Summary:

The transition from your Working Life and Career to Retirement can be quite demanding. The challenges in this phase extend from psychological to financial and social. In this note, we focus on the financial challenges. The Equity Investor can use the Four Bucket Approach detailed here to think though the changes and plan for Retirement.

Introduction

Retirement is an important goal of work life, for the equity investor. The image of a relaxed day schedule, no monetary pressures and more time for your favorite hobbies, seems so attractive. In early career, it seems so far away, time wise, that planning for Retirement seems like a waste of time. However as we hurtle through our ever busier careers, it comes closer, and planning for it becomes more important. The suggestion I make is that Retirement should be incorporated in your financial plan from an early stage in your career. To do this, we present the Four Buckets Approach to Retirement as it offers a simple yet powerful framework to plan your financials. Do take advantage of this in your planning.

Wealth Management for Mid-Career: The 3-Buckets Strategy

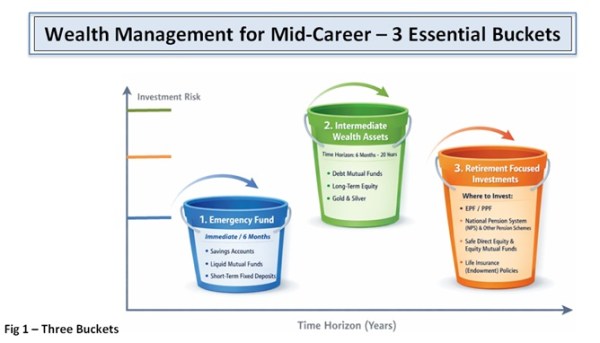

In the age bracket of 30-55, mid-career working professionals and businesspersons need to convert savings into wealth. They need to plan for the rainy day, as well as fight inflation, to meet financial goals.

For them, the bridge between today’s pay check and tomorrow’s financial freedom is built on two pillars: growth and safeguards. The most effective way to manage this is through a “Buckets Strategy,” which classifies your money according to when and what you need it for. By splitting your investment portfolio into three separate buckets, you can allocate funds and leverage the power of compounding as well as plan for shorter term needs, under various market scenarios. See – Fig 1 – Three Essential Buckets.

Bucket 1: The Emergency Fund (EF)

Time Horizon: Present to 6 months. Purpose: To cover 6 months of normal living expenses, which acts as a financial safety cushion, so that any emergencies like job loss, sudden expenses or medical issues are planned for, so we get time to react and recover from these.

Where to Invest:

- Savings Accounts: The ultimate tool for instant access. It keeps your money safe and ready for withdrawal at any ATM, branch or online banking.

- Liquid Mutual Funds: low-risk option that offers better returns than savings accounts with easy access to funds.

- Short-Term FDs: Ideal for guaranteed, predictable growth. They give fixed returns with a locked interest rate over a fixed time. Tax impact is more compared to liquid MFs.

Allocation Ratios: Here the household and personal expenses for 6 months will be the EF budget.

Bucket 3: Retirement Focused Investments

Time Horizon: Period till Retirement. Purpose: To build an asset that matures by retirement, beats inflation (high-growth investments plus compounding), and includes retirement tax-saving features.

Where to Invest:

- EPF / PPF: These are government-backed schemes with guaranteed, tax-free returns.

- National Pension System (NPS) and other Pension schemes: Pension policies and NPS provide a low-cost retirement plan with asset growth. These may have equity and debt options. There are tax benefits on investment as well as on maturity.

- Safe Direct Equity and Equity Mutual Funds: Generally targeting Blue Chip firms, these provide safety and growth. Assets must be spread in a number of companies. These help capture long-term market growth. Nifty and Sensex ETFs is also a good option.

- Life Insurance (Endowment) Policies: They offer life insurance along with disciplined, regular long-term savings for future needs.

Allocation Ratios:

- A common, actionable rule of thumb for retirement is a target corpus of 15 times your annual gross income by the time you retire. This can be reviewed every 5 years, so that the retirement target stays aligned with career growth.

Bucket 2: Intermediate Wealth Assets

Time Horizon: 6 months – 20 years /period till retirement. Purpose: To fund medium to long term goals as well as general wealth building. Goals can include buying a home, car, or planning for major family events, etc. This balances growth with capital protection through a mix of assets.

Where to Invest:

- Debt Mutual Funds: These focus on fixed-income securities to provide stable and predictable growth with better post-tax returns than FDs. These provide steady returns with relative stability.

- Long-Term Equity: Direct Investing in listed companies help you benefit from business growth. Investments can be aligned with risk profile. Aggressive equity investments are possible here. Also investment can be in Equity Mutual Funds, where professional managers handle your assets.

- Top of Form

- Bottom of Form

- Gold & Silver: Act as a safety asset to protect from geopolitics, inflation or currency weakness.

Allocation Ratio Options:

- All savings available after EF and Retirement allocations should be used for Intermediate Wealth Asset building.

- A 60:40 ratio: Thetraditional allocation has been 60% equity and 40% debt. This has to be periodically rebalanced.

- With the rise of Gold and Silver, we suggest a 10% allocation to them. The ratio can be 60:30:10%.

- A dynamic allocation approach: With(100 – Age) allocated to equity, rest to Debt and Gold/silver.

- Age 30 → 70% equity, 30% to debt + G/S

- Age 50 → 50% equity, 50% debt + G/S

- Age 40 → 60% equity, 40% debt + G/S

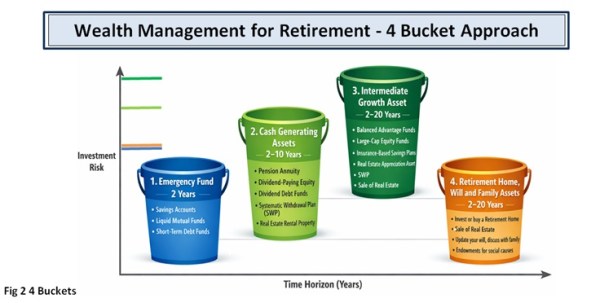

Wealth Management in Retirement: The 4-Bucket Strategy

Lifespans have increased. Life expectancy in India has shown significant rise, reaching 70–72.5 years in 2022–23, up from 49 years in the 1970s. So we have to plan for a longer retirement period, even as inflation and healthcare costs rise.

After you progress from a working career to Retirement, the focus changes from primarily asset growth to primarily capital protection and encashing your assets for retirement income. The goal is to ensure your retirement funds support you and your family for your lifespans, even as markets go up and down.

Retirement:

The salary or business income disappears and has to be replaced with cash income from available assets.

Your Retirement Focused Investments are encashable on retirement and may also convert into annuity funds. The investor’s other Intermediate Wealth Assets also need to be repurposed post Retirement.

The 4-Bucket Approach helps to protect your assets while still allowing some growth to beat inflation during a long retirement. See Fig 2 – The Four Bucket Retirement Approach.

Bucket 1: The Emergency Fund

Time Horizon: 2 Years. Purpose: The Emergency Fund needs increase as it should provide for around 2 years of expenses. This provides better safety and peace of mind.

Where to Invest:

- Savings Accounts: For instant access to money when needed.

- FDs: Stable investments that provide predictable cash flow with low risk.

- Liquid / Debt Mutual Funds: Low-risk option with slightly better returns and easy withdrawal.

Allocation Ratios: Here the household and personal expenses for 2 years will be the EF budget.

Bucket 2: Cash Generating Assets

Time Horizon: 2–10 Years. Purpose: On retirement, many assets built till now need to be closed, encashed or converted into Cash Generating Assets. These assets helps meet regular monthly expenses and lifestyle costs during early retirement by providing steady income with low risk.

Where to Invest:

- Pension Annuity: LIC, insurance plans and PF can convert into pension annuities.

- Dividend – Equity: Blue-chip stocks and MFs that provide regular dividend income; REITs and INVITs.

- Dividend Debt Funds: Offer steady income with lower risk than equity.

- Equity assets and debt MFs: A Systematic Withdrawal Plan (SWP) on existing equity assets and debt MFs helps encash these assets. Even as the core portfolio grows, one can generate monthly income.

- Real Estate Rental Property: Generates regular monthly rental income and adds stability.

Allocation Ratio:

- The allocation starting point has to be the monthly cash requirements in retirement.

- Working backwards from this, the Cash Generating Assets need to fulfil this requirement.

- Pension annuities, dividend paying assets and rental property can be accurately predicted.

- The SWP can be increased to meet any gaps. In case of surplus, the cash may be reinvested in Dividend-Paying Equity and Debt assets.

Bucket 3: Intermediate Growth Assets

Time Horizon: 2–20 Years. Purpose: Assets need to grow and fund the retirement period, protect from inflation and refill Buckets 1 and 2 over time while keeping risk moderate. Non rental Real Estate may be sold and proceeds reinvested in rental property or equity / MF assets.

Where to Invest:

- Balanced Advantage Funds: Balance equity and debt MFs based on market conditions.

- Large-Cap Direct Equity and MFs: Stable companies for steady growth.

- Real Estate Appreciation Asset: Land or Commercial property can be considered these assets can be considered for liquidation in order to generate capital and cash.

Allocation Ratio: Here the allocation can be similar to Mid-Career Bucket 2: Intermediate Wealth Assets

Bucket 4: Retirement Home, Will and Assets Planning for the Family

Time Horizon: 2-20 Years Purpose: The career home and location may change to a retirement home in a new location. The Will and Assets Planning are required to bring clarity and certainty to the process.

Activities:

- Invest in, buy or rent a Retirement Home: Post retirement or in old age, there may be a plan to shift home to near the children, to the native place or to a retirement home

- Sale of Real estate – some assets may need to be liquidated as per the plan

- Update your wills, discuss with family – about assets and businesses: it’s time to prepare or update your will so that your assets will be inherited by your family as per your plan. Both husband and wife need to have their own wills. Businesses too need to have a succession plan

- Endowments for social causes: If possible, you may decide on a few endowments for social causes like education, NGOs or religious trusts

Allocation: All your assets must be accounted for in your will. Beneficiaries should be broadly aligned with the laws, to avoid disputes later. Further discussing this with family at the time of making a will helps to handle friction and disagreements at this stage.

Conclusion

- The transition from your working life and Career, to Retirement can be quite demanding.

- The challenges in this phase extend from psychological to financial and social.

- Embracing the changes, working towards your dream retirement activities and good financial planning help to deal with the transition.

- Here’s to your long-term financial security.

Disclaimers and Disclosures

This document has been prepared by JMI, and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. This report should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JMI has not independently verified the accuracy or completeness of the same. Neither JMI nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Investment in the securities market are subject to market risks. Read all the related documents carefully before investing. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from a RIA Registered Investment Advisor or lawyer. Registration granted by SEBI to JMI, and certification from NISM in no way guarantee the performance of the Research Analyst or provide any assurance of returns to investors.

JMI has been an equity investment adviser commercially since Nov 2012, and a SEBI certified and registered since 2016, under SEBI (Research Analysts) Regulations. Any questions should be directed to punit.jain@jainmatrix.com. Name of the RA as registered with SEBI – Punit Jain, SEBI Registration No. INH200002747. Logo/brand names –

Fig 1 – Smartphone entry-exits/ Fig 2 – Marketshare of top 5. Source: ET, News 18

Fig 1 – Smartphone entry-exits/ Fig 2 – Marketshare of top 5. Source: ET, News 18