20th July 2025

Summary

This article investigates a trend in Indian markets — listing of subsidiaries by Corporates that are large conglomerates and sector leaders. Who really benefits from these listings? Are they a source of genuine value creation? To understand this, we map the data on subsidiary IPOs by reputed Indian Corporates between Jul’23 and Jul’25. Building on our earlier analysis, which focused on a few prominent examples, we now expand the scope to 10 IPOs across diverse industries. This deeper dive presents more robust insights into the value creation effects of these IPOs for the Corporates, their shareholders, and IPO investors.

Subsidiary Listings over 2023-25

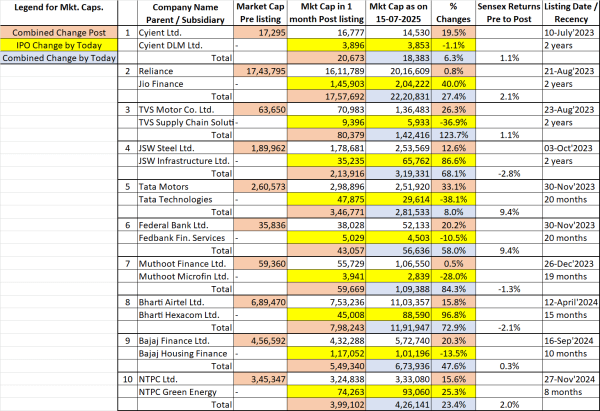

We identified 10 IPOs over the last 2 years, of subsidiaries of well known, listed, Corporates. We share the Market Capitalization data over this period (Jul’23 – Jul’25) at three key timelines – See Table 1:

- Market Cap of the firm prior to listing of Subsidiary (5 days before IPO listing)

- Post-listing of Subsidiary (30 calendar days after the listing day)

- Current levels as on (15th July 2025) to uncover whether value is truly created so far.

Some Findings:

- The combined firms Market Cap one month Post Listing rose by 16%. In 9 of 10 cases, the combined firms market cap rose within 30 calendar days of the subsidiary IPO. See Table 2.

- The highest post-listing rise was in Tata Motors + Tata Tech, with a combined gain of 33%.

- Other notable increases include TVS Motor + TVS SCS: 26%

- Federal Bank + Fed bank Financial: 20%

- Bajaj Finance + Bajaj Housing Finance: 20%

- This confirms a pattern: listing a subsidiary can unlock immediate shareholder value, especially when the market perceives the spinoff as a high-potential, distinct scalable business.

- The average of gains & losses in the IPO subsidiary firms in the period from listing to today was 9%.

- Only 4 out of 10 firms that IPO’d had positive gains as of today; remaining 6 had losses. Thus there are uncertain returns from IPOs, the firms appear to lose market cap after listing.

- This is tough to generalize. It could be due to aggressive valuations. Or excess IPO demand.

- The combined market caps of all the 10 firms (including subsidiaries) gained by an average of 34% in the period from Pre IPO to today. This is a very high number. Even benchmarked against the average Sensex gain of 16% in this period, the combined market caps gain is excellent.

Observations and Patterns

- Value creation is visible in most Subsidiary listings, for the combined firms.

- The Corporates often benefit despite initial volatility in market cap.

- Combined value generally grows faster than Nifty or Sensex.

So, Who Really Gains from a Subsidiary Listing?

- Corporates: The Parent company benefits from improved market visibility and simplification of the business. Valuation of the subsidiary is easier, and due to value unlocking, the Post-listing combined valuation has risen. Only in 2 of 10 cases, the combined valuation was flat Post listing of subsidiary.

- Existing Shareholders of Corporates: Shareholders of Corporates don’t automatically benefit from the subsidiary IPO. To get gains, they have to invest additional capital in the subsidiary IPO. There is an IPO quota that helps parent company shareholders to get good allotment.

- For Subsidiary IPO Investors: The reputation of the parent, coupled with listing of a firm with simpler business, sometimes from high potential sectors, has seen some of these IPOs do well. But with just 9% average gains as of today since listing, and with only 40% of the IPO firms positive today, investing in IPOs must be done carefully.

Conclusion: Value Unlocking, Risks and final thoughts

- Subsidiary listings unlock value — the data supports this. For Corporates, it’s a clean move that sharpens focus and delivers a mkt. cap. growth. For investors, gains may depend on taking some action. Passive investors in the Corporate may experience short-term stagnation or dips. Active investors in the Corporate, and IPO participants, however may see faster capital appreciation.

- The best strategy for Corporate shareholders is to actively invest in subsidiary IPOs in good offerings.

- IPO investing in general is High Risk, but investing in the IPO of a listed company’s subsidiary is a much safer bet, due to past listed history, transparency and better available information.

- The subsidiary being listed often has a simpler structure & business model, so is easier to value.

- As India’s capital markets mature, we observe that legacy structures of complex conglomerates morph and simplify by way of subsidiary IPOs. These may evolve into a strategic norm — not just for restructuring, but as a deliberate value creation mechanism. The IPO of a subsidiary may also be a regulatory requirement (eg. Bajaj Housing Finance, perhaps a few more) so its a compliance activity, not driven by market cap objectives.

- Excess demand has returned to the IPO market, and so IPO investors need to expect over-subscription and high IPO valuations while evaluating IPO opportunities.

- These are 10 recent IPOs, from widely different industries, offered at different valuations, we cannot generalize results with high confidence, every new IPO case could be a different situation.

- Several cases have emerged of firms preferring to raise funds by QIP rather than debt – an aggressive move. This also may result in several equity dilutions in a short time period. Conservative and well run firms prefer to not dilute their Equity Share Capital for years, giving better ROE.

Disclaimer

- Punit Jain discloses that he has no shareholding in any of the firms mentioned in this article except Bajaj Finance (since April 2003, ownership <1%) and Bajaj Housing Finance (since Sept’24 IPO, ownership <1%), and these have been mentioned here only as one of the 10 samples/ examples chosen. He is also a telecom consumer with services from Bharti Airtel and Reliance Jio. Other than these, he has no financial interest or transactions, with any firms mentioned here or any group company. In addition, JMI and its promoters/ employees have no direct or financial interest in these companies, and no known material conflict of interest as on date of publication of this report, to the best of his knowledge.

- This document has been prepared by JainMatrix Investments Bangalore (JMI), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JMI. This report should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JMI has not independently verified the accuracy or completeness of the same. Neither JMI nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Investment in the securities market are subject to market risks. Read all the related documents carefully before investing. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from a SEBI RIA Registered Investment Advisor. JMI has been an equity investment adviser commercially since Nov 2012, and a SEBI certified and registered since 2016, under SEBI (Research Analysts) Regulations. Registration granted by SEBI, and certification from NISM in no way guarantee the performance of the Research Analyst or provide any assurance of returns to investors.

- Any questions should be directed to punit.jain@jainmatrix.com. Name of the RA as registered with SEBI – Punit Jain, SEBI Registration No. INH200002747. Logo/brand name –

Fig 1 – Smartphone entry-exits/ Fig 2 – Marketshare of top 5. Source: ET, News 18

Fig 1 – Smartphone entry-exits/ Fig 2 – Marketshare of top 5. Source: ET, News 18