————————————————————————————————————————————

JainMatrix Investments has published a review of this portfolio, please click on the link October Review

Article Published January 17th 2012

A Happy New Year to you! January 17th 2012

In my first post of 2012, I’d like to mull over a very basic question. There are a number of fundamentally good companies, firms in good sectors that are showing QoQ growth and profits, with upside potential and great order booked numbers. I’d like to invest in such firms.

But my worry has been that along with the Sensex, these firms have seen their share price falling week after week. The question is: How much can a good company fall? More importantly, when can we be sure that the share price fall is complete, a bottom is in place, and the reversal has started?

If we can answer this for a few companies, it can be a great investing opportunity. I suggest the following 9 firms as turnaround candidates.

1. Hanung Toys & Textiles: CMP 128.

- This mid sized consumer products firm has 75% revenues from exports. Its share has jumped by 67% in the last 1 month, on high volumes.

- My fundamental analysis indicates it’s a buy. In my report called Hanung – Look for the rebound, I had predicted such a reversal. Here’s a link to the report

- Here is a one month view of this stock:

- But the two-year view of the stock shows the extent of fall. The converse of this is that this share has a long climb before it, to even reach past highs.

2. KEC International. CMP 49.1

Background:

- KEC is a power transmission EPC firm owned by the RP Goenka group

- It has increased EPS 30% CAGR for 5 years, and over 50% of the revenues from international projects.

- A recent US acquisition in the transmission towers – SAE Towers – gives it 30% growth in balance sheet and a foothold in the America geography

- Overall margins have been steady at 10% for the last 4 years

- Recent small but synergistic diversifications in India give it an entry into Power Systems and Cables, and new verticals like Railways, Telecom and Water.

Situation:

- In the last 4 weeks, the share has gained 53%, again on good volumes.

- Here are the details, in a one month view:

- Here is a two-year view of the stock that shows the extent of the fall. One of the issues is poor sentiments in the Power sector. However, for KEC, the fall is overdone.

3. BGR Energy Systems CMP 229

- It is a leading power generation EPC firm. A detailed analysis is available on the link

- The stock is up 35% in the last 2 weeks

The fall in the last two years has been massive, as we can see:

4. Diamond Power Infrastructure – CMP 111

- This Gujarat based small cap is an integrated power sector player into Cables, transmission towers, transformers and conductors

- It has aggressively expanded capacities, and maintains a higher proportion of in house manufacture in its EPC projects.

- In the last month, the share has risen 51% from its low.

- If you see the two-year chart, the extent of the fall is obvious. Again this is partly due to a poor perception of the Power sector combined with the fall of the Sensex. The fall is overdone, and the stock should bounce back.

5. Titan Industries, CMP 185

- It is the Tata group company that owns the Titan and Tanishq brands

- It is a large Cap, consumer-oriented firm with a big retail presence. A detailed analysis is available at link

- The share is up 21% in the last one month, as we can see:

- The one-year view of Titan shows that it has fallen sharply in this period. It surely has some catching up to do.

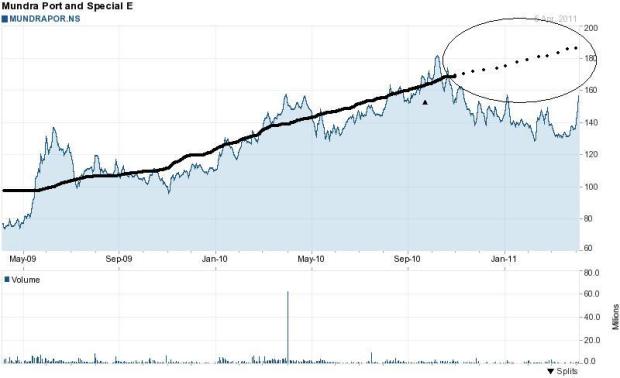

6. Mundra / Adani Port and SEZ, CMP 135

- This Port and SEZ major is part of Adani group. It is an infrastructure stock.

- A detailed report is available on Link

- A recent development in this stock was the acquisition of Abbot Point Port in Australia. This was seen as an expensive acquisition, and this was one reason for the recent fall

- This share is up by 25% from a recent one month low, as we can see:

- The high for Mundra/ Adani was 184.5 in mid 2009 and the share is now 36% lower than this in spite of the recent rise:

7. IRB Infrastructure – CMP 153

- This is a leading Roads Developer and Operator in India.

- It is on a rapid growth path even in the current slow environment. It has a very good portfolio of projects, many of which are operational / toll roads, giving it a predictable and visible cash flow. It has restricted new business bids to larger and more lucrative road projects, where it has competitive advantages. Order Booked are around 10,000 crores.

- In the medium term, the IRB stock has been suffering from a sentiment driven fall. In the last few weeks, however, it has recovered 24% from a low of 123.5 to the current 152 level

Over a 2-year period, we can see that the stock has fallen significantly, and this should reverse in a falling interest rate scenario.

8. Binani Industries – Cement and metals manufacturer. CMP 121

- It is a holding company with interests in Cement, Zinc, Glass Fiber, composites, etc.

- However, the significant valuable asset is Binani Cement, which was recently merged into the holding company. This itself has a turnover of 2000 crores, and had a market cap of 1600 crores (before merger).

- Other assets are not significant loss making entities. As of now, Binani Industries has a market cap of just 360 crores. The stock is under valued.

- The share price has rebounded by 39% from recent lows.

The 2-year picture of Binani Industries shows the spike in 2011 around the time of the merger with Binani Cement, and a subsequent fall.

9. Yes Bank, CMP 285

- It is a leading private sector bank. A detailed analysis of this stock is available on the link

- The share has shot up in the last month by 24% from a recent low.

- The two-year view of the stock indicates that the current price is significantly below the highs, even though business performance is steady.

Risks:

- A close look at any of the 2-year charts of these shares indicates that there are several 20-40% bounces on the way down. There is a small probability that this too is just a bounce. However, several factors build my confidence that this is more than just a small reversal.

- We have indications (see article) that the interest rate cycle has peaked in India; that the Inflation too has peaked. So this could be a sign of economic improvements.

- The INR has weakened considerably. This can be a booster to export oriented firms.

- The coordinated fashion in which above nine firms (and others in the market) have risen indicates a change in sentiment, and perhaps lowering of investment negativity.

- At the beginning of the New Year, many investors, especially foreign, open their books and make fresh investments.

- Investment in turnaround companies is inherently a higher risk approach, but with potentially higher returns. Take this approach only if you have a high-risk appetite.

- One view of the above stocks can be that the best is already past, and the resurgence in the last month is unlikely to be repeated. My view is that at this stage fresh investments in these stocks are less risky than a month ago; the reversal is more likely to be sustained, and most of these stocks have a long way to rise before they are back at their highs, even though on valuation parameters, many should be near their all time highs.

- It is possible that an external negative event takes place that makes share prices fall below these recent lows. However at this juncture, this looks like a small probability event.

- Socialize with us Like on Facebook

- Check back on the website www.jainmatrix.com for updates.

- Do you find this site useful? Please comment below. You can also subscribe for my posts by filling the ‘Posts By Email’ box on top right of this page.

Disclaimer:

These reports and documents have been prepared by JainMatrix Investments Ltd. They are not to be copied, reused or made available to others without prior permission of JainMatrix Investments. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com