of domestic banking industry.

- With the introduction of technology like mobile banking apps, UPI and payment gateways, artificial intelligence, machine learning, and blockchain, the banking sector is going through a digital transformation. These developments improve usability, security, speed and effectiveness.

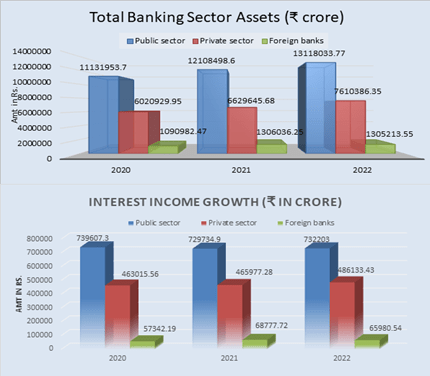

- In 2022, total assets in public & private banking were ₹131 lakh crore & ₹76 lakh cr. resp. see Fig 1a.

- Interest income for the public sector remained relatively stable; the private sector experienced moderate growth, while foreign banks saw a significant increase in interest income from ‘20 to ‘22.

- Two key indicators demonstrate the progress. Successive waves of recapitalisation gave banks enough resources to write off most of their bad loans, especially PSBs. They brought down their gross NPAs from 11% of total advances (’18) to 5.9% in ‘22. NPAs for industrial credit also reduced from 23% to 8.4%. Even after these large write-offs, most banks retain comfortable levels of capital.

- As of FY21, total advances surged to ₹136.75 L Cr. As of March 2023, according to India Ratings & Research, credit growth is at 15% in 2022-23.

- India is set to become the third-largest Domestic Banking sector by 2050.

- The Banking sector in India is domestic focused and services Retail and Commercial sectors, and a large number of industries, providing critical capital for growth and new projects.

Recent News, Events and Updates of Banking Sector:

- HDFC Bank expects 17-18% credit growth this year as there is enough credit demand. (ET 23rd July)

- The merger entity of HDFC bank and HDFC became the #7 valued lender globally with market cap of ₹ 12 L cr., this is more than Bank of China and Royal Bank of Canada. (ET 18th July)

- IDFC First bank transformed from an infrastructure lending business into a universal bank. Over the last year, it has given a return of 134% in a period when the Sensex was up just 18%. (ET 24th July)

- Domestic Indian Banks, which have fast tracked their efforts to enhance their digital capabilities, are luring top-notch tech talent from leading new age companies and global firms. (ET 23rd July)

- Govt. of India (GoI) instructed Banks not to take harsh steps for collections related to repayment of loans. And to deal with such cases with “sensitivity” and through humane approach. (ET 24th July)

- S&P Global Ratings predicts that India’s banking sector will see a decrease in weak loans to 3-3.5% of gross advances by Mar’25, based on structural progress and good economic prospects. (ET 20/07)

- Recently GoI has encouraged public sector banks (PSBs) to consolidate through mergers. GoI indicated in the Union Budget for 2021–22 that it intended to proceed with the privatisation of two PSBs. This will allow both PSBs and PVBs to grow their businesses and succeed.

- Several nations are planning to introduce a digital currency called CBDC – Central Bank Digital Currency. As per a 2021 Bank for International Settlements (BIS) survey, 90% of central banks were actively investigating the possibilities, 62% were testing, and 26% were implementing pilot projects.

- State Bank of India (SBI) will set up a trustee company, which will be its wholly-owned subsidiary, for managing the Corporate Debt Market Development Fund (CDMDF). SBI Funds Management Ltd has been identified as the investment manager cum sponsor of the fund. (ET 18th July)

Analysis of the Banks

The 32 listed banks were identified for this report, see Fig 1b. Further, the banks were first classified into PSUs -12, Large cap Private – 8 and Mid and Small cap Private – 12.

Fig 1b – Full List of Banks

Next we ran two assessments on these banks – Blue Chip and High Growth / Turnaround parameters.

Phase I (a) – Blue Chip Banks Funnel

- The Blue Chip Bank criteria identified were P/E, Mar Cap., ROCE %, NET NPA and Capital Adequacy.

- We ran these on the 32 listed banks, to get the top 12 and next the top 4 Blue Chip Banks. See Fig 2.

Fig. 2 – Blue Chips

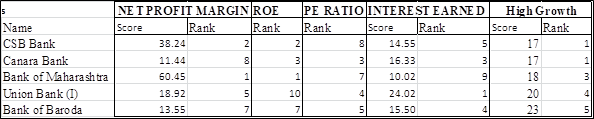

Phase I (b) – Five year Growth Banks Funnel

- To identify the growth / turnaround leaders, we took 5 year data of criteria – Net Profit Margin, Return on Equity, PE Ratio and Interest Earned, and looked for the trends on these parameters.

- We ran this on the 32 listed banks, to get the top 12, and further the final top 5.

Fig 3: Growth

- Note that there was only one common find from both lists – CSB Bank.

- We thus chose 8 banks for the next phase of analysis, Phase – II. This analysis has three parts – Financial Metrics, Benchmarking and Qualitative Parameters.

Phase II (a) – Financial Metrics

- Having identified the top 8 banks on two major criteria, we first ran a deep Financial Metrics analysis on these firms, where we took 5 years data for the banks on the following 10 parameters –

- Net Interest Margin, Earning Yield (%), Cost To Income Ratio (%),

- Return on average Assets, Return on equity, Gross NPAs %, Net NPAs %, PE ratio

- Provision coverage ratio, Capital Adequacy Ratio

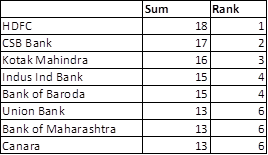

- Based on these parameters, the banks were ranked 1-8 and the results were

Fig. 4 – Financial Metrics

- Thus BoM, HDFC, CSB, Canara and Bank of Baroda emerged as the top 5 banks here.

Phase II (b) – Benchmarking

- We ran a Benchmarking analysis to compare these top 8 firms with each other.

- We took 10 parameters listed below, which were banking specific and covering various aspects of the business, but only the recent year data.

- We can see that CSB and Union Bank emerge as winners in this comparison, in sum of winners.

Fig. 5 – Benchmarking

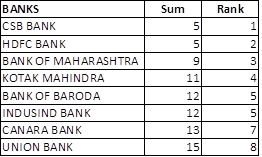

Phase II (c) – Qualitative Parameters

- We identified 6 qualitative parameters of Vision, Management Quality, Governance, Other ESG, Operational Flexibility, Products Flexibility, Litigation and Notices from authorities.

- We ranked the above 8 firms on these, and summed it up to get the results in Fig 6a.

Fig. 6a – Qualitative Parameters

Fig 6b – Final Tabulation and Count

- Putting these three sections of Phase – II together, we got a final score in Fig 6b.

Risks

- Banking sector is considered a cyclical sector due to a strong correlation with GDP growth.

- A few years ago, interest rates in India were much higher than developed countries. Many Indian banks and corporates borrowed abroad for cost advantages. Today, the interest rate differential has reduced, even as INR has weakened, and these firms may be affected.

- This analysis has not deeply covered drivers of future growth of these banks such as new product innovation, rural presence, tech savviness, hiring patterns, M&A and management quality. We have not built price targets for the recommended shares.

- If Interest Rates rise sharply in India, banks may face lower demand and higher borrowing costs, which can squeeze profit margins. Conversely, a sharp fall in interest rates can reduce the income.

- Banks give floating rate loans that protect them in case interests rise.

- The Credit Risk is where Banks lend money to individuals and businesses, and some borrowers fail to repay their loans. It’s doing well now, but in a few years, a deteriorating economy could lead to higher default rates, which can negatively impact a bank’s profitability and asset quality.

- Regulatory and Compliance Risks: The banking sector is heavily regulated by RBI. Changes in regulations, compliance requirements, or government policies can impact the banks.

- Cybersecurity and Tech Disruption Risk: Banks store a vast amount of sensitive customer information, and cybercriminals often target this. A data breach can be very damaging. Fintech companies and digital innovations are changing the landscape here. Traditional banks that fail to adapt to these may lose market share.

- Liquidity Risk: Banks rely on short-term funding to meet obligations. If a bank experiences difficulties in accessing funding, it can lead to liquidity problems that may threaten its operations and solvency. Banks need to not get over leveraged, and maintain an Asset Liability match.

- Systemic Risk: The banking sector is interconnected, and the failure of a lender or large corporate can have ripple effects throughout the financial system, eg. DHFL and IL&FS.

- Competition: The banking sector is highly competitive, with both traditional and online banks vying for customers. Intense competition can put pressure on a bank’s margins and profitability.

- However the Indian market is underpenetrated and underserved, so there is scope to grow

- Market Risk: Bank stocks like all stocks are subject to market risk. Economic conditions, investor sentiment, market volatility and liquidity outflows can cause banks’ stock prices to fall.

Conclusion and Recommendation

- Though hampered by the recent economic slowdown, the domestic banking sector has rebounded well from this, and seen a rise in demand for loans and other financial services.

- Banks over the last 5-6 years are also recovering from a NPA crisis, as multiple actions such as IBC, Sarfaesi Act and collections tightening have helped clear frauds, bankruptcies, delinquencies and old dues. The sector has improved performance recently, with profits up by 23% in Q1FY24 YoY.

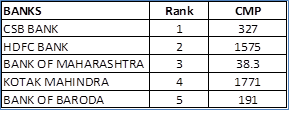

- Based on our analysis in this report, we have identified the top five banks out of 32. See Fig 7. This analysis process is comprehensive, covering fundamental factors such as valuations, margins, growth, internal performance metrics, improvements and qualitative parameters.

Fig. 7 – Final Bank Basket

- These banks form a good investment Basket. We suggest an equi-weight approach, and an investment time frame of 2-3 years.

Disclaimers

Punit Jain discloses that he is a long term investor (less than 1%) in HDFC Bank (since Aug 2008), Bandhan Bank (since Mar 2018) Yes Bank (since July 2005) and IDFC First Bank (since June 2020), out of the banks mentioned in this report. He and his family may be normal customers, of one or more of these banks for savings and current accounts, credit cards, insurance, etc. Other than this, JainMatrix Investments Bangalore (JMI) and its promoters/ employees have no direct or financial interest in these banks, and no known material conflict of interest as on date of publication of this report.

This document has been prepared by JMI, and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JMI. The information contained in this report has been obtained from sources that are considered to be reliable. However, JMI has not independently verified the accuracy or completeness of the same. Neither JMI nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from a RIA Registered Investment Advisor. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Punit Jain is a Research Analyst under SEBI (Research Analysts) Regulations, 2014. Registration granted by SEBI, and certification from NISM in no way guarantee performance of the RA or provide any assurance of returns to investors. JMI has been publishing equity research reports since Nov 2012. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com Name of the RA as registered with SEBI – Punit Jain, SEBI Registration No. INH200002747. logo/brand name –

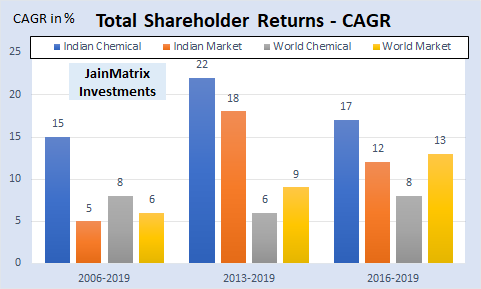

Fig 1. CAGR of TRS, source McKinsey & Co

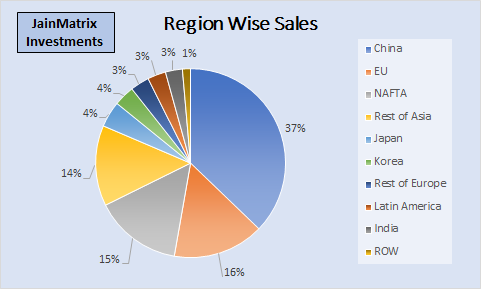

Fig 1. CAGR of TRS, source McKinsey & Co Fig 2. Region wise sales of Chemicals

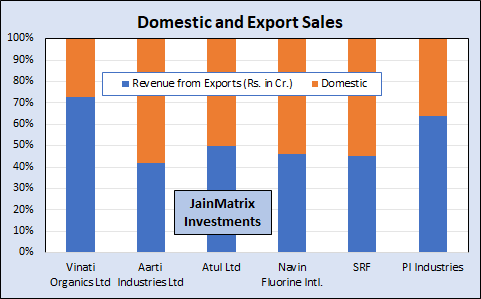

Fig 2. Region wise sales of Chemicals  Fig 3. Revenue from exports

Fig 3. Revenue from exports

A friend visited Mysore and shared this picture recently.

A friend visited Mysore and shared this picture recently.