In this note, Research Analyst Punit Jain shares his thoughts around Financial Freedom, a case study on Financial Goal based investing, and finally the concept of Escape Velocity on wealth.

Financial Freedom We used to call it Retirement, but now it is referred to as Financial Freedom. During our working careers we need to track our wealth, and have Financial Freedom as the Goal.

Its possible that Financial Freedom can be achieved before 60. And it need not be imposed on you by your employer, but achieved by you based on your earnings, lifestyle, planning and wealth management. Here are more details.

Case for Financial Goals: Being a primarily Equity focused professional, I have come up with a Case for Goals based investing. Its targeted at young working executives early in their career. Here it is –

This case has many assumptions, including ones stated above, and 1) This is for an equity investor starting off his journey 2) this is a primarily direct equity investment that can possibly give a 20% compounded return over the long term 3) By no means is 20% return a guarantee or even a promise, but just an achievable possibility, and real annual results can vary widely depending on the markets and the actual investments made by the investor. Also this case can be customized for different goals.

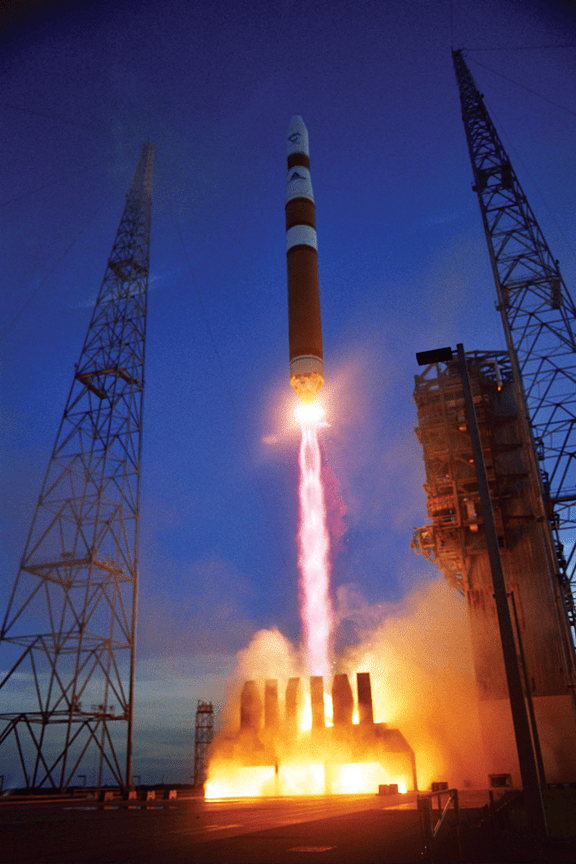

Escape Velocity in the context of space is the speed at which a rocket has to travel away from earth in order to escape its gravity force and enter space. For those so interested, it is 11.2 km per sec (6.96 miles).

Escape Velocity in the context of Financial Freedom is where your wealth and investments are large enough that the average annual gains from them exceed your average annual expenses. For this its required that your wealth grows faster than your expenses. To achieve this, most people need both good investments and good discipline.

A very simplified example. Lets say you have achieved a wealth corpus in equity of ₹ 30 lakhs. It is growing by 20% average a year, so this year by ₹ 6 lakhs. Your expenses however are ₹ 40,000 a month, or ₹ 4.8 lakhs a year. If your returns and expenses remain in this range, and you stay invested, you should be able to grow your corpus every year. You have already achieved Financial Escape Velocity !!

Direct Equity investments can help you achieve this Escape Velocity earlier, and better.

If you are an individual investor, we at JainMatrix Investments, as a SEBI registered Research Analyst firm can help with your wealth building. Sign up for our services, or to find out more reach out to us.

Do keep in mind that equity is a volatile asset class, and returns can vary widely from year to year.

Also see our recently updated

Regards, Punit Jain

Comment, leave a reply below, and like and share this post with your friends.

DISCLAIMER

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. This is a blog and marketing collateral. The securities quoted here, if any, are for illustration only and are not recommendatory. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an Investment Advisor. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Punit Jain is a registered Research Analyst under SEBI (Research Analysts) Regulations, 2014. Registration granted by SEBI, and certification from NISM in no way guarantee performance of the RA or provide any assurance of returns to investors. JM has been publishing equity research reports since Nov 2012. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com. Name of the RA as registered with SEBI – Punit Jain, SEBI Registration No. INH200002747.

Click and Share this post :