- Date 08th May; IPO Opens 8-10th May, at ₹ 300-315/share

- Mid Cap: ₹ 13,500 cr. Mkt cap

- Sector – NBFC, Affordable Housing

- Valuations: P/E 18.4, P/B 2.9 times

- Opinion: Subscribe

- Summary: Aadhar Housing Finance is a leader in independent affordable housing finance firms. The industry has high growth and AHF is likely to grow in line. Post covid, AHF has enjoyed high growth and improved metrics. It is the largest affordable HFC in India in terms of AUM. The company also has a geographically diversified AUM. The IPO has a fresh issue part, which will strengthen the balance sheet and support loan growth. The firm is professionally run.

- Risks: 1) micro home loans can be affected by political, social and weather disruptions 2) Blackstone as promoter is an asset manager, and can exit its holdings over the next few years 3) Regulatory risks like RBI norms compliance and policy changes 4) rising interest rates can put pressure on margins 5) Housing is a cyclical industry

- Opinion: Subscribe to Aadhar Housing Finance IPO.

Here is a note on Aadhar Housing Finance IPO – AHF.

IPO highlights

- The IPO opens from 8-10th May 2024 in a Price Band of ₹ 300-315 per share

- It is a Fresh Issue of ₹ 1,000 cr. & OFS ₹ 2,000 cr., total ₹ 3,000 cr., which is 22.3% of share capital post IPO. (OFS – offer for Sale by the promoter of existing holding).

- Promoter is Blackstone Asset’s fund BCP Topco VII Pte whose 98.7% will fall to 76.5% post-IPO.

- The main objects of the OFS part of IPO are 1) ₹ 750 cr. towards maintaining higher Tier 1 capital towards lending and 2) Rest for General Corporate purposes.

- The lot size is 47 shares and Face Value ₹ 10 per share.

- The IPO share quotas are Institutional: Non-Institutional Investors: Retail of 50:15:35%.

- The unofficial/ grey market premium of AHF is ₹ 90 /share over IPO price. This is a positive.

- The IPO allotment is likely to be finalized on 13 May, refunds and crediting of shares will be on 14 May. AHF shares will list on BSE and NSE, on 15 May.

Introduction

- AHF is a retail-focused affordable housing finance company, serving economically weaker and low-to-middle-income customers, who require small-ticket mortgage loans.

- Revenue from operations grew from ₹ 1,575 cr. in FY’21 to ₹ 2,043 cr. in FY’23 at a CAGR of 13.89%, PAT CAGR was 26.56% and EBITDA CAGR was 10.44% over last three years.

- It is the largest affordable HFC in India in terms of AUM.

- The firm has been operational since Feb 2011, but underwent a transformation when it merged into DHFL Vysya in Nov’17. Subsequently, it was rebranded as AHF Ltd.

- BCP TOPCO VII PTE. LTD. (a Blackstone Group Company) is the holding company of AHF Ltd. Blackstone is the world’s largest alternative asset manager, with more than $1 trillion in AUM based in New York City.

- AHF has a total of 3,885 employees and its 100% owned subsidiary has a total of 1,875 employees.

- The company has solidified its position as the leading housing finance company in India’s low-income housing market (ticket size less than ₹ 15 lakhs), due to good metrics in this fast growing sub-segment.

- AHF has the most geographically diversified AUM and the highest operating expenditure ratio efficiency. The company has a network of 487 branches including 109 sales offices (Dec’23), with branches spread across 20 states and UTs. During the year, 59% of the total loans disbursed were through in-house channels.

- No single state accounts for more than 15% of the gross AUM. See Fig 1.1.

- Management – Rishi Anand (MD/CEO), Rajesh Viswanathan (CFO) and O. P. Bhatt (Chairman). The firm is professionally run, and management is impressive in terms of work experience. See Fig 1.2.

Fig 1.1 – AUM by States / Fig 1.2 – Key leaders

Industry Outlook of Indian Housing Sector

- Affordable home loans is nothing but a form of microfinance but secured against housing collateral.

- High Growth: Post Covid in 2020, the housing sector has emerged with high growth. The pandemic established the importance of owned housing, and also drove the Work From Home habits that are widely accepted in the software and tech industry, and have made inroads across the industrial landscape. Its helped by the GoI focus on housing. Following a period of subdued growth in FY20 through FY22, AHFCs experienced good growth during FY23, expanding by 27% year-over-year. This growth trajectory is expected to continue, with CareEdge Ratings forecasting a 29% growth in FY24 and 30% in FY25 for AHFCs.

- Contribution to Economy: The Indian housing sector is a crucial aspect of the country’s economy, contributing nearly 11% to the GDP and providing employment opportunities to millions of people. However, in the last decade, the sector has faced various challenges such as a shortage of affordable housing, a lack of adequate funding for developers, and limited access to mortgage finance for consumers.

- Industry data: public sector and private sector banks held the largest market share in housing loans, with a share of 69%. Housing finance companies had 29%, followed by a 2% market share by Affordable Housing Finance companies. Although affordable housing loans constitute around 6% of the overall housing finance industry (Dec’22), the market remains severely underpenetrated. (ICRA, April 2023).

- Priority Sector Lending Benefits: The RBI has also provided incentives to the housing finance industry by extending priority sector status to housing loans. In addition, pursuant to Section 36(1)(viii) of the Income Tax Act, 1961, up to 20% of profits from eligible business computed under the head “profits and gains of business or profession”, may be carried to a “Special Reserve” and are not subject to income tax.

- Pradhan Mantri Awas Yojana: The Indian government has initiated a Housing for All scheme by 2022 to promote affordable and low cost housing in the country. To achieve this objective, the government has introduced several measures, including the PMAY for rural and urban regions aims to provide affordable housing for lower-income groups and economically weaker sections of society.

- Relaxed ECB guidelines: The GoI has also relaxed External Commercial Borrowing (ECB) guidelines to help finance homebuyers. In addition, GoI has announced tax incentives to promote the housing sector. The RERA has been implemented to improve transparency, timely delivery, and organized operations in the sector. GoI also announced a last-mile affordable housing funding package to complete ongoing housing projects in affordable and middle-income categories.

- Increase in Non-Housing Portfolio Share: Amidst intense competition and the imperative to maintain margins, the share of the non-housing portfolio among AHFCs has risen from 17% as of March 31, 2019, to 26% as of March 31, 2023. This trend is anticipated to persist, with the non-housing portfolio share projected to reach 27% by March 31, 2024. (CareEdge ratings report).

- Gruh Finance, an affordable housing finance subsidiary of HDFC was acquired by Bandhan Bank in October 2019. It used to enjoy excellent valuations, and can be remembered as an excellent industry case study.

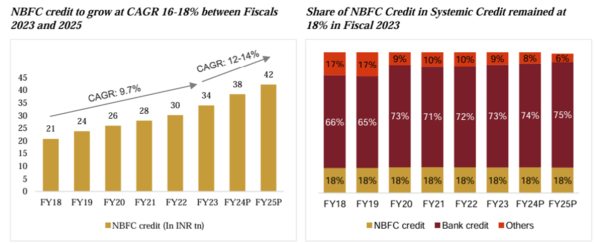

- NBFC Share Steady: NBFCs have grown at 16-18% overall, see Fig 2.1.

Fig 2.1 NBFC Industry

Aadhar Housing – Financials

- AHF Revenue, EBITDA & PAT grew by 13.89%, 10.44% and 26.56 % resp, see Fig 3.1.

- The chart indicates high growth in the last three years from AHF. Margins too are improving.

- EBITDA Margin is for 3 years ranges between 75% to 80% and PAT margin around 21%-27% for 3 years.

- The EPS for the company has increased from 8.62 in FY21 to 13.80 in FY23.

- Gross NPAs and Net NPAs are – 1.4% and 1.0 % (of AUM) in FY23.

Loan services offered are-

- Home Loan for Salaried Employees, Self-Employed

- Loan for Purchase of Non-Residential Property, Loan for Plot Purchase & Construction, Composite Loan

- Balance Transfer and Top-Up

- Home Construction Loan, Loan for Construction of Non-Residential Property, Home Improvement Loan, Home Extension Loan, Loan Against Residential and Commercial Property (LAP)

- Aadhar Gram Unnati

Fig 3.1 – Financials

Fig 3.2 – Product-wise Revenue, Fig 3.3 Assets under Management

Fig. 3.4 – Shareholding pattern pre and post IPO

- The Fig 3.2 shows Customer Wise Revenue; and Fig 3.3 Assets under Management. As of Dec’23, salaried customers accounted for 57.2% and self-employed for 42.8% of Gross AUM, resp. and the company had 255,683 live accounts (including assigned and co-lent loans).

- We can see that Blackstone which was the dominant shareholder is selling some stake in the Offer for Sale, and taking the firm public through the IPO process. See Fig 3.4 Shareholding pattern.

- For Blackstone / Topco, the average cost of acquisition per Equity Share in AHF was ₹ 80.54 (RHP). This indicates a 3.9X gain for promoter in the OFS part of IPO.

News, Updates and Strategies

- IPO resurgence: Indian IPO market has been buoyant over 2-3 years, and most mid/large offerings have been successful. We now worry about excessive valuations and demand in IPO offerings.

- In Nov 2023, AHF announced its AUM had crossed the $2 billion (₹16,300 cr.) milestone.

- 07th May – AHF has raised ₹898 cr. from anchor investors a day ahead of the IPO, to 61 anchor investors at the upper price band. Morgan Stanley Asia, Amundi Funds, Neuberger Berman Emerging Markets Equity Fund, Theleme India Master Fund, SBI Life Insurance, ICICI Prudential Life Insurance, HDFC MF, ICICI Prudential MF, Axis MF and Quant MF are among the anchor investors.

- Blackstone-backed AHF decided to reduce the size of its initial public offer to ₹ 3,000 crore from the originally planned ₹ 5,000 cr. (Source- April, Money Control)

- This week, primary market is abuzz with anticipation as 3 prominent firms, AHF, Indegene (₹ 1,800) and TBO Tek (₹ 1,500) will launch IPOs to raise nearly ₹ 6,300 cr. (Source- May, Republic World)

- Mar 2023 – Yes Bank and AHF ink co-lending partnership, in accordance with the co-lending framework of the RBI that enables banks and non-banking companies to jointly bring forth financial solutions that cater to the requirements of the unserved and underserved sections of the society.

- June 2022 – AHF awarded an IT deal to TCS for an end-to-end business process transformation project, which will use the integrated and collaborative blockchain-based cloud platform.

- The IPO is for selling 22.3% of the stake of AHF. However a SEBI mandate is that minimum 25% of the listed company should be available to public and institutions in a few years after IPO. Thus we feel that AHF may have a QIP or Follow-on Public Offer (FPO) in a year or two.

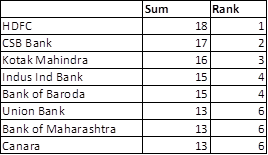

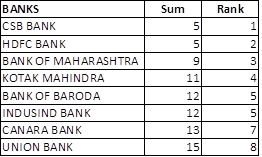

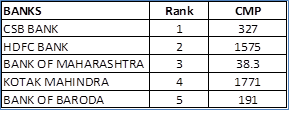

Benchmarking

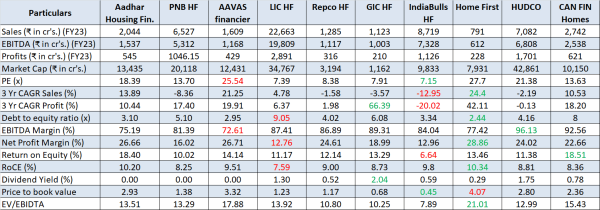

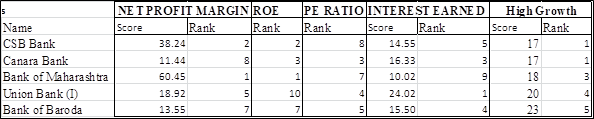

Fig 4.1 – Benchmarking

In a benchmarking exercise we compare AHF to industry peers, to understand it better. See Fig 4.1.

- Positives: AHF has achieved robust sales growth, outperforming the industry average of 6.08%. While AHF profit growth of 10.4% is respectable, it falls slightly below the industry average of 14.21%.

- AHF maintains a lower D/E ratio (3.10x) compared to the industry average (4.14x), indicating lower reliance on debt financing and better financial stability. This is positive.

- AHF demonstrates a strong net profit margin of 26.7%, exceeding the industry average of 21%, indicating efficient cost management and operational efficiency.

- On Returns parameters of RoE and RoCE, AHF is excellent, while not leading the peers. A positive.

- Negatives: In terms of Valuation, PE of AHF is on the high side, so it’s expensive. AHF’s price-to-book value ratio of 2.93x, a premium over the industry average of 2.05x. This is also true for EV/EBITDA.

- EBITDA margin of 75.19% is lower than the industry average of 81.42%, suggesting lower operating profitability.

AHF hasn’t stood out as either very good or bad on the benchmarking section. It appears to be stable and improving steadily on current performance. The high valuations can be interpreted as the cost of quality.

SWOT Analysis

Fig 4.2 – SWOT

Risks

- Similar to microfinance, micro-home loans can be affected by political, social and weather disruptions, which can affect customers’ livelihoods and their ability to repay loans.

- Blackstone is the promoter and asset manager and may be interested in exiting its holdings in AHF over the next few years. If this happens, it may be an unstable promoter, and there may be pressure on share prices on every exit, or until the firm is taken over by a stable new promoter.

- Regulatory risks include RBI intervention, changes in Priority Sector policy, KYC issues, etc.

- Window dressing: Many companies present improved financials pre-IPO, and these unwind after listing. We are unable to ascertain if AHF has done this, but it remains a risk.

- AHF is a party to certain legal proceedings and any adverse outcome can be an issue.

- An increase in the NPA will adversely affect the company and its financials. NPA resolution can be long drawn out and involve litigation and friction.

- AHF is exposed to adverse fluctuations in interest rates and credit spreads. Inflation too can affect demand for loans from this firm.

Overall Opinion and Recommendation

- The Real Estate & housing industry is now in a multi-year upcycle, following a downcycle from 2010-20.

- Microfinance has been a high-performing sector but affected by political & social disruptions.

- AHF has been sharply focused on rural Housing finance and is structured to grow in this segment.

- AHF has a high expertise in the low-income housing segment which makes it the largest player in the low-income housing market in India. It enjoys a Pan India presence, so extensive branch networks, geographical penetration, and good sales channels contribute significantly to loan sourcing and servicing. The company posted steady growth in its top and bottom lines for the reported periods. AHF is well placed to leverage its dominance to tap the growth potential of the industry.

- The future growth of the affordable housing finance market looks positive aided by government policies, an increased supply of affordable homes, rising demand in tier 2/3/4 cities, and fair home loan interest rates.

- Key Risks – 1) micro home loans can be affected by political, social and weather disruptions 2) Blackstone as promoter is an asset manager, and may exit its holdings over the next few years 3) Regulatory risks like RBI norms compliance and policy changes 4) rising interest rates can put pressure on margins 5) Housing is a cyclical industry

- Opinion – Subscribe to Aadhar Housing Finance IPO

Disclaimer

Punit Jain discloses that he has no positions in Aadhar Housing Finance or Blackrock Asset as on date of this report. But inline with this report, he intends to subscribe to the Aadhar Housing Finance in the IPO.

This document has been prepared by JainMatrix Investments Bangalore (JMI), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JMI. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JMI has not independently verified the accuracy or completeness of the same. Neither JMI nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from a RIA Registered Investment Advisor. Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

Punit Jain is a registered Research Analyst under SEBI (Research Analysts) Regulations, 2014. Registration granted by SEBI, and certification from NISM in no way guarantee performance of the RA or provide any assurance of returns to investors. JMI has been publishing equity research reports since Nov 2012. Any questions should be directed to the director of JainMatrix Investments at punit.jain@jainmatrix.com Name of the RA as registered with SEBI – Punit Jain, SEBI Registration No. INH200002747. Logo/brand name –