- IPO is open from 06-08th Oct, at ₹ 310-326/share

- Large Cap. of mkt cap ₹ 1,38,000 cr.

- Sector: NBFC – Shadow Bank

- The IPO is to raise ₹ 15,500 cr.

- It will be the #4 largest IPO of the Indian markets, after Hyundai India, LIC and Paytm

- Opinion: BUY with a 2-year perspective

In this note, we look closely at Tata Capital Ltd (TCL) which is opening for its IPO this week.

IPO Details

- To raise ₹ 15,500 cr. – Fresh Issue, 21 cr. shares (₹ 6,846 cr.) and Offer for Sale, 26.58 cr. (₹ 8,665 cr.)

- IPO Applicants can bid for a minimum of one lot of 46 shares, and in multiples of this.

- Reasons and Objects of the Issue: 1) TCL was classified as an Upper Layer NBFC by RBI. It was required to IPO by Sept’25 as per these regulations 2) Tata Sons, the promoter of TCL will sell part of their stake in the Offer for Sale 3) TCL will utilize the proceeds from the Fresh Issue to augment their Tier – I capital base, to meet requirements of onward lending, and growth of the business 4) a portion of the proceeds from the Fresh Issue will be used towards meeting Offer Expenses.

- The IPO share quotas will be QIBs: NIIs: Retail is 50:15:35. (Qualified and Non-Institutional Investors)

- The unofficial/ grey market premium of TCL is ₹ 13/share today thus about 4% over the IPO price.

- IPO shares allotment is by Thu, Oct 9th, and Listing Date is Mon, Oct 13, 2025.

Tata Capital Introduction

- TCL is the flagship financial services firm of the Tata Group, a subsidiary of Tata Sons Pvt. Ltd., and is a NBFC. RBI classified it as a Upper Layer – Non-deposit taking NBFC – ICC Investment and Credit Company.

- TCL operates across areas of business like: Commercial Finance, Consumer Loans, Wealth Services & distribution, and marketing of Tata Cards. It provides this to retail, corporate and institutional customers.

- It 3 key subsidiaries are Tata Capital Housing Finance Ltd., Tata Securities Ltd. and Tata Capital Pte. Ltd.

- Tata Capital Pte. incorporated in Singapore, operates fund management and proprietary investments business, directly and through its eight subsidiaries, including Tata Capital Advisors Pte. Ltd.

- TCL is being put together as the Finance & Capital flagship of the Tata group. Tata Motors Finance Ltd., formerly part of Tata Motors, is merging with TCL. This was sanctioned by the National Company Law Tribunal, Mumbai by an order in May’25. TCL’s 3 key subsidiaries also have JVs, subsidiaries and partners. This complex organization may merge and simplify over a few years.

- Thus a lot of opportunities exist for TCL to grow its loans and product sales, aligning with Tata group companies and their customers in India.

- Management – Saurabh Agrawal Ch’man (Non-ED), Rajiv Sabharwal MD & CEO and Rakesh Bhatia CFO.

Comparison of Financial Parameters

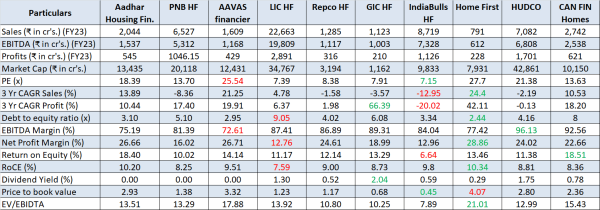

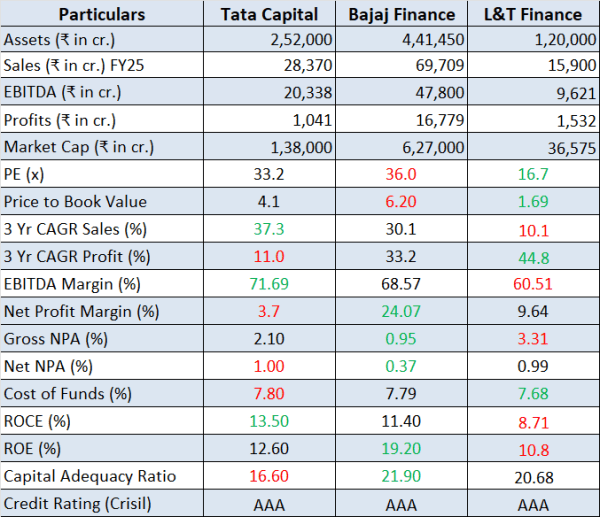

We analyse the key ratios and financial data for TCL with 2 peers. See table and analyses below.

Fig 1 Benchmarking Annual data is for FY25/ TCL data is as per RHP

- By assets, BFL is the largest of the three, next is TCL and smallest is LTF. Valuation wise, BFL is most expensive and LTF the cheapest. TCL is between the two. The pricing appears aggressive.

- TCL leads on 3-year Sales growth, while profit growth is highest for LTF. EBITDA margins are highest for TCL but it is low on Profit margins, while BFL is best here. On gross and net NPA, BFL leads. TCL is low on Net NPA. Cost of Funds is higher for TCL. It leads on ROCE but BFL leads on ROE. TCL is weak on Capital Adequacy.

It will take 1-2 years for ongoing mergers to be complete at TCL and key ratios in Fig 1 to stabilize, while BFL and LTF are established well set firms with clear strategies.

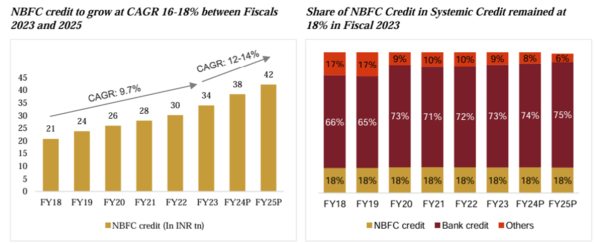

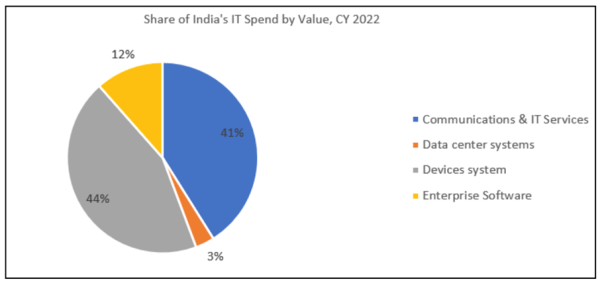

Industry Notes

- Recently RBI has released a circular regarding 15 NBFCs in Upper Layer classification under Scale Based Regulations. NBFCs have witnessed significant growth in size and interconnectedness in recent years.

- An RBI UL NBFC is a systemically important firm identified by the RBI for higher regulatory scrutiny.

- As per a CRISIL Report, TCL is the third largest diversified NBFC in India. These are in order of loan book

- 1) Bajaj Finance 2) Shriram Finance 3) Tata Capital 4) Cholamandalam Investment

- 5) Aditya Birla Capital 6) HDB Financial 7) L&T Finance 8) Sundaram Finance

- HDFC Ltd which was the largest NBFC, a Housing Finance firm, merged with HDFC Bank last year. Conversely group company HDB Financial was listed this year. Several groups are slowly consolidating their financial firms under the Bank umbrella, such as ICICI Bank, Axis Bank and IDFC First Bank.

SWOT Analysis

Strengths

- As the #3 diversified NBFC in India today TCL already has a good size and diversified loan book.

- The Tata brand stands for high ethics, sustainable operations and of late focus and aggressive growth.

- The NBFC structure provides the flexibility for fast growth, partnerships and JVs for TCL.

Weaknesses

- The other financial services firms of Tata group are Tata Asset Management, Tata MF, Tata AIG, Tata AIA Life and Tata Invest. Corp. are subsidiaries of Tata Sons, they may not become part of TCL.

- TCL is a complex group with an ongoing merger and reorganization. It may take some time to stabilize.

- As a non-deposit taking NBFC, TCL will face a higher cost of funds raised as wholesale deposits.

- For several years, the Tata group struggled to set up the Finance arms, its only taken shape recently.

Opportunities

- The Tata Group is a diversified conglomerate, with 29 listed and 100s of group companies. There exists opportunity for TCL to align with these firms and their customers to provide loans and financial services.

- Wealth management and new categories such as Gold loans hold potential. From just Tata Motors loans, TCL will expand to provide loans across OEMs, and this can be a large business.

Threats

- Competition – Bajaj Finance as the leader in the NBFCs has shown high growth rates and return ratios.

- Other firms in the industry have strong sector focus such as Commercial Vehicles or housing loans.

- Banks are free to compete in all sectors as NBFCs and also have lower cost of funds.

Conclusion

- TCL has priced its IPO aggressively. While pricing is close to BFL on P/B, it is a far smaller firm by loan book. Also TCL is taking shape now, and it will be 1-2 years by the time its mergers and new divisions are complete, and performance ratios stabilize.

- Opinion: BUY with a 2-year perspective

- Addendum – Other useful reports we have made from this sector are

- NBFC – The Leaders

- Bajaj Housing Finance IPO

Disclaimers and Disclosures

- Punit Jain discloses that he has no shareholding in TCL. He does have shareholding in BFL (<1%) since 2003. Similarly, JainMatrix Investments Bangalore (JMI) and its promoters/ employees have no shareholding in TCL, and no known material conflict of interest as on date of publication of this report. This document has been prepared by JMI, and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JMI. This report should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JMI has not independently verified the accuracy or completeness of the same. Neither JMI nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Investment in the securities market are subject to market risks. Read all the related documents carefully before investing. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an RIA – Registered Investment Advisor.

- JMI has been an equity investment adviser commercially since Nov 2012, and a SEBI certified and registered since 2016, under SEBI (Research Analysts) Regulations. Registration granted by SEBI, and certification from NISM in no way guarantee the performance of the Research Analyst or provide any assurance of returns to investors. Any questions should be directed to punit.jain@jainmatrix.com. Name of the RA as registered with SEBI – Punit Jain, SEBI Registration No. INH200002747. Logos / brand name –