Price band 51-59 ; Issue period Retail – July 27 – 29, 2011.

(For a detailed note on L&T Finance Holdings IPO with analysis, business charts and IPO risks, subscribe for free to this blog, on the right panel)

Update on July 28th

- On the second last day, the IPO has already been subscribed 1.21 times, with breakup of QIB (0.72), HNI (0.5), Retail (2.21), Employees (0.51) and Shareholders (0.96).

- Retail has the highest oversubscription till now !! This is a new phenomenon. Looks like QIB’s are worried about USA’s debt problems, and a dull Sensex with an Interest Rate increase over last 2 days has affected overall demand.

- The investment limit for Retail is Rs 2,00,000. If you want to maximise your subscription, bid for 3300 (33X100 lot size) shares at Cut Off for an investment of Rs 1,94,700.

- Good luck !!

Report on July 25th

L&T Finance Holdings is a high quality NBFC offering. Buy with a 2-3 year investment perspective.

L&T Finance Holdings – Description and Profile

- This is the first public issue from the house of L&T since the parent’s listing way back in 1950

- L&T FH is the holding company for the financial services business of the L&T Group. L&T FH has four arms that manage the mutual fund, asset financing, infrastructure financing and working capital funding businesses. This includes firms like L&T Infrastructure Finance, L&T Finance, India Infrastructure Developers, L&T Investment Management and L&T Mutual Fund Trustees.

- L&T FH plans to mobilize Rs 1,245 crore, for a 14.2% dilution (17% total dilution including pre – IPO placement), valuing the firm at Rs 8,700 – 9900 crores.

L&T – Snapshot

- L&T is a proxy for infrastructure, machinery and construction in India. The recent aggression and focus on core competence by management in the last decade has yielded results – of excellent growth and profits.

- Over the last 10 years, L&T share has shown results:

– Share price increased 48% CAGR

– EPS has increased 31% CAGR

My conclusion is that L&T has rewarded shareholders over the years, grown consistently and transparently, and built a good reputation. And this rubs off very positively on L&T FH.

L&T FH Financials

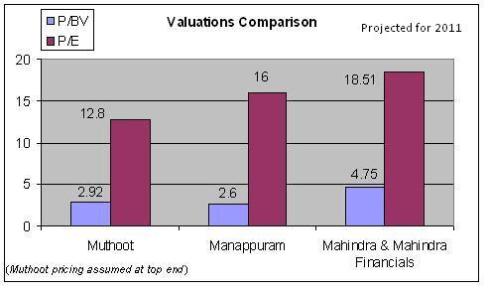

- At Rs 59 (upper end of the price band), the L&T FH valuations are at 2.2 times the consolidated FY-11 book

- The capital adequacy of L&T Finance and L&T Infrastructure Finance is 16.5 per cent.

- Business Assets of L&T F and L&T IF combined are 11,491 crores as of Mar 2010; Assets have grown at 77% CAGR over the last 5 years

- Combined PAT is 267 crores in Mar 2010; PAT has grown 62% in last 5 years

- These high growth rates are expected to continue for many years, as Infrastructure spending in India is on the upswing.

- Another attractive investment in this space is Yes Bank, see the report

IPO Offer:

- The IPO price band is 51-59 per share; Issue period for Retail is July 27-29, 2011.

- Investor categories includes – interestingly – Shareholders, in addition to the usual QIB, NII (HNI), Retail and Employees. Shareholders can decide if they wish to bid for shares under shareholder quota or Retail/HNI, as multiple bids may be rejected.

- The purpose of the IPO is:

- Retire Rs 345 crore of inter-corporate deposits. The inter-corporate deposit was taken from L&T to support the capital needs of its subsidiaries last fiscal.

- To support capital adequacy ratio of its subsidiaries. Around Rs 570 crore would go to L&T Finance,and Rs 535 crore would be used for augmenting capital of L&T Infrastructure Finance.

- P/E at upper end may be around 21 times. The IPO has been rated – IPO GRADE 5 by the Agencies – CARE and ICRA, indicating superior fundamentals

Opinion, Outlook and Recommendation

- All the large Capital Goods and Infrastructure firms worldwide have created finance arms/ tie-ups to bundle their product with financing. This provides a good synergy as the product is capital intensive e.g. GE Capital, Airbus and Boeing financial arms, etc.

- The L&T Finance business will be better valued as an independent company, rather than as a mere subsidiary

- L&T FH is well diversified as a firm, and is present in the high growth areas of Infrastructure financing and Rural development

- The prospects for L&T are good over the next decade. L&T FH has strong synergies with the parent firm, and by independent listing, will be able to manage it’s capital needs and growth better

- Invest with a 2-3 year horizon.

- Check back on this website www.jainmatrix.com for updates

Do you find this report useful? Please comment below. For a detailed note on L&T Finance Holdings IPO with analysis, business charts and IPO risks, subscribe for free to this blog, on the top of the right panel

Disclaimer:

These reports and documents have been prepared by JainMatrix Investments Ltd. They are not to be copied, reused or made available to others without prior permission of JainMatrix Investments. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com