This article has been updated. Click on this link to see the latest version.

March 2016 – A Superior Investing Process – Do a DIP SIP

Jan 2011

- The market indices have fallen, and it seems like a good time to invest?

- But you’re not sure what to invest in? Should you choose just one or two stocks with good prospects, and invest a large sum?

- Or should you just choose a Mutual Fund, and invest in a lump sum, or even a SIP?

I have another idea for you. Invest in a direct market SIP !!

By this I mean, use your current Online Trading & Demat account to buy 5-6 shares yourself in a systematic manner every month.

Comparisons of direct market SIP with a Mutual Fund:

- Only initial charges of 0.5 to 0.75% which are the brokerage commissions + taxes, compared to 2.5% per annum, which are the normal Mutual Fund charges. This really adds up over the years.

- A quick look at equity MFs performance over 3 years (from Value Research) shows that only 15/57 MFs outperformed the Nifty’s 5% gains over the last 3 years.

- Instead of a decision on which MF, you have to only make an initial decision on the bunch of 5-6 stocks. I will help you through this also :-)

- Utilize your online trading account better, and gain control over your investments !!

Comparison of direct market SIP with a lump sum in 1-2 direct stocks:

- The market indices can fall further. A systematic investment every month will help you gain more from falls in the market

- Do not try to time the market. Instead by investing systematically, you can beat the Sensex in terms of returns !!

- Just one or two stocks for investing heavily – this may be too concentrated a portfolio. Even the largest and most stable stocks (think Reliance or DLF) can be victims of pockets of non performance, or worse, large unpredictable swings.

Comparison of direct market SIP and Brokerage Equity SIP:

- Several brokerages – ICICI direct and ShareKhan for sure – have introduced Equity SIP facility for customers.

- They can specify the stocks and purchase monthly of a specified Value (of portfolio) or specified quantity (of shares)

- Initial and recurring charges are identical

- There have been doubts expressed about the brokerage’s transaction – Bad Trade Execution/ buying into morning spike, etc. as expressed in this article – http://shabbir.in/why-no-stock-sip/

- My feel is a Do-It-Yourself approach removes these doubts and gives some satisfaction (while taking just 10 minutes a month).

- See fig 1 for a tabular comparison of above options

Checklist for a direct market SIP:

- You will use your current Online Trading account/ broker relationship for this SIP. If you have to choose among your options, choose the one with lower brokerage. Could be ICICI securities, or Kotak securities, or whatever.

- Decide on the 5-6 stocks you will invest in. My help here – see next section – Choose your stocks.

- Decide on the amount you will invest every month – here I would suggest you fix an amount such as Rs 10,000 or 20,000 and keep up this amount every month.

- Create a small calculation excel for helping you decide the actual number of shares to be bought. See section – Here’s an example.

- Decide on a date for investing. If you are salaried, perhaps 2nd or 3rd every month is a good date as it is right after you have received your salary. Or any other convenient date. Keep a self reminder for this date.

Choose your stocks

This is an important first step. My key principles in choosing the stocks are:

- Choose large liquid blue chips. They should be Nifty/ Sensex stocks. You do not want too much volatility in your mutual fund.

- The 5-6 stocks should be from different sectors. Bad news in one stock / sector should not affect the other.

- These stocks should be solid businesses that are going strong even 10-15 years from now, as your SIP and asset building is for long term

My recommended stocks – choose only one per sector:

- Banking – HDFC Bank or SBI

- Automobiles – Tata Motors or Bajaj Auto

- Capital Goods & Engineering – L&T

- Information Technology – TCS or HCL Technologies

- Oil & Gas – ONGC or Petronet LNG

- Telecom – Bharti Airtel

- FMCG/ Food – Hindustan Lever or ITC

Returns from this approach.

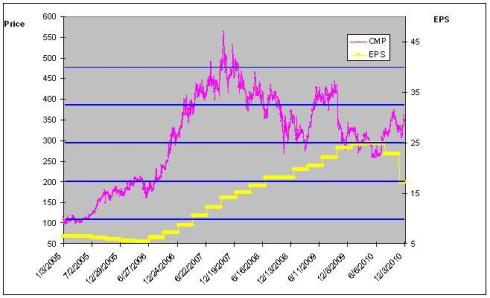

- Lets say you chose 5 stocks for your SIP – HDFC Bank, Infosys, L&T, ONGC and Bharti Airtel.

- If you invested in these five on a monthly basis over the last 30 months, following above approach, you will get returns per fig 2

Here’s an example

- Choose your MF portfolio from above recommended stocks

- Next you have chosen Rs. 20,000 per month for your SIP.

- Create a small excel – which can help you calculate the number of shares to be bought every month. See fig 3. This will help do this easily in a few minutes

- Decide the date of the month you want to invest every month – say 2nd. Very important – stick to your monthly investing routine as far as possible.

- There you go – you are all ready.

- Happy Investing :-)

![]()